A Close Look at Starbucks' Dividend Potential

Image Source: Getty.

When investors hear the phrase "dividend stocks,"Starbucks(NASDAQ: SBUX) is probably not the first company that comes to mind.

Investors tend to think of stalwarts likeCoca-ColaandProcter & Gamble as go-to dividend payersrather than a growth stock like Starbucks. That makes sense. Coke and P&G are both dividend aristocrats that have paid annually increasing dividends for more than a generation, while Starbucks trades at a P/E of 32 and started making quarterly payouts to shareholders in 2010.

Starbucks also offers a much smaller yield than most traditional dividend stocks, at just 1.4%, but income investors shouldn't be so quick to dismiss the coffee giant. For long-term investors, here's why Starbucks could be an excellent fit into your dividend portfolio.

Not a bad track record

Below is Starbucks' dividend history.

| Date | Quarterly Payout | Growth |

|---|---|---|

| March 2010 | $0.05 | |

| July 2010 | $0.065 | 30% |

| 2011 | $0.085 | 30.8% |

| 2012 | $0.105 | 23.5% |

| 2013 | $0.13 | 23.8% |

| 2014 | $0.16 | 23.1% |

| 2015 | $0.20 | 25% |

Data source: Starbucks Investor Relations.

Starbucks has not yet announced its dividend increase for this year, which should come in October, when it reports fourth-quarter earnings. However, one pattern stands out from the chart above. Every one of Starbucks' six dividend increases has been for 23% or more. That kind of pattern simply does not exist with dividend aristocrats like Coke and Procter & Gamble, whose recent dividend increases have been in the single digits. If that streak continues, Starbucks' dividend will more than double in the next four years.

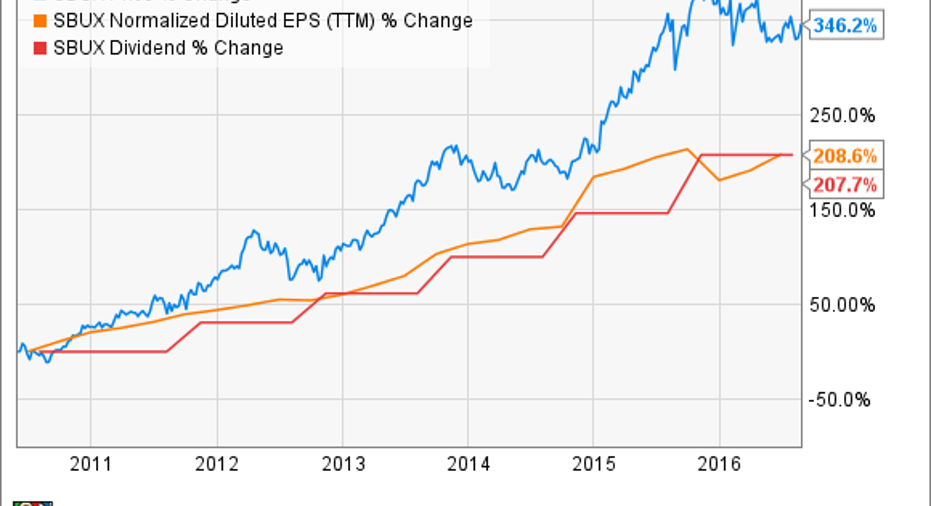

Starbucks' strong earnings growth has enabled it to consistently issue such significant dividend hikes. The charts below highlight the company's recent success.

Two things in particular stand out about the charts above. First, if you purchased Starbucks stock on April 7, 2010, the record date for its first dividend payout, your dividend yield based on what you paid that day would now be 6.4% -- much better than most dividend stocks offer today.

The second is that Starbucks' earnings have risen in tandem with its dividend increases. The gains over the last six years are almost identical. That means that the company's dividend hikes are funded by growing profits and not by debt or cash on hand. If Starbucks' profits continue to grow at the same pace, its dividend can follow suit endlessly. Also of note is that the company's payout ratio, or the percentage of profits devoted to dividends, is still under 50% -- much less than the typical dividend stock, which might spend around 80% of profits on dividends. That means Starbucks has room to hike its dividend even if profit growth slows.

Growth is the key

Image Source: Starbucks.

Even the most venerable dividend payers have to deliver growth to attract income investors. Wal-Mart(NYSE: WMT), for instance, is a dividend aristocrat, but has raised its quarterly payout by just 2% in each of the last three years as earnings growth has slowed and even turned negative this year. Though the retail giant offers a yield of 2.8%, double that of Starbucks, the dividend growth has been disappointing to investors and makes Starbucks the better long-term play.

With Starbucks, on the other hand, there are signs that its strong earnings growth should continue. The company plans to add 500 stores a year in China every year for the next five years, and its comparable sales growth has been rock-solid in recent years, the best sign of its ability to continue to grow profits. Store growth around the world continues at a fast pace, with the company expecting to add 1,900 net new stores this year.

Meanwhile, the company has diversified further into consumer products, leveraging its brand into high-margin items like K-Cup pods, ready-to-drink beverages, and Tazo tea boxes.

Those factors should enable it to continue raising its dividend at an aggressive rate. While 25% hikes may not be sustainable, I'd expect an increase rate of 15%-20% over the next few years, making Starbucks' dividend much more valuable for long-term investors.

The company should raise its dividend again in October. Look for a hike of at least 20%, to $0.24 per quarter.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Jeremy Bowman has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool recommends Coca-Cola and Procter and Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.