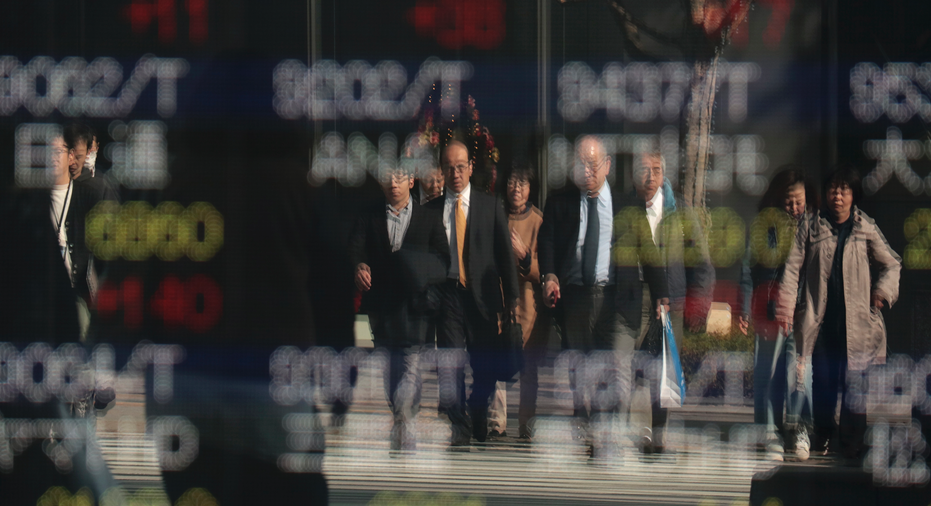

Asian shares mixed following North Korean missile launch

TOKYO – Shares are mixed in Asia following a broad rally on Wall Street that lifted U.S. stocks to a milestone-shattering finish. Investors appeared to shrug off the latest launch of a ballistic missile by North Korea.

KEEPING SCORE: Japan's Nikkei 225 index gained 0.3 percent to 22,552.38, while South Korea's Kospi was almost unchanged at 2,513.42. Australia's S&P ASX 200 added 0.6 percent to 6,059.59. The Hang Seng index in Hong Kong fell 0.3 percent to 29,590.11 and the Shanghai Composite index sank 0.7 percent to 3,312.05. Shares in Southeast Asia were mixed.

WALL STREET: Banks led gains, along with industrial stocks, retailers and health care companies. Investors were encouraged by news that a Senate committee cleared the way for a tax reform bill to go before the full Senate. Financial stocks also got a boost from Federal Reserve chair nominee Jerome Powell, who told another Senate committee that the Fed would consider easing up on bank regulations. The S&P 500 index rose 1 percent to 2,627.04. The Dow Jones industrial average gained 1.1 percent to 23,836.71 and the Nasdaq composite added 0.5 percent to 6,912.36. The Russell 2000 index of smaller-company stocks picked up 1.5 percent, to 1,536.43. Gainers outnumbered decliners more than 2 to 1 on the New York Stock Exchange.

NORTH KOREA MISSILE: North Korea on Wednesday ended its longest pause in missile tests this year with what appeared to be its most powerful version yet of an intercontinental ballistic missile meant to target the United States. North Korea's 20th launch of a ballistic missile this year adds to fears that the North will soon have a military arsenal that can viably target the U.S. mainland. But it barely registered in regional markets.

ANALYST'S TAKE: "The markets seem to be more immune than in the past to North Korea's missile testing and, taking cues from the overnight reaction, we can expect a muted reaction in the Asian session today," Prakash Sakpal of ING said in a commentary.

U.S. DATA BOOST: Investors got a double dose of encouraging U.S. economic data when the Conference Board said its consumer confidence index rose this month to its highest level in 17 years. Economic growth clocked at a healthy 3 percent annual pace in the third quarter, and the unemployment rate fell to a 17-year low of 4.1 percent. A separate index showed U.S. home prices rose at the fastest pace in more than three years in September.

ENERGY: Benchmark U.S. crude gave up 30 cents to $57.69 per barrel in electronic trading on the New York Mercantile Exchange. It dropped 12 cents to settle at $57.99 a barrel on Tuesday. Brent crude, used to price international oils, lost 35 cents to $62.89 per barrel. It declined 23 cents to close at $63.61 in London.

CURRENCIES: The dollar rose to 111.52 Japanese yen from 111.46 yen on Tuesday. The euro rose to $1.1850 from $1.1839.

___

AP Business Writer Alex Veiga in Los Angeles contributed to this story.