Biden tax hikes bigger threat to stock market than slowing economy: Goldman Sachs

Goldman Sachs sees tax reform hurting corporate earnings

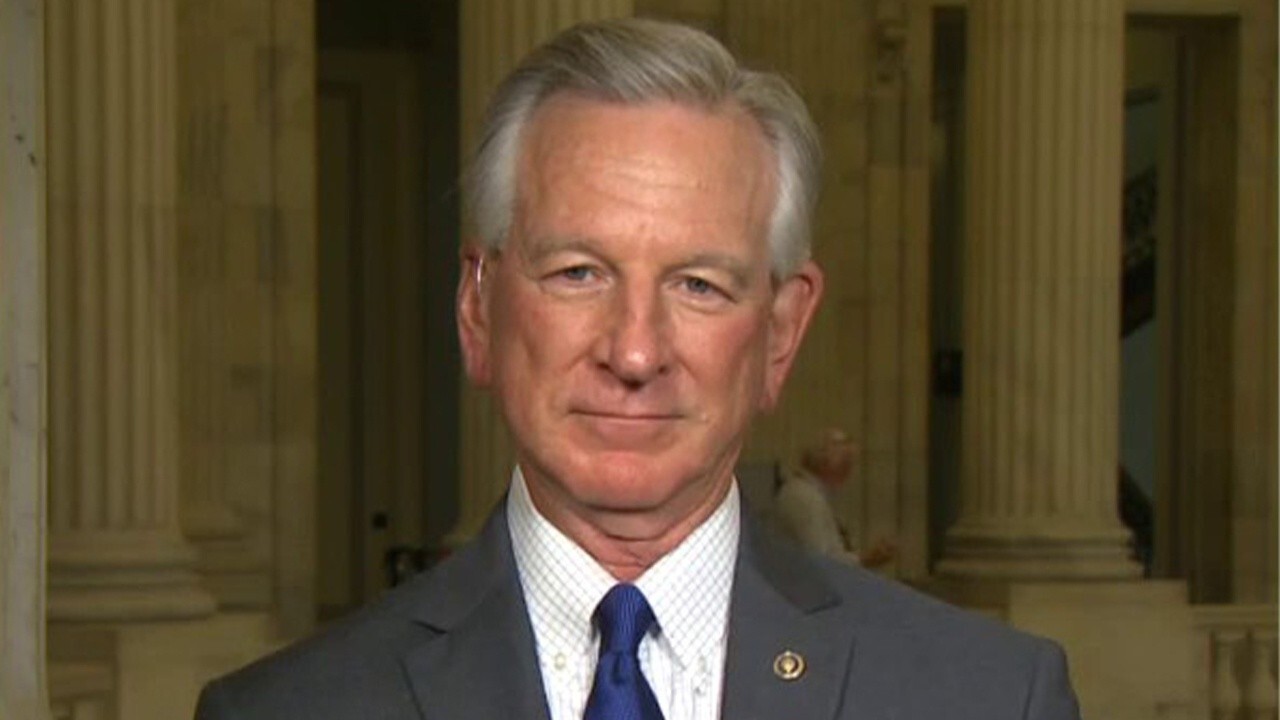

Manchin will vote for part of $3.5T reconciliation bill: Sen. Tommy Tuberville

Sen. Tommy Tuberville, R-Ala, on Sen. Joe Manchin and spending negotiations.

President Biden's ability to win new tax hikes will dictate the future of the stock market, according to Goldman Sachs.

The firm estimates that raising the domestic statutory tax rate to 25% and passage of about half of the proposed increase on tax rates to foreign income will lower S&P 500 earnings by 5%. Goldman’s 2022 S&P 500 earnings forecast is $212, or 3% below the $220 consensus.

Goldman sees the S&P 500 finishing 2021 at 4,700, or 5.41% above where the index finished Friday. The firm says the S&P 500 will edge up another 4.26% next year to 4,900.

GROCERY PRICES HEADED HIGHER: KROGER

"Tax, not economic growth, is the key risk to stocks," wrote a team led by David Kostin, chief U.S. equity strategist at Goldman Sachs, adding that changes to the tax code will "affect corporate earnings" next year.

House Democrats over the weekend slimmed down their tax-hike proposals after Sen. Joe Manchin, D-W.Va., said he opposed Biden’s $3.5 trillion spending package.

The updated draft proposal, which could still change, is said to include raising taxes on individuals making over $400,000 annually and married couples filing jointly making at least $450,000 per year. Other potential changes include hiking the top corporate tax rate to 26.5% from 21% and increasing the top capital gains rate to 25% from 20%.

The changes to the corporate tax rate pose a bigger threat to the stock market than the recent growth worries that have been emanating from Wall Street banks, the firm said.

Goldman Sachs and a number of other investment firms have in recent weeks ratcheted down their growth forecasts for the U.S. economy for the rest of this year amid concerns over reduced fiscal stimulus and consumer spending, and a resurgence in COVID-19 infections.

Last week, Goldman’s economists cut their fourth-quarter growth forecast to 5.5% from 6.5%. A few weeks prior, the firm slashed its third-quarter forecast to 5.5% from 9%.

Morgan Stanley’s Ellen Zentner, meanwhile, lowered her third-quarter growth outlook to 2.9% from 6.5%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

But Goldman says a proposed tax on corporate buybacks "could affect equity supply and demand" as U.S. corporations have been the biggest buyer of U.S. stocks over the past decade.

"In an uncertain economic and tax policy environment, stocks with stable earnings and strong balance sheets should continue to outperform," Kostin wrote.