5 Gambling Stats that Will Blow You Away

Las Vegas strip. Image source: Getty Images.

The gambling industry has been an interesting place over the past few decades. The rise of Las Vegas, boom and bust of Atlantic City, recent unstable growth in Macau, and a changing consumer and economic landscape have led to volatility for companies such as Wynn Resorts (NASDAQ: WYNN), Las Vegas Sands (NYSE: LVS), andMGM Resorts International (NYSE: MGM) that are the biggest players in this sector. Here are some mind-boggling stats that shed light on what's happening in the industry now.

1. Macau's gambling revenue is 3 times that of Las Vegas

Macau has a rich history, from being a Portuguese-owned trading port that saw its share of pirates, military posts, and gambling, to coming under Chinese control in 1999. It eventually became the only place in China where gambling is allowed, and its government went on to open the region up to foreign resorts. Once the first American-owned casino opened in 2004, the next decade was one of intense growth, leading to record profits quarter after quarter for Wynn, Las Vegas Sands, and others with the biggest bets there.

Gambling is such a big deal today that revenue in Macau exceeds that of Las Vegas three times over. Even more incredible, that figure is far lower where it set as of early 2014 -- back then, Macau had around seven times Las Vegas' gambling revenue.

What happened in 2014? That's when the Chinese government imposed stricter regulations, hitting revenue and gambling stocks alike. After that, many analysts were quick to portray Macau as a has-been, as they do now with Atlantic City. But considering Macau still manages to pull in around three times the gambling revenue Las Vegas does, that doesn't seem to be the case. Furthermore, November gambling revenue was up 14% year over year in Macau,the fourth month in a row of year-over-year gains, which could be signaling a more robust turnaround.

Macau at night. Image source: Getty Images.

2. Las Vegas will get a record 43 million visitors in 2016

While Macau brings in more gambling revenue, Las Vegas still brings in far more visitors. Macau will welcome around 30 million visitors for all of 2016, but Las Vegas will welcome a record 43 million. That's equivalent to about one-seventh of the entire U.S. population.

What's more, Las Vegas looks to build on its record visitor numbers. According to theLas Vegas Convention and Visitor Authority's Las Vegas visitor profile(link opens a PDF), which surveyed 3,600 people in 2015 about their Vegas experience, 100% of respondents said they were "very satisfied" or "satisfied" with their trip, and 90% said they were "extremely likely" or "likely"to return. Those high satisfaction marks, mixed with the fact that16% of people were in Las Vegas for the first time, shows that the number of newcomers and happy returners should lead to more record visitation in years to come.

3. Las Vegas visitors have spent an estimated $12.5billionon food in 2016

Those visitors to Las Vegas, not including locals, spend an estimated $292 each on food during their trip, or about $12.5 billion total, making up the third highest expenditure behind hotels and gambling. Notably, gambling revenue now makes up just about one-third of total visitor spend, whereas dining, entertainment, and other non-gambling revenue is becoming more important than ever.

The average gambling spend for visitors who gambled in the most recent visitor profile survey was a sizable $578, but the number of visitors who gambled was down from77% in 2011 to 73% in 2015, and 50% reported that they gambled for two hours or less total. Gambling is still a very important part of Las Vegas' revenue, but an increasing focus on non-gambling entertainment is helping to drive growth for the big names in Vegas, such as MGM Resorts.

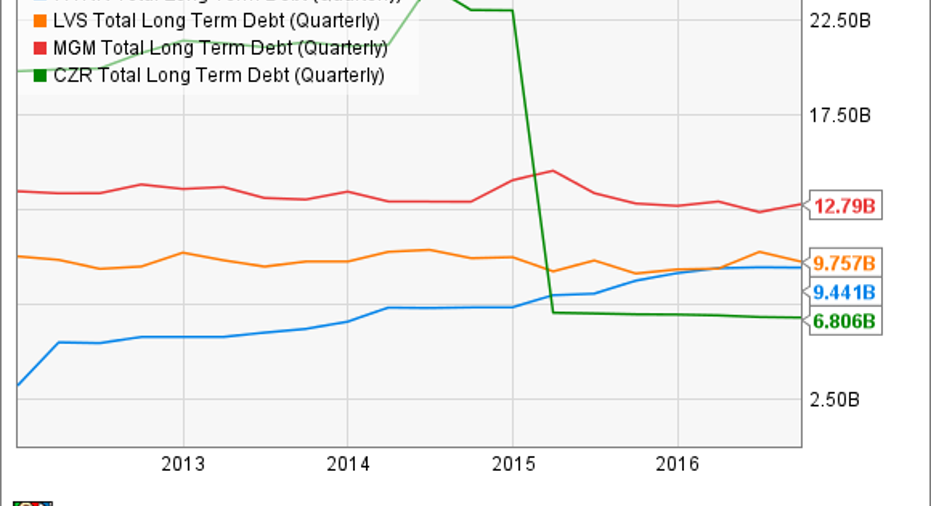

4. The four big gambling companies have a collective $39 billion in debt

The big four U.S. companies -- Wynn, MGM, Las Vegas Sands, and Caesars Entertainment(NASDAQ: CZR) -- all carry a heavy debt load, with around $39 billion in total long-term debt among the four of them. That figure would have been about $16 billion higher before Caesars Entertainment's bankruptcy dealings over the past year that has now made the casino company the least debt-burdened of its rivals.

WYNN Total Long Term Debt (Quarterly) data by YCharts

It's important to understand that building multibillion-dollar resorts is a capital-intensive business, but debt is still an important metric to gauge how well these companies might do in the face of an economic downturn, sudden increased regulation, or other factors that could limit their ability to grow despite heavy interest expenses.

5. Wynn stock has gained 30% this year, but that's still less than half of what it was 2014

The past few years have been rough for the casino industry, with shares of Las Vegas Sands, Wynn, and MGM each crushed between 2014 and 2016. However, those fortunes have largely changed in the past few months, as shares of each of those three companies are up since August, with the momentum seemingly on their side.

Going forward, there are likely to be plenty of twists and turns in the gambling industry, as there have been in the past -- but right now these companies look to be on a rebound following the past two years of pain.

10 stocks we like better than Wynn Resorts When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Wynn Resorts wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Seth McNew owns shares of Las Vegas Sands. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.