STOCK MARKET NEWS: FTX bankruptcy, Nasdaq has best week since March, veterans turned Fortune 500 CE

Stock investors remained in buying mode on Friday following the mega rally, FTX goes belly up in bankruptcy filing, Bitcoin slides to $16,000 level. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Cryptocurrency trading firm FTX has filed for Chapter 11 and Sam Bankman-Fried announces his future.

Voyager Digital has reopened bidding for the bankrupt cryptocurrency exchange following the bankruptcy of buyer FTX Group.

FTX won a bankruptcy auction for Voyager with a $1.42 billion bid.

Voyager did not transfer any assets to FTX US in connection with the previously proposed transaction.

FTX US previously submitted a $5 million "good faith" deposit as part of the auction process, which is held in escrow.

Voyager successfully recalled loans from Alameda Research for 6,500 BTC and 50,000 ETH. At this time, Voyager has no loans outstanding with any borrower.

U.S. stocks wrapped a choppy session ending the day and week higher across the board with the Nasdaq Composite rising 8% for the week, the best action since March, while the S&P 500 rallied nearly 6%, the best five day stretch since June. The Dow Jones Industrial Average tacked on a more modest 4% weekly gain. In commodities, oil rose 3.9% to $88.96 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAL | $14.88 | -0.04 | -0.30 |

| DAL | $35.47 | -0.03 | -0.07 |

| UAL | $44.79 | 0.46 | 1.04 |

American Airlines Group's pilots said on Friday that their union has agreed to explore a merger with the Air Line Pilots Association (ALPA), which represents pilots at major U.S. carriers United Airlines and Delta Air Lines.

The Allied Pilots Association said its board of directors unanimously agreed to create a merger committee to look at joining forces with ALPA, although members have yet to be appointed.

American is the only major U.S. carrier whose pilots are not represented by ALPA. Some American pilots argue that a merger with ALPA would give them greater heft and leverage in contract negotiations and a tie up has previously been discussed informally.

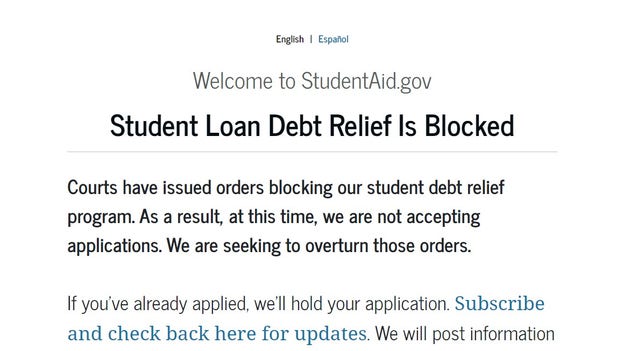

The federal government is no longer taking applications for student loan forgiveness, according to Federal Student Aid, the office that provide grants, loans, & work-study funds for college or career school.

The agency’s website said: “Courts have issued orders blocking our student debt relief program. As a result, at this time, we are not accepting applications. We are seeking to overturn those orders.”

Federal Student Aid said it will hold applications of anyone who has already applied.President Biden's student loan forgiveness program was stuck down Thursday by a federal judge in Texas.

CNBC was the first to report application halt.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DUOL | $76.50 | -8.25 | -9.73 |

Duolingo is lower in Friday trading despite topping Wall Street revenue and profit estimates.

Subscription bookings and total bookings increased at a slower pace than last year.

Subscription bookings were up 42%, compared to 64% in Q3 2021.Total booking increased 41% versus 57%.

Additionally advertising revenue rose 18% compared to 34%.

The company reported a quarterly adjusted loss of 46 cents per share for the quarter ended in September. The mean expectation of nine analysts for the quarter was for a loss of 55 cents per share.

Revenue rose 51% to $96.06 million from a year ago; analysts expected $95.24 million.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DOCS | $33.72 | 7.39 | 28.07 |

Doximity Inc. on Thursday reported fiscal second-quarter profit of $26.3 million.

The San Francisco-based company said it had net income of 12 cents per share. Earnings, adjusted for one-time gains and costs, came to 17 cents per share.

The results topped Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of 16 cents per share.

The medical social networking site posted revenue of $102.2 million in the period, which also beat Street forecasts. Eight analysts surveyed by Zacks expected $99.9 million.

For the current quarter ending in December, Doximity said it expects revenue in the range of $110.7 million to $111.7 million.

The company expects full-year revenue in the range of $424 million to $432 million.

