How to Sign Up for a Fidelity Brokerage Account: a Step-by-Step Guide

Image source: Getty Images.

Setting up an online investing brokerage account can be a bit intimidating. That's why The Motley Fool has put together a few step-by-step guides to help walk you through the process. For this how-to, we're focusing on Fidelity's online individual brokerage account. If you'd like to see competing offers from other brokers, then head on over to our broker comparison page.

What you'll need to get started

You'll need to have the following information on hand to get your Fidelity account up and running:

- Social Security number.

- Employer's name and address, if applicable.

- Bank account information to fund the account.

There aren't any fees for opening up or maintaining a Fidelity brokerage account, but there is a $2,500 investing minimum. So you can set up an account for free, but you'll need to fund it with $2,500 to start investing. As with most online brokerage accounts, there's an equity trade fee, which is $7.95 per trade for Fidelity.

If you need help during the application process, Fidelity provides a link on the right-hand side of the page where you can chat with an online representative. You can also call the number above the chat option.

Image source: Author screenshot of Fidelity site.

Step 1: Fill in your personal information

First, go here and click "Open online" next to the first option, "Brokerage Account - The Fidelity Account." Select individual account and click "Next," and then you'll be asked whether you're an existing Fidelity customer. If you don't already have a Fidelity account, then you'll need to fill in some basic personal information -- email address, street address, Social Security number, and so on -- on this page and the following page.

This section will also be where you enter your employment information, if applicable. The site will also ask you to estimate how often you'll be trading. (Promise us you'll stay away from day trading.)

You'll also be asked whether you're associated with a broker-dealer, a stock exchange, or the Financial Industry Regulatory Authority. You'll also have to answer whether you or any immediate family members are a director or a 10% shareholder of a publicly held company. Most likely, you'll answer "no" to these questions.

Image source: Author screenshot of Fidelity site.

Once you've filled out the personal information and answered those quick questions, move on to Step 2.

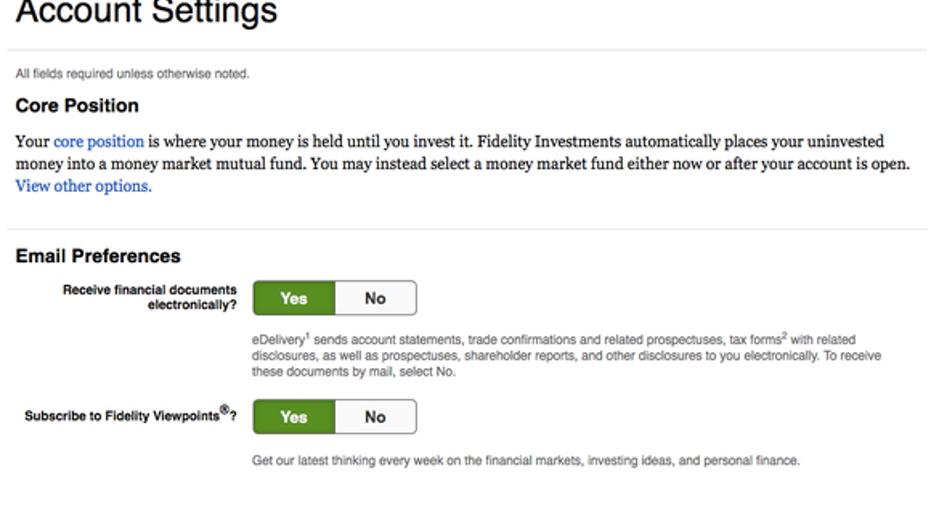

Step 2: Add account settings

On this page you'll answer a few quick questions about your account. It's worth noting here that Fidelity's account settings are some of the simplest and quickest to set up. Other brokerage accounts aren't necessarily difficult, but Fidelity's is one of the most straightforward.

You'll essentially just answer questions about your email preferences and whether you want to subscribe to Fidelity's newsletter. The company also discloses here that it will automatically put your money in a money market account when you're not using it to invest. If you don't want Fidelity investing the money you're not using, then there's a link to see other options as well.

Image source: Author screenshot of Fidelity site.

Step 3: Review and confirm

You're almost done. In this section you'll just review your personal information, the account you selected, your employment information, and some general account settings.

You'll also go through some technical information, such as the customer agreement, terms and conditions, electronic delivery agreement, and so on. Read and review these documents, and then click the "yes" button at the bottom.

Image source: Author screenshot of Fidelity site.

The next page will show a taxpayer identification agreement and some additional terms. Once you read though them, just click "Open account."

Step 4: Fund the account and start investing

Congratulations -- you've opened the account! From here you'll be able to fund your account using your bank information, or you can fund it through another brokerage account.

Other than that, you're all done setting up your Fidelity brokerage account. Remember that you can always view special broker offers here, and if you need some tips on how to get started investing, check out these handy Motley Fool articles:

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known Social Security secrets could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.