Here's What the Average American Receives in Social Security Benefits

Image source: Getty Images.

As of July 2016, the average Social Security benefit is $1,237.15 per month, but that doesn't tell the whole story. This figure includes several different types of benefits, each with its own average. The average monthly payments vary widely by beneficiary type, so here's a breakdown of Social Security benefits -- and how to estimate your own.

Average Social Security benefits -- the detailed version

There are approximately 60.5 million Social Security beneficiaries in the United States, including recipients of retirement benefits, survivor benefits, and disability insurance.

The majority of Social Security beneficiaries, about 72%, are collecting retirement benefits, either on their own work record, or the work record of a spouse or parent. Within this category, here's how the average Social Security retirement benefit breaks down:

Data source: Social Security Administration.

Another 10% of Social Security beneficiaries are receiving survivor benefits -- that is, their benefits are based on the work record of a deceased relative or guardian. These benefits can be paid to children, widow(er)s, and dependent parents of deceased workers, although the number of parents receiving survivor benefits is negligibly low.

Data source: Social Security Administration.

Finally, the remaining 18% of Social Security beneficiaries are receiving disability payments:

Data source: Social Security Administration.

How will you compare with the average?

To estimate your own benefit, you'll need to know how Social Security is calculated. Unlike most pension programs, Social Security isn't based just on your last few years of earnings. Rather, your top 35 years of earnings are taken into account, up to the taxable maximum each year.

All of these years of earnings are then indexed for inflation and averaged together. Your monthly average lifetime earnings are then applied to a benefit formula in order to determine your primary insurance amount (PIA), your monthly benefit at full retirement age. As of 2016, this formula is:

- 90% of the first $856

- 32% of the amount greater than $856, up to $5,157

- 15% of the amount above $5,157

Once your PIA is determined, your actual benefit will be adjusted based on when you decide to claim Social Security. You can choose to file for retirement benefits anytime between the ages of 62 and 70, and your benefit will be permanently decreased or increased for filing early or late, by the following percentages:

- Your benefit will be reduced by 6 2/3% per year before your full retirement age (5/9% per month) up to three years early.

- It will be reduced by 5% per year (5/12% per month) if you choose to begin receiving benefits more than three years early.

- For delayed retirement, your benefit will be permanently increased by 8% per year (2/3% per month) for each year you choose to wait, until a maximum age of 70.

The Social Security Administration has a worksheet that can help you calculate or estimate your Social Security benefits, which you can find here.

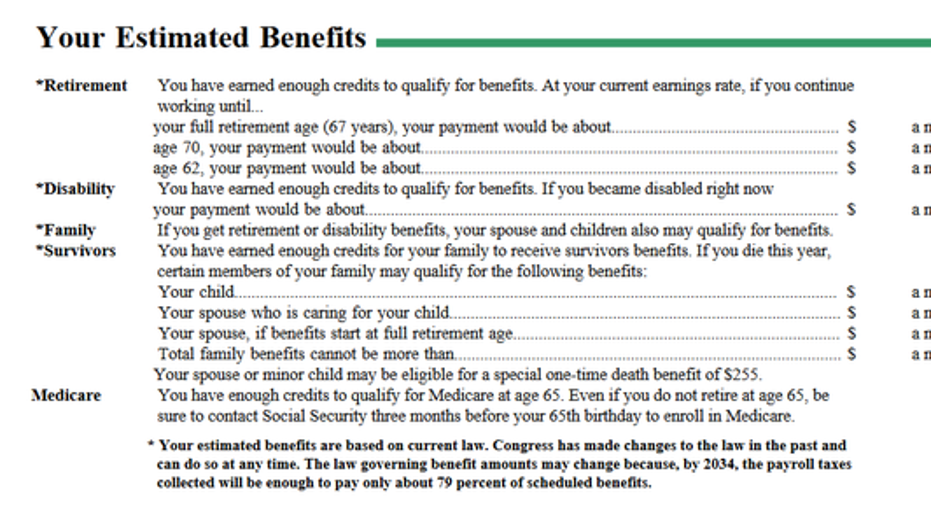

Or, better yet, simply create an account at www.SSA.gov and take a look at your most recent Social Security statement. This will give you an estimate of your full retirement benefit, as well as what it could be at ages 62 and 70. It will also provide details about how much you'd receive if you became disabled, and how much your survivors could receive if you were to die.

Here's a screenshot from my own Social Security statement to give you a better idea of the information on it:

Image source: Author's screenshot of Social Security statement.

How to maximize your own Social Security benefits

While some of the more lucrative Social Security strategies recently went away, there are some smart things you can do to maximize your own benefit.

Knowing how the formula works is a big one. This is especially true if you've worked for fewer than 35 years or have a few particularly low-income years on your record. In that case, simply working an additional year or two could make a big difference -- on top of the increased benefit for waiting.

Reading up on spousal benefits is also a smart idea, if it might apply to you. There are certain considerations when a spousal benefit is in the picture that you should be aware of. For example, couples can generally get more from Social Security by filing when both spouses reach full retirement age, as opposed to waiting until 70.

The bottom line is that every situation is different, so it's important to read up on the advantages and disadvantages of claiming Social Security early or late in order to make a well-informed decision for you and your family.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.