3 Important Takeaways From Ford Motor Co.'s January Sales Data

The Continental continues to drive Lincoln's sales. Image source: Ford Motor Company.

Just as analysts had expected, U.S. light-vehicle sales dipped slightly in January. The 1.9% decline to 1.14 million units was actually a little better than forecast, as the seasonally adjusted annual rate (SAAR) topped estimates at 17.57 million vehicles.Demand for new vehicles tends to drop off in January, following the typical blockbuster December, when sales are fueled by holiday and year-end deals, leaving January one of the lowest-volume months of the year. Let's zoom in on Detroit's second-largest automaker, Ford Motor Co. (NYSE: F)to examine its overall data and a couple of important takeaways from its January sales results.

By the numbers

The automaker's total sales declined 0.6% year over year in January, with its namesake Ford brand's 1.6% slip partially offset by Lincoln's 22.4% surge. Its total car segment (unsurprisingly) plunged 17.5% compared to the prior year, while SUVs and trucks moved 7% and 5.5% higher, respectively.

With that data in mind, let's dig deeper into the story.

Hot, hot, hot!

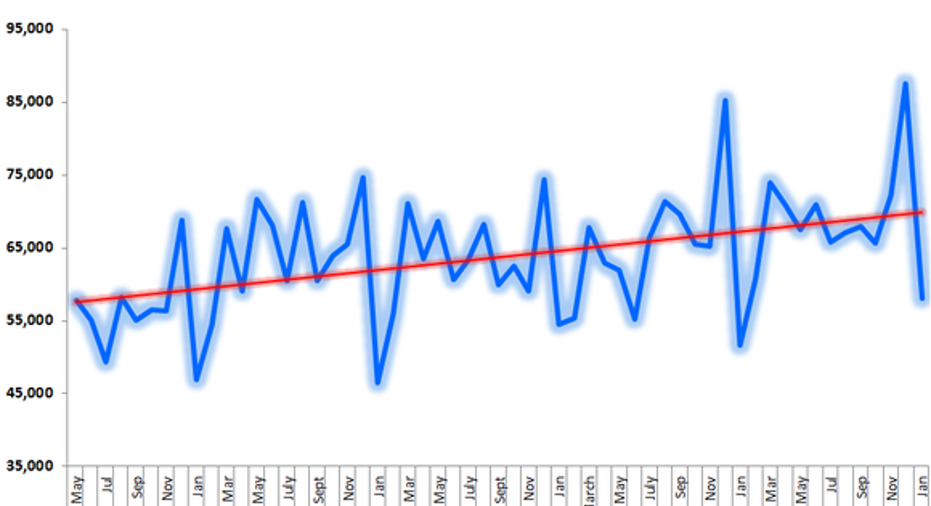

Vehicle sales vary wildly from month to month, due to seasonality, incentive deals, and sometimes inventory levels, but over time, the F-Series has increased its sales consistently.

Data source: Ford Motor Company sales releases. Chart by author.

Last month, sales of F-Series pickup trucks nearly hit 58,000 units, a 13% increase compared to the prior year during what's typically the weakest month for major automakers. What's better is that total sales were fueled by retail sales: F-Series retail sales were up 19% last month, with gains in all regions. Put simply, it was the F-Series' best January sales result since 2004.

"The new year brought strong consumer demand for F-Series, Lincoln and record SUV sales, especially high-end models," said Mark LaNeve, Ford vice president of U.S. Marketing, Sales and Service, in a press release. "This drove near-record company average transaction prices for Ford, up $2,500 versus a year ago and far outpacing the overall January industry increase of $550."

Overlooked data

It's obviously more fun to discuss how the F-Series is dominating its segment, but just as important (and often overlooked) is data surrounding fleet sales and gross stock. Last month, Ford's fleet sales as a percentage of total sales checked in at 30.2%, a 420-basis-point decline from the prior year's January. However, as you may or may not remember, Ford's fleet sales were extremely inflated early in 2016 before tapering off during the back half of the year. For full-year 2016, Ford's fleet sales as a percentage of total sales was 29% -- business as usual, in other words.

Another important set of figures for automakers is gross stock and dealer stock. Gross stock includes vehicles in transit from automakers to dealerships, while dealer stock does not include vehicles in transit. Ford ended December 2016 with 73 days' supply of gross stock, a figure which moved significantly higher to 103 days' supply at the end of last month -- but still below 2016's January supply of 104 days. The trend was similar with dealer stock: Ford had 85 days' supply at the end of last month compared to 61 days' supply at the end of December 2016, and below January 2016's supply of 88 days.

Generally, investors would prefer supply to see it between 60 days and 70 days, but it's important for automakers to refill the lots after a strong finish to the year, as they head into the busy spring selling season, so a rise in inventory now isn't abnormal.

Lincoln surges

It's been a long decade, or more, for Ford's luxury Lincoln marque. Fortunately, it appears the brand's turnaround is finally gaining some traction: In 2016, it achieved its third consecutive year of annual gains -- and as you can see below, that hasn't happened in some time.

Data source: Ford Motor Company sales releases. Chart by author.

Lincoln kicked off 2017 with a strong 22.4% gain to 8,785 units. That was driven in large part by the all-new Lincoln Continental, which sold 1,167 units and was incremental compared to the prior year's sales figures. Lincoln's MKZ, MKC, and MKX all posted strong results, up 7%, 16%, and 43%, respectively.

January was a better than anticipated month for the folks at the Blue Oval, despite total sales declining slightly. Pricing remains very strong, sales of the F-Series and Lincoln continue to impress, and as long as incentives and inventory remain in check, 2017 has started off in a very profitable way for Detroit's second-largest automaker.

10 stocks we like better than Ford When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Ford wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Daniel Miller owns shares of Ford. The Motley Fool owns shares of and recommends Ford. The Motley Fool has a disclosure policy.