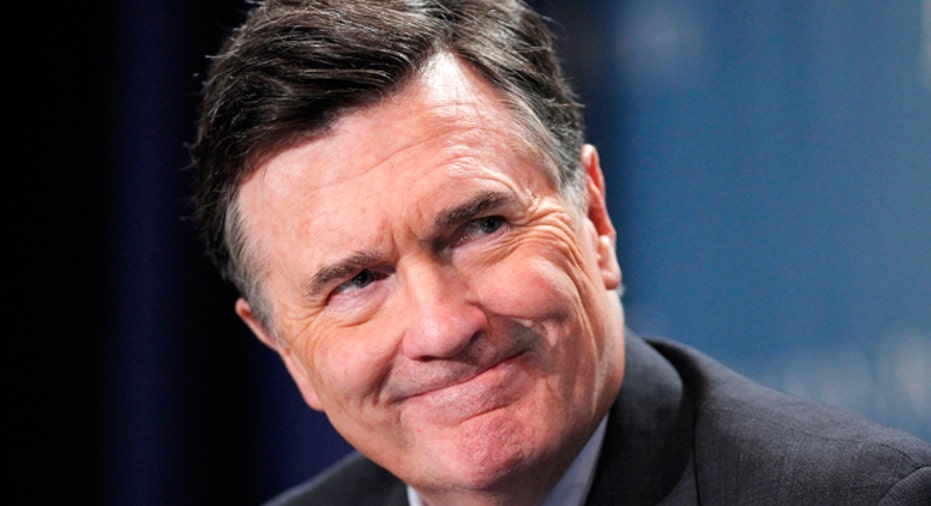

Fed's Lockhart Sees Strong U.S. Growth, Rate Hike in Mid-2015

ATLANTA – The U.S. economy is motoring ahead in its recovery, likely putting the Federal Reserve in position to raise interest rates by the middle of the year, Atlanta Fed President Dennis Lockhart said on Monday.

In some of his strongest comments to date about the direction of the economy, Lockhart said the U.S. economy "is hitting on all cylinders. The recovery that began in 2009 is well-advanced."

In remarks to the Rotary Club of Atlanta, Lockhart said his expectation is that reasonably strong growth will continue through 2015, unemployment will fall, and inflation will eventually begin to rise - a set of conditions that should allow the Fed to raise rates by the middle of the year.

The comments from a Fed centrist give an important insight into how the U.S. central bank is steadily moving towards a rate hike that will put a formal end to its era of crisis response.

The initial hike will still leave interest rates unnaturally low, and they are expected to rise only slowly, over a period of years, towards what is considered a neutral level. That means years more of economic stimulus remain in the offing even after that initial increase.

But the moment of liftoff will be "momentous" said Lockhart, who is among the regional Fed presidents voting this year on the central bank's policy-setting committee.

"There was more improvement in labor markets in 2014 than in any other year of the recovery," Lockhart said, with the strongest job growth in more than a decade. Meanwhile, consumers "seem to be more prepared to open their pocketbooks."

The major risks may be outside the United States, Lockhart said, with weak global growth, the collapse in oil prices and other factors complicating progress towards the Fed's goal of raising the annual rate of inflation to 2 percent.

He said low oil prices will eventually be a great benefit to the U.S. economy, though for now it may leave the Fed with "considerable ambiguity" over whether its inflation goals will be met in a reasonable time frame. Wage growth is also weak.

Still, he said he felt the economy would maintain its underlying momentum.

"The first action to raise interest rates will in all likelihood be justified by the middle of the year," he said.

(Reporting by Howard Schneider; Editing by Paul Simao)