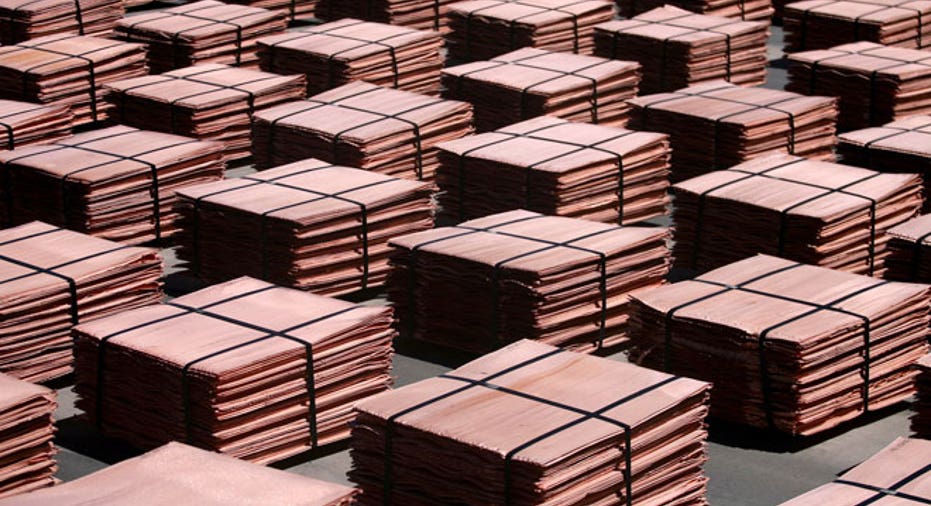

Copper Falls As Fears Intensify Over China Slowdown

Copper resumed its decline on Thursday after a brief recovery the previous day, as concerns about the economy of top consumer China intensified following data showing a slowdown in industrial output.

Hefty losses for the metal used in power and construction earlier this week have pushed prices 12 percent lower for the year. It has lost more than 8 percent of its value since Friday, on fears of an economic slowdown and credit problems in China.

Three-month copper on the London Metal Exchange (LME) had slipped to $6,480 a tonne by 1041 GMT, down 0.4 percent from a close of $6,505 on Wednesday. Prices hit a 44-month low of $6,376.25 in intraday trade on Wednesday before recovering at the close to post their first daily gain since Friday.

Reinforcing fears was Chinese data showing growth in investment, retail sales and factory output falling to multi-year lows. Industrial output rose 8.6 percent in the first two months of 2014 from a year earlier, missing market expectations.

China accounts for 40 percent of global refined copper demand.

"The industrial production data has further reinforced the concerns that the threat is becoming more real and the recent policies by the PBOC are failing to rebalance their economy," said Naeem Aslam, chief market analyst at Ava Trade, referring to the Chinese central bank.

Traders said lower prices had attracted some bargain-hunting, especially among European industrial consumers taking advantage of the euro's strength against the dollar to stock up on copper.

The euro is at 2-1/2-year highs against the dollar. A weak dollar makes commodities priced in the U.S. unit cheaper for holders of other currencies.

"The metal is extremely oversold and it is very attractive at this price and we are expecting a bounce back soon," Aslam said.

Copper was rattled by a bond default by a Chinese solar panel company last week, which ignited worries about risk in the country's credit market.

A good amount of copper held in China's bonded zones is tied up in financing deals in which importers sell the metal on domestic markets to raise credit for more lucrative investments elsewhere, and there are fears these arrangements may unravel.

Copper inventories in warehouses monitored by the Shanghai Futures Exchange rose 4.6 percent last week to 207,320 tonnes, while stocks in bonded warehouses were estimated by industry sources at up to 800,000 tonnes.

"Fundamentally the situation in China is not looking bright. Defaults are surfacing, inventory has been rising very quickly, credit tightening is likely to continue," said Joyce Liu, investment analyst at Phillip Futures in Singapore.

She said the market lacked a surge in Chinese copper demand necessary to push prices sustainably higher and that further downside to $6,050 per tonne looked possible on technical charts.

In industrial news, spot iron ore prices pulled further away from 17-month lows as some buyers returned to the market after an 8 percent slide earlier this week, but traders and mills were wary that a sustained recovery could remain elusive.