Fidelity, once stodgy and adrift, bets on the Reddit crowd

Abby Johnson, a CEO some doubted, has lifted the firm’s profits while reshaping it for the generation of young investors spurred by the pandemic

Expect something 'spectacular' form the meme crowd: WallStreetBets founder

Jaime Rogozinski discusses if the meme stock madness will continue on 'The Claman Countdown.'

Fidelity Investments Chief Executive Abigail Johnson, granddaughter of the financial behemoth’s founder, checks the pulse of the investing world from an unlikely place these days: Reddit’s stock-picking forums.

Not long ago, Fidelity appeared to some adrift and old-fashioned. Profits were down. Its mutual funds’ star stock pickers were losing clients. A firm that once stood as the world’s biggest money manager had slipped behind BlackRock Inc. and Vanguard Group. Some inside the family-controlled firm worried Ms. Johnson wasn’t bold enough to lead it.

Fidelity Chairman and CEO Abigail Johnson interviews founder of Bloomberg L.P. and former New York City Mayor Michael Bloomberg about innovation at the Boston-based HubWeek in Boston. (Reuters/Brian Snyder)

Today, Johnson’s 75-year-old company has placed more bets than nearly any other big Wall Street firm on the future of cryptocurrencies and doubled down on other areas powered by individual investors—and the plan appears to be working.

REDDIT FILES CONFIDENTIALLY FOR IPO

Seven years into her tenure as CEO, Fidelity is more profitable than ever. It oversees $11 trillion in assets. That figure, which includes assets in Fidelity accounts as well as Fidelity funds held by other brokers’ clients, has more than doubled since Johnson took over. Fidelity’s individual accounts number more than 70 million, up nearly two-thirds since the end of 2014.

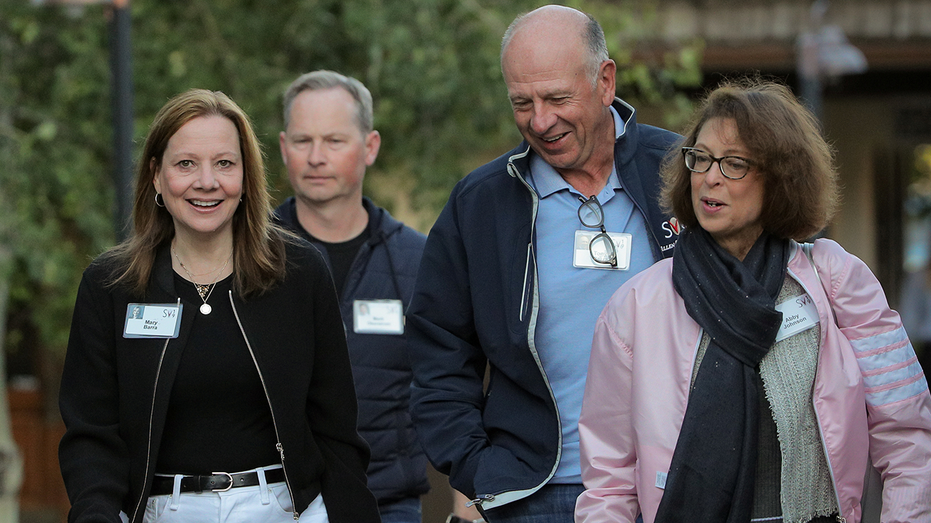

Mary Barra, CEO of General Motors, walks with her husband Tony Barra and Abigail Johnson, Chairman and CEO of Fidelity Investments, during the annual Allen and Co. Sun Valley media conference in Sun Valley, Idaho, U.S., July 12, 2019. (Reuters/Brendan McDermid)

Johnson, 60, has remade Fidelity with a focus on giving a new generation of individual investors what they’re looking for. She spent heavily on expanding its customer-service workforce and building up tech platforms. She lowered fees on products most popular with small investors, in some cases undercutting Fidelity’s rivals.

PEOPLE ARE SELLING PRE-PAID RESTAURANT RESERVATIONS ON REDDIT

Her efforts helped Fidelity ride the country’s biggest wave of new investors since the dot-com bubble. In the months after the 2020 pandemic lockdowns, many cooped up and bored Americans discovered stock-market trading. Since March 2020, customers have opened 12.7 million new retail Fidelity accounts.

FILE: Robinhood and Reddit logos printed in 3D are seen near one-dollar banknotes in front of displayed GameStop logo in this illustration taken February 8, 2021. (Reuters/Dado Ruvic/Illustration)

Their enthusiasm has revived the brokerage industry and, at Fidelity, accelerated a shift away from the actively managed funds that had been the firm’s core business. Fidelity has arrived at a point where its most important assets no longer are star fund managers.

CLICK HERE TO READ FOX BUSINESS ON THE GO

"Most of it was going to happen anyway," Ms. Johnson said in an interview at Fidelity’s downtown Boston headquarters. "But what changed was people’s sense of how important it was."

To continue reading on The Wall Street Journal, click here.