1 Little Known Healthcare Stock to Put on Your Radar

Alison Bauerlein's grandmother, Mae, was suffering from chronic obstructive pulmonary disease (COPD) at the turn of the century and was prescribed oxygen therapy. Thankfully, the therapy itself helped Mae to get the oxygen that she needed, but she often complained about the hassle of lugging around a heavy oxygen tank.

In 2001, Alison and two of her close college friends took it upon themselves to do something about this problem. The trio founded a company called Inogen (NASDAQ: INGN) and less than three years later presented Mae with their solution. Mae was thrilled with what her granddaughter had created, and Inogen has been improving the lives of patients who need oxygen therapy ever since.

Fast forward to today, and Inogen's products are now helping thousands of patients from around the world to get on oxygen therapy. What's more, the company is profitable, growing fast, and has become a Wall Street darling. In fact, investors who bought in during the company's IPO in 2014 are currently sitting on a gain of more than 500%.

I was recently afforded the opportunity to hold an exclusive interview with Alison (who has since become Inogen's CFO) as well as CEO Scott Wilkinson to learn more about the company. Below are some of the highlights from our conversation. (Some quotes have been edited for clarity.)

The problem

I started out the conversation by asking CEO Scott Wilkinson to provide us with an overview of the reasons a doctor recommends oxygen therapy to a patient:

I next asked Scott to give us a sense of the current size of the oxygen therapy market:

Next, I asked Scott to opine on the limitations of using traditional oxygen therapy:

Inogen's solution

Given the limitations of traditional oxygen therapy, Inogen innovated a solution called a portable oxygen concentrator (POC). Rather than storing oxygen in a tank, a POC creates an oxygen-rich air flow stream directly from the surrounding air.

I asked Scott to talk about the benefits of using a POC:

In essence, POCs provide patients with a degree of mobility and mental freedom that oxygen tanks simply can't provide. Furthermore, they are also designed to be simple to use, which is an important feature for some seniors who are not comfortable using complex technology.

The business model

Coming up with a great product is one thing, but getting it into the hands of paying customers is another. I asked Scott to describe the company's commercialization strategy and business model:

Once completing this process, patients can either buy the product outright or rent it on a month to month basis.

Internationally, the company operates a slightly different business model:

Financial results

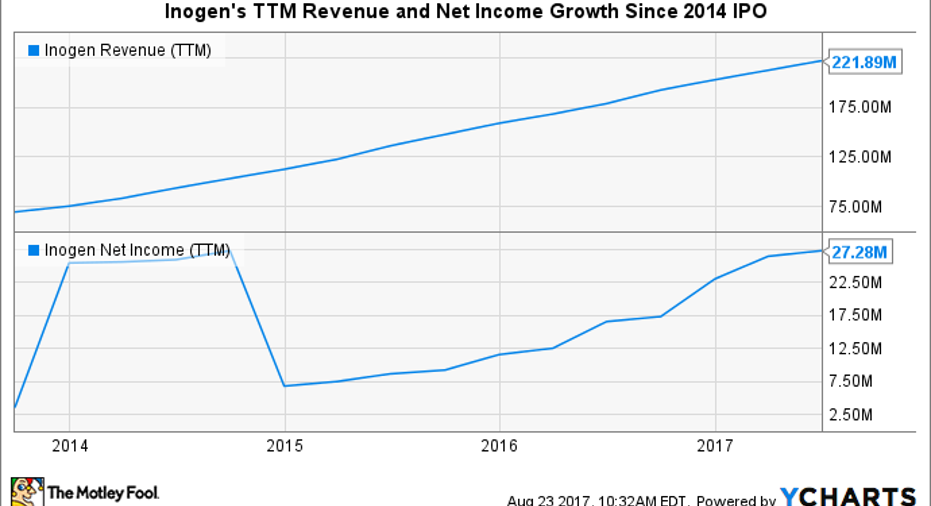

Understandably, Inogen's differentiated product offering and direct to consumer business model have allowed the company to grow rapidly. So rapidly, in fact, that the company has maintained an annualized revenue growth rate of more than 47% since 2009.

With this success in mind, I asked Alison to share her views of the key metrics for investors to watch as the company moves forward.

To get a sense of what Alison means, here's a chart that shows the company's revenue and net income growth rates since its IPO in 2014.

Importantly, since POCs have only grabbed about 8% market share, there are reasons to believe that Inogen will be able to keep these rapid growth rates going for the foreseeable future.

Keeping ahead of the competition?

While Inogen has clearly had a lot of success thus far, the company does not have a monopoly in the portable oxygen concentrator business. In fact, huge companies like Philips, ResMed, and Chart Industries all have subsidiaries that sell POC products and compete with Inogen.

As for the legacy oxygen providers, companies like Linde Group, Apria Healthcare, and Rotech Healthcare have plenty of reasons to work hard to stop their market from being disrupted.

I asked Alison to share what Inogen has done to keep ahead of the competition:

Scott also noted that the company's commercialization strategy is a major differentiator for the company:

Why Inogen deserves a spot on your radar

After speaking with management and thinking through the opportunity, I must admit that I'm quite impressed with Inogen. After all, it is rare to find a company that's rapidly taking market share in a growing market while simultaneously producing a profit.

The only knock against investing in Inogen's stock right now is that Wall Street has caught on to company's growth story and has priced its shares accordingly. Trading for more than eight times sales and 71 times forward earnings, there's no doubt that Inogen is currently being priced for rapid growth. Any potential hiccup in the company's growth rate could cause shares to tumble.

Still, it's not every day that I come across a company that is growing fast, is profitable, and has a large market opportunity ahead. For that reason, I for one plan on adding this interesting company to my watchlist and would be a happy buyer if the valuation became more reasonable.

10 stocks we like better than InogenWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Inogen wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of August 1, 2017

Brian Feroldi has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Chart Industries. The Motley Fool recommends ResMed. The Motley Fool has a disclosure policy.