Did Rockwell Automation Really Just Have a Lucky Quarter?

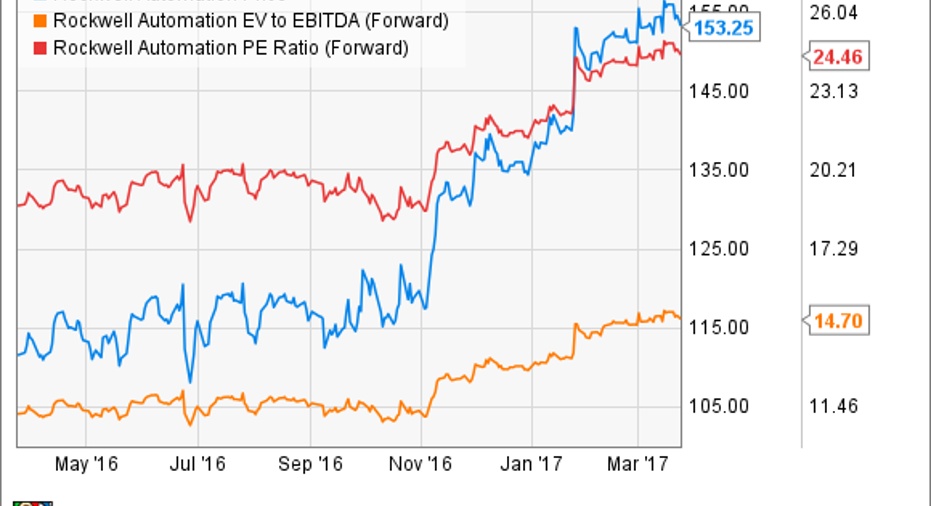

Rockwell Automation's(NYSE: ROK)recent first-quarter earnings report had more than its fair share of bullish signals to encourage investors in the stock.Indeed, Rockwell looks well-placed in an environment in which most forecasters are predicting a pickup in North American industrial production. So is it time to pile into the stock? Let's look at the cases for and against.

Rockwell Automation sets pulses racing

As you can see above, the stock has been on a strong run in the past year, and the first-quarter results released at the end of January only served to further stoke the flames of optimism. Some of the key reasons that bulls are warming to the company:

- First-quarter 2017 sales were ahead of expectations and marked a return to organic sales growth (see chart below).

- Management raised full-year guidance for organic growth (1%-5% from 0%-4% previously), adjusted diluted EPS ($5.95-$6.35 compared to $5.85-$6.25 previously), operating margin (a little below 20% to a little above 20%), and free cash flow conversion from net income (100%-plus from around 100% previously).

- Ted Crandall, CFO at the time, noted that the guidance hike was "primarily based" on the better-than-expected sales growth in the first quarter. In other words, management hasn't baked in any change to growth assumptions it last made in November.

- Given that peers like Parker-Hannifin Corp (NYSE: PH) and Emerson Electric Co. (NYSE: EMR) have given notice of an improving environment, and that much of Rockwell's revenue depends on cyclical capital spending, it's understandable if the market gets excited by the prospect of an improving macroenvironment.

Data source: Rockwell Automation presentations. Chart by author.

Improving environment

Focusing on Emerson Electric and Parker-Hannifin for the moment: There is evidence of an improving environment in the industry. For example, Emerson Electric -- sometimes seen as a potential bidder for Rockwell -- had a better-than-anticipated quarter and raised guidance amid seeing its trailing-three-month order growth return to positive territory. Meanwhile, in its second-quarter results released in February, Parker-Hannifin increased its second-half organic growth forecast to 3.3% compared to a previous forecast for 2.3%.

Putting these points together, it's not hard to think of Rockwell's management as being conservative with guidance in the face of an improving backdrop in its end markets. Does this mean you should rush to mentally pencil in potential upside to earnings forecasts for 2017?

Auto sales were very strong for Rockwell in the first quarter. Image source: Getty Images.

The real deal?

Before you do that, it's worth reflecting on management's commentary on the quarter, and then considering whether the reasons for the beat are part of a sustainable trend or not. While the evidence for improving end markets is compelling, it also appears that Rockwell had a uniquely good quarter. Management made the following points on the earnings call:

- CEO Blake Moret talked of a "higher-than-normal budget flush at the end of the quarter, primarily in the U.S.," with some "larger projects" pulled forward.

- China (up mid-teens) and Asia-Pacific in general (up 19.8% ) had a very strong quarter led by consumer and transportation, but management expects full-year growth in mid-single digits.

- Rockwell's sales to the auto sector were up 10% --Illinois Tool Works (NYSE: ITW) also reported a strong quarter in autos, particularly in China -- and this may not prove sustainable, as it's not clear where China auto sales will go as the impact of incentives fades.

- The control products and solutions segment -- responsible for 34% of segment earnings in the first quarter -- is expected to see "margin pressure" this year.

Regional contributions to year-over-year organic growth in the first quarter. Data source: Rockwell Automation presentations. Chart by author.

Time for caution?

Clearly, the economic backdrop is improving for Rockwell Automation and others, but at the same time it appears that Rockwell has just had an unusually strong quarter. To be fair, management hasn't got carried away and aggressively increased guidance, but the valuation (forward P/E ratio of 24) suggests the market is expecting more upside. Rockwell is set for growth, but perhaps not as strong as seen in the first quarter, so cautious investors may want to wait a quarter or two before buying in.

10 stocks we like better than Rockwell AutomationWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Rockwell Automation wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Lee Samaha has no position in any stocks mentioned. The Motley Fool recommends Emerson Electric and Illinois Tool Works. The Motley Fool has a disclosure policy.