Fed Dissenter Fisher: Political Leaders Must 'Get Their Act Together'

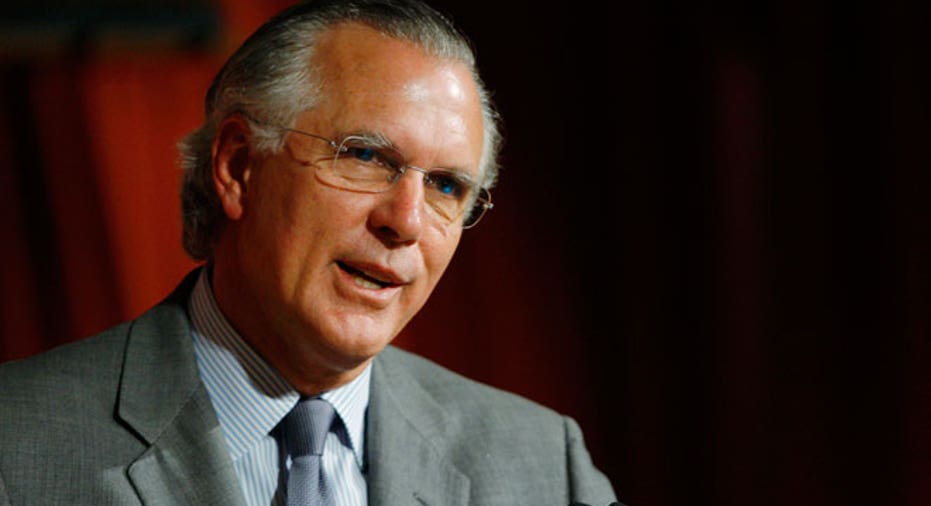

No amount of intervention by the Federal Reserve will have a meaningful impact on the ailing U.S. economy until political leaders in Washington, D.C., “get their act together,” Fed member Richard Fisher said in speech on Tuesday.

Fisher, president of the Federal Reserve Bank of Dallas and a member of the influential Federal Open Market Committee, has been perhaps the most vocal dissenter of the Fed’s activist approach in the wake of the 2008 financial crisis.

Fisher and two other dissenters -- Charles Plosser of Philadelphia and Narayana Kocherlakota of the Minneapolis Fed -- opposed the decision made last week, dubbed Operation Twist, to shift the Fed’s portfolio into more long-term securities in effort to reduce long-term interest rates such as mortgages.

In a speech in Dallas, Fisher said, “I believe … that there is significant risk that the policies recently undertaken by the FOMC are likely to prove ineffective and might well be working against job creation.”

Operation Twist entails the Fed purchasing $400 billion of Treasury securities with remaining maturities of 6 to 30 years by June of next year while selling an equal amount of Treasury securities with remaining maturities of three years or less.

Supporters of the move on the FOMC, led by Fed Chairman Ben Bernanke, believe Operation Twist “should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative.”

Fisher and the other dissenters, who also opposed the Fed’s decision in August to keep interest rates at historically low levels through mid-2013, feel otherwise.

“Both within the FOMC and in public speeches, I have argued that until our fiscal authorities get their act together, further monetary accommodation―be it in the form of quantitative easing or performing “jujitsu” on the yield curve through efforts such as Operation Twist―will represent nothing more than pushing on a string,” Fisher said Tuesday.

It’s been a poorly kept secret for months that a handful of FOMC members have grown skeptical of the easy money policies advocated by Bernanke and the rest of the majority. Those policies have included two-and-a-half years of interest rates at a record-low range of 0% to 0.25%, and artificially pumping cash into financial markets through the purchase of U.S. Treasuries, a strategy known as quantitative easing.

The skeptics, inside and outside the Fed, say these programs haven’t worked and are in fact harmful because they raise the risk of inflation. These dissenters, for whom Fisher has been a de facto spokesman, have loudly questioned not only whether the Fed has any additional weapons, but whether those weapons can have any genuine impact.

The rift within the Fed seems to have grown more pronounced over the summer as the fledgling economic recovery ground to a virtual halt.

In addition to his belief that the Fed’s policies simply aren’t working, Fisher said “the moral hazard of being too accommodative” is another concern.

“For years, I have been arguing that monetary policy cannot solve the problem of substandard economic performance unless it is complemented by fiscal policy and regulatory reform that encourages the private sector to put to work the affordable and abundant liquidity we are able to create as the nation’s monetary authority. These actions are not within the Fed’s purview; they are the business of Congress and the president,” he said.