AT&T Stock History: A Dividend Dynamo That Stands the Test of Time

Image source: Getty Images.

Having existed in one form or another for over 130 years, AT&T's (NYSE: T) stock history is in many ways a history of the telephone itself.

With dividend investing as a whole enjoying something of a resurgence lately, high-yielding stocks like AT&T are having something of a moment right now. In light of that, here's a quick overview of AT&T stock's historical performance and why its sizable dividend should continue to provide value for its shareholders.

AT&T stock history: From Graham Bell to Ma Bell to today

It isn't a stretch to regard AT&T's history as a reflection of American business as a whole in the more than a century since its founding by Alexander Graham Bell in 1876.

In its early years, the revolution in communication that AT&T and Bell helped spur gave birth to a business many grew to regard as a monopoly in the telecom industry for much the 20thcentury. Predictably, this culminated in the eventual break-up of AT&T, or "Ma Bell" as many had come to call it, in 1984. However, the shattered remnants of AT&T's former glory also sowed the seeds for the company's more recent renaissance.

AT&T's 1980s breakup witnessed the creation of a number of smaller fragments of the former monopoly, which at least some readers will remember as the "Baby Bells." Of particular importance in terms of AT&T's corporate history today, the destruction of the original AT&T monopoly gave birth to the Southwestern Bell Corp, or SBC, which after a series of mergers and re-namings is the publicly security represented by AT&T stock today.

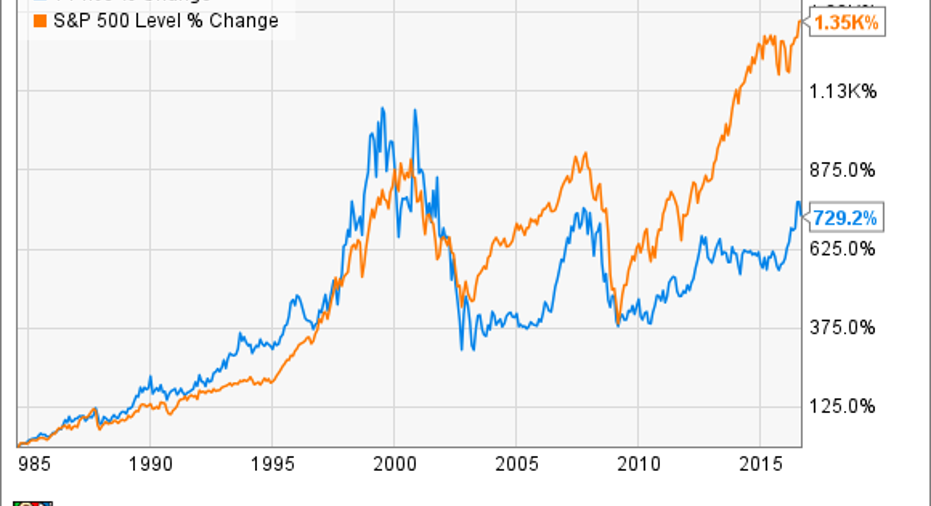

Here's how AT&T shares have fared against the broader market since their SBC days.

It's an important caveat here that the above chart doesn't reflect the effect of dividends, of which AT&T and its myriad predecessors have all been prodigious payers.

Since it has engaged in so much merger activity in the past two decades, precisely calculating out how much dividends would change the equation becomes unwieldy. Just know, the above underperformance would be dramatically reduced or removed when counting dividends. As it also happens, AT&T's dividend prowess remains one of the core tenets of the current investment thesis in its stock today.

Outlook for AT&T shares

Though it has other multibillion-dollar business units, AT&T's financial success largely rests on the strength of its massive U.S. wireless business; international sales account for less than 3% of total revenues. Its massive consumer and business wireless segments together produce 50% of AT&T's total revenues and 80%of its operating income. Thankfully, these businesses are relatively stable -- even growing slightly. However, with the U.S. smartphone market quickly approaching maturity,AT&T's long-term revenue growth outlook appears moderately constrained. That's also where AT&T's history of outsized dividend payments helps create value for its shareholders.

Data sources: S&P CapIQ, AT&T investor relations, and dividend.com.

Even given its relatively diminutive dividend growth, AT&T shares undoubtedly remains an income-generating machine. In an era in which the 10-year Treasury currently yields just 1.6%-- roughly two-thirds below its historic average -- those seeking income investments for whatever reason are increasingly, and rightly, shifting their attention toward dividend investing.

AT&T's stock is far from exciting. But in the context of helping meet savers' important needs, this U.S. telecom giant certainly appears to fit the bill. Relatively safe and sizable, AT&T shares should offer great value for dividend investors for years to come.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early, in-the-know investors! To be one of them, just click here.

Andrew Tonner has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.