The latest read on inflation rose a slowing in the rate of price increases. The consumer price index rose 7.7% in October, the smallest 12-month increase since the period ending January 2022.However, inflation is not spread evenly across the country.

Several Mountain states have become a hotbed for inflation, with the region — which includes Arizona, New Mexico, Colorado, Utah, Nevada, Wyoming, Idaho and Montana — reporting that prices soared 9.3% in October.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TRI | $110.45 | 0.13 | 0.12 |

Thomson Reuters Corp said on Friday it would buy SurePrep LLC, a U.S.-based provider of tax automation software and services, for $500 million in cash.

The information company has been partnering since April with 20-year-old SurePrep, whose products and solutions are used by more than 23,000 tax professionals.

SurePrep is projected to generate about $60 million in revenue in 2022 and is expected to grow more than 20% annually in the next few years.

"This transaction builds on our existing partnership/reseller arrangement to deliver our vision of end-to-end tax automation that solves our customers' biggest pain points," said Dave Wyle, Chief Executive of SurePrep.

Thomson Reuters, which is the parent of Reuters News, expects the deal to close in the first quarter of 2023.

From the battlefield to the boardroom, these CEOs honed their skills in various branches of the military and transferred them to the C-Suite.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GSK | $31.34 | -2.13 | -6.35 |

Britain's GSK said on Friday it would limit the use of its ovarian cancer drug Zejula in the United States as a second treatment option to keep cancer at bay in patients whose tumors carry certain mutations.

The news marks a second setback for GSK's oncology portfolio this week, after the company on Monday revealed its blood cancer drug Blenrep failed to outperform an older therapy in a key study, calling into question Blenrep's existing U.S. approval.

In September, GSK withdrew the use of Zejula in certain ovarian cancer patients who had previously undergone three or more chemotherapy regimens.

Zejula — which GSK acquired through its $5.1 billion acquisition of U.S. cancer specialist Tesaro in 2018 — generated a total of 120 million pounds ($141.4 million) last quarter.

Barclays has forecast 697 million pounds in peak annual sales for the drug in 2026, following which analyst Emily Field expects sales to stay flat, before starting to decline in 2031.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PSNY | $5.41 | 0.85 | 18.66 |

Polestar on Friday reported a smaller third-quarter operating loss as revenue more than doubled and the company cut spending, sending shares soaring 29% in early trading.

However, the electric vehicle (EV) maker warned that higher raw material costs would start to hurt later in the year.

The Swedish carmaker, founded by China's Geely and Volvo Cars, posted an operating loss of $196.4 million, down from $292.9 million a year ago, while revenue rose to $435.4 million from $212.9 million.

Chief Executive Thomas Ingenlath said Polestar was on track to deliver 50,000 cars in 2022.

The company delivered 9,215 vehicles in the third quarter, while deliveries for the first nine months of 2022 rose 100% to about 30,400 cars.

Ingenlath said the remaining 20,000 cars needed to meet its target have been produced.

U.S. equity futures looked to continue the rally in stocks that was sparked on Thursday following a better-than-expected inflation report.

The major futures indexes suggest a rise of 0.7% or a gain of more than 150 points on the Dow, the day after that index soared 1,200 points.

It was the biggest one-day gain for the Dow in more than two years.

Inflation cooled more than expected in October, but consumer prices remained near a multi-decade high, continuing to squeeze millions of U.S. households and small businesses.

The Labor Department said Thursday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 0.4% in October from the previous month. Prices climbed 7.7% on an annual basis.

Those figures were both lower than the 8% headline figure and 0.5% monthly increase forecast by Refinitiv economists.

The yield on the 10-year Treasury, which helps set rates for mortgages rates for mortgages and other loans, was at 3.81% on Friday.

Oil prices gained Friday after a milder than expected U.S. inflation data reinforced hopes that the Federal Reserve will slow down rate hikes.

Prices were still set to show a decline for the week after COVID-19 cases in top oil importer China jumped, raising fears of weaker fuel demand.

U.S. West Texas Intermediate (WTI) crude futures traded around $87.00 a barrel.

Brent crude futures traded around $94.00 a barrel.

On Wall Street, the S&P 500 gained to 3,956.37, propelled by big gains for tech heavyweights. Amazon soared 12.2%, Apple rose 8.9% and Microsoft climbed 8.2%.

The Dow Jones Industrial Average gained 3.7%, or more than 1,200 points, to 33,715.37.

The Nasdaq composite, dominated by tech stocks, shot up 7.4% to 11,114.15 for its best day since March 2020,

Asian stock markets surged Friday.

