Could This Oil Stock Really Become the Next Apple?

Pioneer Natural Resources (NYSE: PXD) has long believed that it's sitting on one of -- if not the-- biggest oil fields in the world. In fact, so much low-cost oil saturates the rocks beneath the land it controls in the Permian Basin of western Texas that the company recently unveiled a bold decade-long plan to develop this resource. What's remarkable about that plan is that the production from new wells will fuel more than 20% annual cash flow growth over the next 10 years even if oil prices don't budge.

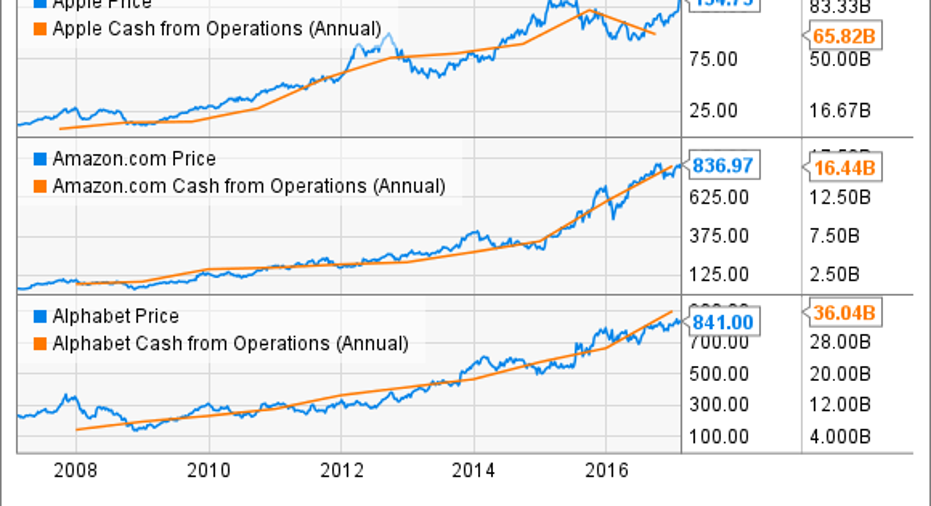

That's elite-level cash flow growth that, according to an analysisbyJPMorgan, only 15 companies have eclipsed over the past decade. Among those cash flow growth kings were tech giants Apple(NASDAQ: AAPL), Amazon, and Alphabet. Given the historical performance of those tech giants and the others on the list, Pioneer's ambitious growth plan could fuel its stock to deliver market-thrashing returns in the years ahead.

Sands Weems. Image source: Pioneer Natural Resources.

Already a step ahead

Pioneer Natural Resources is one of the few oil companies that has consistently grown production during the oil market's recent downturn. The company has increased output every quarter since oil prices collapsed in 2014, with last year's production up 15% versus 2015. Contrast this with similarly sized rivals like Bakken Shale-focused Continental Resources (NYSE: CLR) or diversified shale driller Encana (NYSE: ECA). In Continental Resources' case, its production was down 4.3% year over year in 2016 while Encana's output slumped double-digits due in part to asset sales.

The reason Pioneer could continue growing was due to its cash-rich balance sheet and the fact it earns higher returns on new wells thanks to the unique properties of the Permian. Currently, Pioneer Natural Resources' internal rates of return on new wells in the Basin will range from 50% to 100% assuming $55 oil and $3 natural gas this year. Contrast this with Encana, which earns a minimum 35% return from its best wells at those prices or Continental's 40% return for Bakken wells at $55 oil. Those higher returns enable Pioneer to generate more cash flow, which it can reinvest to grow faster than its rivals.

Drilling down into the plan

As those returns suggest, Pioneer Natural Resources controls some prime drillable land. Thanks to a series of smart acquisitions and organic leasing, the company currently holds a 785,000-acre position that it built up over the past two decades. The company believes that there are as much as 11 billion barrels of oil equivalent resources underneath that land, which it can extract through an estimated 20,000 future drilling locations.

At current oil prices, the company anticipates that it can generate sufficient cash flow to drill enough new wells each year to boost its production by 15% annually over the next decade. That would grow the company's output from an average of 234,000 barrels of oil equivalent per day last year (BOE/D) up to an even 1 million BOE/D by the end of 2026. Moreover, due to the high-margin nature of these wells, it would grow Pioneer Natural Resources' cash flow by a more than 20% compound annual rate over that same time frame assuming no further improvement in crude prices.

Image source: Getty Images.

Putting things into perspective

Those metrics would put the company in an elite category. For example, if it achieved its cash flow grow target, it would generate more than $10 billion in operating cash flow in 2026, up from $1.5 billion last year. Just to put that into perspective, big oil giant ConocoPhillips (NYSE: COP) generated roughly $4.4 billion in cash flow from operating activities last year on more than 1.5 million BOE/D of production. Though, to be fair, ConocoPhillips' realized price per BOE was $28.35 last year, so its cash flow would have been higher using Pioneer's commodity price assumptions.

However, it's the sheer rate of Pioneer's growth that is so remarkable, not just for an oil producer, but when taken in the context of the broader market. As previously mentioned, JPMorgan found that just 15 stocks in the entire Russell 1000 Index have grown cash flow by more than 20% annually over a 10-year period, with the bulk of that elite group made up of tech giants such as Apple. Needless to say, that steadily growing cash flow has done wonders for their stock prices:

In fact, according to the bank's research, these 15 stocks have delivered an average total shareholder return of 662% over that timeframe, or an average yearly return of nearly 19%. That's not to say Pioneer will match those returns, but it's 10-year growth forecast certainly gives it the fuel to deliver market-beating returns as long as oil prices don't collapse again. Meanwhile, if prices rise above Pioneer's outlook, it would likely grow cash flow by an even healthier clip.

Bottom line, Pioneer Natural Resources's forecast makes it a stock that growth investors should seriously consider.

10 stocks we like better than Pioneer Natural ResourcesWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Pioneer Natural Resources wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Matt DiLallo owns shares of AMZN, Apple, and ConocoPhillips and has the following options: long January 2018 $85 calls on Apple and short January 2018 $90 calls on Apple. The Motley Fool owns shares of and recommends GOOGL, GOOG, AMZN, and Apple. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. The Motley Fool has a disclosure policy.