Duke Energy's 20-Minute CEO Johnson Set to Testify

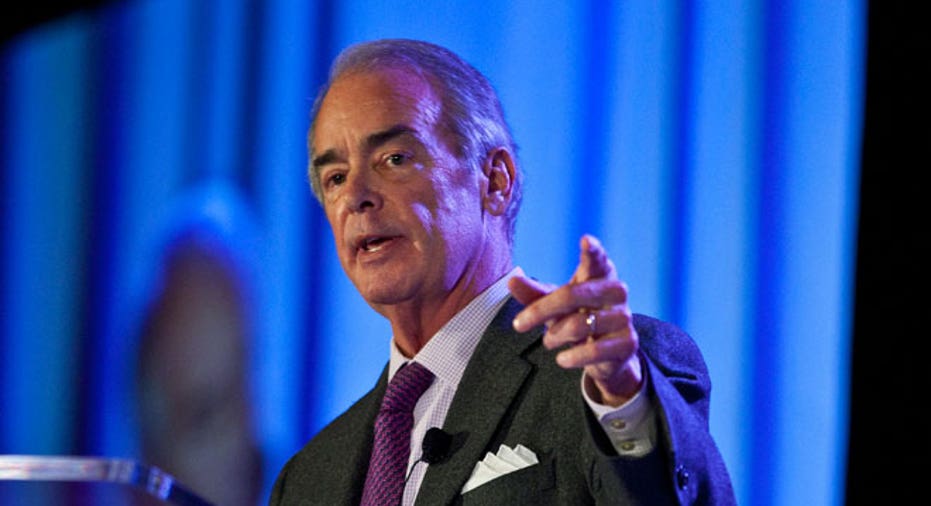

Duke Energy Corp's 20-minute CEO is set to give his side on Thursday of the saga that saw him ousted from the top job just moments after the company finalized the $18 billion deal that made it the nation's largest utility.

William Johnson, the former head of Progress Energy who was set to run Duke (NYSE:DUK) at the completion of the takeover, will testify before North Carolina's utility regulators about the surprise boardroom drama that saw Duke's directors vote him out of the CEO spot earlier this month and return Duke CEO James Rogers to the position.

The newly-merged Duke board, which was dominated by directors from the former Duke board, voted Johnson out minutes after he took the CEO spot despite the companies' long-stated plan for him to take the helm of the company from Rogers, who was to step aside and become the merged company's executive chairman.

In a filing to the North Carolina Utility Commission earlier this week, Duke director Ann Gray, who is scheduled to testify on Friday, pointed to Johnson's handling of troublesome repairs at the Crystal River nuclear plant in Florida.

"We understood that the Crystal River nuclear plant had been shut down for repairs since 2009. However, we were told that Progress expected Crystal River to resume operations in April 2011, and that Progress expected significant insurance recoveries in connection with the repairs," Gray said in the filing.

The 838-megawatt Crystal River reactor remains shutdown, and the Progress had not secured insurance payments by the close of the Duke-Progress deal.

Duke has said it has not yet decided whether pay for expensive repairs at Crystal River, or to seek to shut it down and perhaps build a new nuclear plant.

So far, Johnson has remained quiet, abiding by a "non-disparagement" clause in his separation contract that paid him a total stock and compensation package of about $44 million.

That clause, however, does not apply to comments made to the regulatory bodies.

Angry commissioners from the North Carolina Utility Commission questioned Rogers last week about why the power company's board moved immediately from closing the merger to voting to request Johnson's resignation.

Rogers, who took the CEO job at Duke after the Charlotte, North Carolina-based company bought Cinergy, where he was CEO, said there was no triggering event.

But the board became discouraged with Johnson toward the end of the 18 months it took to win federal approval for the deal around Progress' handling of Crystal River, its weak financial results and Johnson's early moves toward integrating the two companies, Rogers said.

"They felt his style was autocratic and discouraged different points of view," Rogers testified.

Former Progress board members have blasted the quick ouster, including the former lead independent director John Mullin who wrote in an open letter that the move was "the most blatant example of corporate deceit that I have witnessed."

Still, it is unlikely that the NCUC will move to add new conditions to the merger, which it had already approved. But Duke could face a chilly reception when it comes before the regulator in the coming months to seek electricity rate adjustments that will determine how much money the company can earn in the state, which is home to about 45 percent of its customers.

And that pain could spread, as utility regulators in Florida have requested the Duke's Rogers testify there as well about the issue.

Since the turmoil on July 2, Duke shares have fallen 5.5 percent, and rating agency Standard & Poor's put its "A-" rating on Duke's debt on watch for a downgrade because of the abrupt executive switch.