How to Sign Up for a TD Ameritrade Brokerage Account: A Step-by-Step Guide

Image source: Getty Images.

Getting started in investing can be a bit intimidating. That's why The Motley Fool has put together a few how-to articles about opening up online brokerage accounts to help you with the process. Below are the step-by-step instructions for opening up a new individual TD Ameritrade (NASDAQ: AMTD) brokerage account. If you're shopping around for a brokerage to use, be sure to take a look at our broker comparison page.

What you'll need to get started

TD Ameritrade's website says that setting up a new account with them will only take a few minutes and that you'll need just a couple things to get started:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer name and address (if applicable)

The company charges a flat $9.99 fee per trade, no matter how many times you buy or sell within the account. TD Ameritrade doesn't have require a minimum cash deposit to get started, but if you want to do options or margin trading, you'll need to have at least $2,000 in the account. (You can read more about those two types of trading here and here.)

Like other online brokers, TD Ameritrade provides a customer service number you can call for assistance, and there's also a chat box that will periodically pop up on the screen offering you the chance to ask questions as you fill out the application.

Image source: Author screenshot from TD Ameritrade site.

Step 1: Start your application

Start by navigating to TD Ameritrade's account application page. You'll fill out some basic information about yourself (name, email, etc.) in this section, and you'll also select which type of account you want to open. The instructions for this how-to deal with a TD Ameritrade individual brokerage account.

The website will also ask you questions about whether you plan to use the account for buy-and-hold investing (as you should!) or for more active trading.Other than that, just read through the company's privacy statement at the bottom of page and click the continue button to head on to the next section.

Image source:Author screenshot fromTD Ameritrade site.

Step 2: Enter personal information

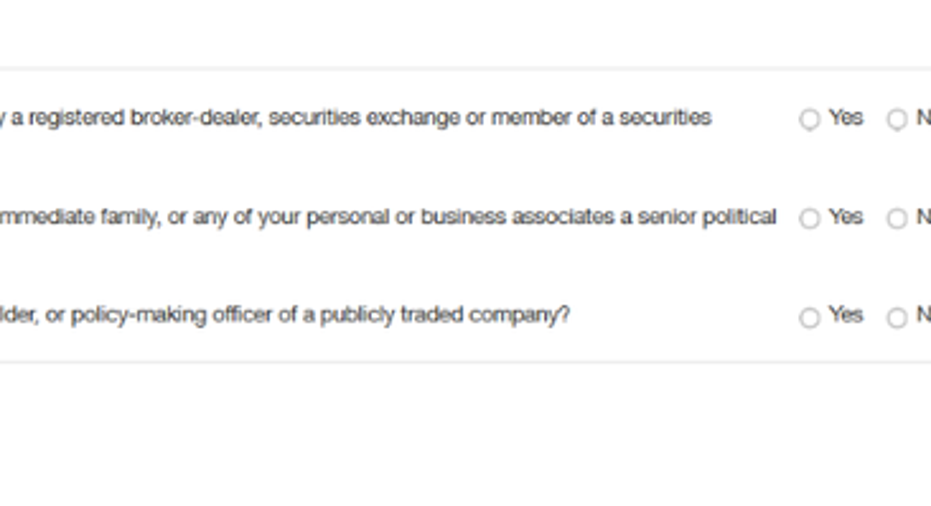

In this section you'll enter more personal information like your Social Security number, mailing address, date of birth, and employment information.

You'll also be asked whether or not you or someone in your household works for any stock exchange, or if an immediate family member is a director or10% shareholder of a publicly held company. You'll probably answer "no" to these questions.

Image source: TD Ameritrade.

Step 3: Review and edit information

This section is pretty straightforward. All you need to do is go through the information that you've already entered for the account and make sure everything is correct. Once you've done that, just click on the continue button and move on to the the next step.

Image source: TD Ameritrade.

Step 4: Agree to terms

This section has a bit of technical information for you to agree to. There are PDFs of the client agreement, account handbook, a business continuity plan statement, and an IRA account agreement disclosure. If any of these apply to you, then be sure to read through them carefully before you agree to open up the account.

Image source: TD Ameritrade.

You'll also have the option in this section to select what will happen to the cash in your account when it's not invested in an asset. The company says that if you don't specify where you want your money to be held, then it will be put in an FDIC-insured deposit account. You can also opt to have the money put into a TD Ameritrade account, which will earn some interest and is protected by the Securities Investor Protection Corporation (SIPC). You can read more about the different accounts here(link opens a PDF).

In this section you'llalso see a few questions from the IRS. This is simply an online version of a W-9 form that will ask you if your Social Security/Tax Identification Number is correct, whether you're subject to backup withholding on your taxes, and whether you're a U.S. citizen. Simply answer the questions, review them, and click the continue button.

Step 5: Set up your online login

Image source: TD Ameritrade.

This is where you'll set your username, password, and security questions. The company says the account will then be opened, at which point you can fund it, choose trading features, and edit your account preferences.You'll also be able to see your official account number on the final page.

And that's it: You've set up your TD Ameritrade brokerage account! If you want to compare TD Ameritrade to other brokers you can always viewspecial offers here. And if you need some tips on how to get started investing, check out these articles:

Forget the 2016 Election: 10 stocks we like better than TD Ameritrade Donald Trump was just elected president, and volatility is up. But here's why you should ignore the election:

Investing geniuses Tom and David Gardner have spent a long time beating the market no matter who's in the White House. In fact, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and TD Ameritrade wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 7, 2016

Chris Neiger has no position in any stocks mentioned. The Motley Fool owns shares of and recommends TD Ameritrade. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.