The Nikkei 225 in Tokyo gained 2.9%, Hong Kong's Hang Seng index soared 7.7% and China's Shanghai Composite Index added 1.7% after the ruling Communist Party promised to alter quarantine and other anti-virus tactics to reduce the cost of China's severe “zero-COVID” strategy, according to the Associated Press.

Cryptocurrency prices for Bitcoin, Ethereum and Dogecoin were lower Friday as regulators froze some assets of distressed cryptocurrency exchange FTX and industry peers raced to limit losses on Friday amid worsening solvency problems at the company.

Cryptocurrency lender BlockFi said it was pausing withdrawals and limiting activity on its platform, according to The Wall Street Journal.

CLICK HERE FOR FOX BUSINESS' REAL-TIME CRYPTOCURRENCY PRICING DATA

Bitcoin was trading around $17,000, after snapping a four-day losing streak.

For the week, Bitcoin was trading 13% lower. For the month, the cryptocurrency was down 12%.

Bitcoin is down 61% year-to-date.

Ethereum was trading around$1,200, after losing 15% in the past week.

Dogecoin was trading at 8 cents, after losing 27% in the past week.

Hours after a federal court in Texas ruled against President Biden's student loan handout, the administration stated it "strongly disagrees" with the District Court's decision and an appeal has been filed by the Department of Justice.

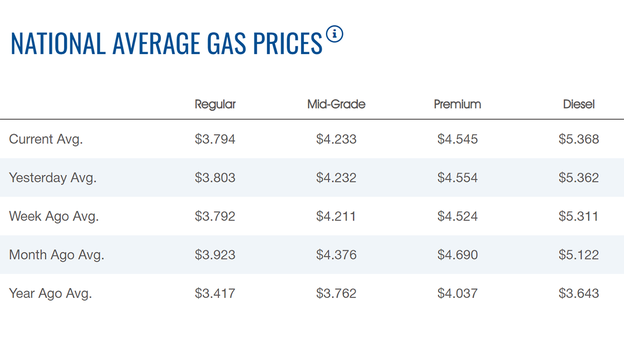

The nationwide price for a gallon of gasoline slipped Friday to $3.794, according to AAA.

The average price of a gallon of gasoline on Thursday was $3.803.

One week ago, a gallon of gasoline cost $3.792. A month ago, that same gallon of gasoline cost $3.923.

Gas hit an all-time high of $5.016 on June 14.

Diesel gained to $5.368.

Oil prices gained Friday after a milder than expected U.S. inflation data reinforced hopes that the Federal Reserve will slow down rate hikes.

Prices were still set to show a decline for the week after COVID-19 cases in top oil importer China jumped, raising fears of weaker fuel demand.

U.S. West Texas Intermediate (WTI) crude futures traded around $88.00 a barrel.

Brent crude futures traded around $95.00 a barrel.

Still, prices were headed for weekly declines of over 4% due to rising U.S. oil inventories and fears of weakening demand in China, due to Beijing sticking to its zero-COVID strategy.

Major works of art that were owned by the late Microsoft co-founder Paul Allen went for big bucks at a two-day Christie's auction.

Included were works by artists including Cézanne, Seurat, and van Gogh.

The auction brought in a record-breaking $1.6 billion.

All 155 of the artworks put up for auction Wednesday and Thursday in New York sold, and five paintings sold for prices above $100 million.

For more on the story, click here: Art works from Microsoft founder Paul Allen's collection fetches $1.6B

A group representing some of Wall Street's biggest titans says Gov. Kathy Hochul has her work cut out for her over the next four years following her election win. The state still faces struggles keeping and attracting business post-pandemic.

Partnership for New York City President and CEO Kathryn Wylde, whose organization's executive committee includes JP Morgan's Jamie Dimon and BlackRock's Larry Fink, spoke with FOX Business about the group's wish list as Hochul enters her first full term at the helm and the obstacles New York's governor faces in achieving them.

Following Hochul's victory over Republican challenger Lee Zeldin this week, Wylde issued a statement touching on PNYC's priorities while expressing confidence in the governor's willingness and ability to address them.

"The city’s business community looks forward to working with Governor-elect Kathy Hochul to maintain a strong economy and achieve a more competitive climate for developing and attracting talent and creating jobs in New York state," Wylde's statement said.

"The next four years will involve fiscal challenges, while requiring additional state investment in affordable housing, expanded mental health services and workforce training," she added. "It will require tough decisions on the part of the governor, who is definitely up to the job."

Click here to read more on the story: New York City CEOs want Gov. Hochul to address taxes, crime

Live Coverage begins here