Carl Icahn sells stake in insurance giant AIG: Report

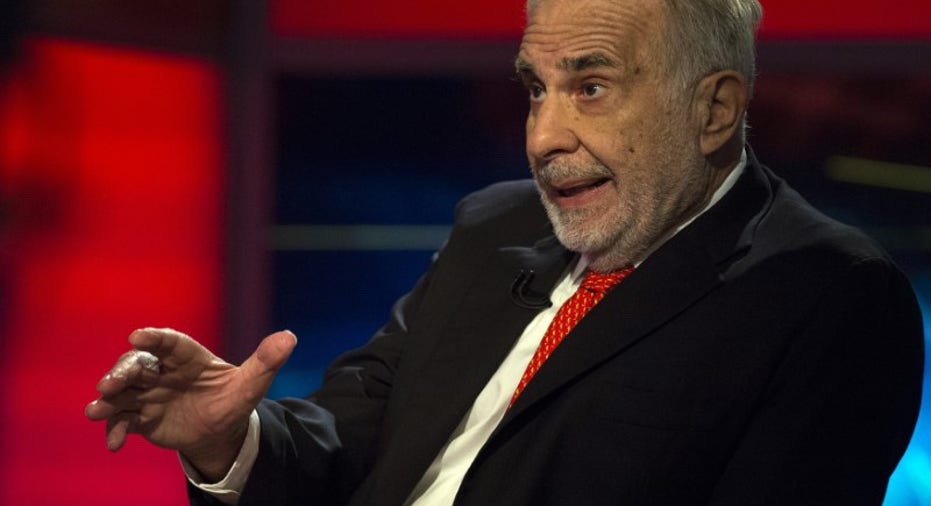

Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network's Neil Cavuto show in New York February 11, 2014. REUTERS/Brendan McDermid (Reuters)

Billionaire investor Carl Icahn has sold his stake in U.S. insurance giant AIG, Forbes reported on Monday.

Icahn’s near 4.8% stake in AIG made him the third-largest shareholder in the company at the end of 2017, according to data from Thomson Reuters. The investor sold his shares of AIG when the stock changed hands between $60 and $65, according to Forbes, citing a person familiar with the matter. AIG last traded at those levels in early February.

Icahn Enterprises and AIG did not respond to FOX Business’ request for comment at the time of publication.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AIG | AMERICAN INTERNATIONAL GROUP INC. | 76.72 | +0.76 | +1.00% |

| MET | METLIFE INC. | 76.38 | +1.06 | +1.41% |

| PRU | PRUDENTIAL FINANCIAL INC. | 102.80 | +2.98 | +2.99% |

Known for his hostile takeovers of businesses, Icahn started acquiring shares in AIG in 2015 and called for the resignation of its CEO, Peter Hancock, and for the insurer to split into three companies. Instead, a turnaround plan was designed, though it wasn’t enough for Hancock to keep his position. He stepped down during a board meeting in March of last year, after AIG posted a $3 billion loss in its fourth-quarter results. Brian Duperreault succeeded Hancock, who was at the helm for less than three years.

Shares of AIG were slightly lower at $52.47 in late morning trading Monday.