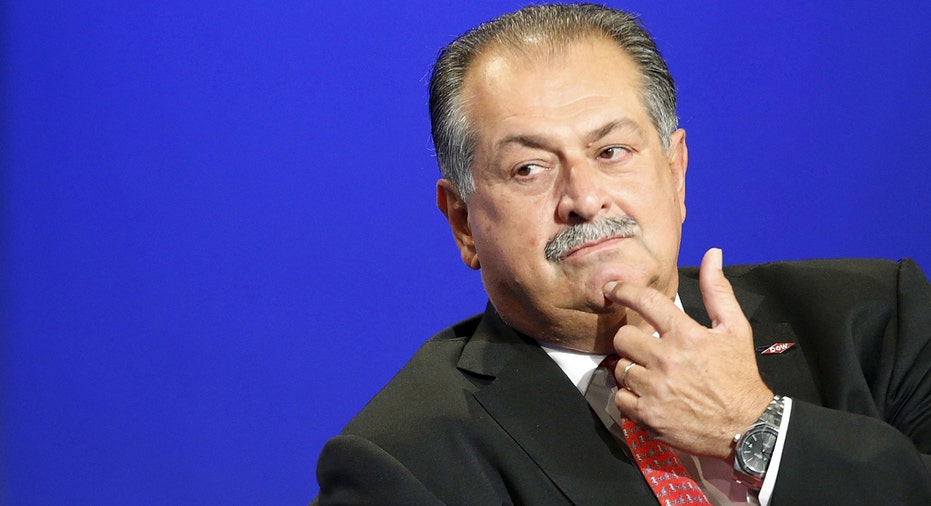

Dow Chemical CEO Plans to Leave Company After Planned Merger

Longtime Dow Chemical Chief Executive Andrew Liveris says he plans to leave the company by mid-2017, after the company completes its planned merger with rival DuPont. Midland, Mich.-based Dow, a giant in the chemical and agriculture industries and maker of products ranging from corn seeds to plastic, in December struck a deal to combine with DuPont into a $120 billion company that will have about $90 billion in sales. The merged firm, if the deal is approved, expects to cut some $3 billion in costs before splitting into three separate businesses 18 to 24 months after the merger closes. Mr. Liveris, who has served as Dow's chief executive for over a decade, said Tuesday that he won't stay on to helm one of the new businesses. Late last year, Mr. Liveris hinted that the deal was a culmination of his tenure at the company and that he was nearing retirement. And in response to activist investor Dan Loeb and his hedge fund Third Point LLC, which had called for Mr. Liveris to step down, Dow said that Mr. Liveris "does not contemplate serving" as CEO of the new material-sciences business that will emerge from the breakup. Third Point won't be launching a proxy fight for board changes at Dow this year, which Mr. Loeb had privately threatened in the past year, people familiar with the matter said. Dow announced Tuesday the elevation of Vice President and Chief Operating Officer James Fitterling, who will help shepherd the merger through and assist the with transition. Dow said the companies hope to complete their combination by the end of this year. Dow said Tuesday profit rose in its latest quarter, thanks to a gain stemming from the sale of a chunk of its chlorine business. Revenue, meanwhile, slid 20% due mostly to price declines and adverse foreign-exchange rates. Results topped expectations and sent shares up 3.3% in premarket trading. The company said that consumer demand remains strong even amid worries that global economies are precarious. Sales volumes rose 4% over last year, excluding the impact of acquisitions and divestitures. "The global economy continues to be volatile with consistent demand being driven by the consumer, especially in the U.S. and increasingly from China," Mr. Liveris said in a statement. "We believe low energy prices are a net benefit and will help overcome negative investment sentiment in other sectors." In Dow's plastics segment, its largest, cheap raw materials helped push that business's operating profit to a fourth quarter record of $1.3 billion. In the fourth quarter, Dow separately completed its roughly $5 billion divestiture of Dow Chlorine Products. The sales decline was offset by a large gain on the sale of the chlorine business in addition to reduced overhead costs and lower research and development spending. For the quarter, Dow reported a profit of $3.61 billion, or $2.94 a share, up from $819 million, or 63 cents, a year earlier. Per-share results reflect the payout of preferred dividends. Excluding a gain of $1.96 a share resulting from the aforementioned divestiture, among other items, per-share earnings rose to 93 from 85 cents. Revenue declined 20% to $11.46 billion. Analysts projected 70 cents in adjusted earnings per share on $11.2 billion in revenue, according to Thomson Reuters. David Benoit contributed to this article.