Where Money Goes to Die

A lot of businesses want to attract “old money.â€

Ford is no exception – only it’s more interested in the shredded-up variety than in the kind that belongs to a fancy country club.

Stepping up its efforts to curb the use of petroleum-based products, the automaker announced last month that it’s attempting to use old U.S. cash to make trays and bins for its vehicles. Ford (NYSE:F) already employs a range of alternative materials in the manufacturing of its products, including plastic bottles to make seat fabric and denim to muffle sound. The company is looking at ways to incorporate dandelions, coconuts and sugarcane into future vehicle parts as well.

But U.S. paper currency is arguably the most interesting ingredient in Ford’s recipe book. After all, it’s hard to imagine that there’s a supply of old bills that exists outside of a collector’s safe or government vault – and if there is, that it isn’t serving some lofty purpose.

The reality is that old cash abounds, and with almost nowhere to go but the landfill.

What makes a bill old

Contrary to what you might believe, the only thing that makes a bill unusable is its physical condition. The year it was issued, the length of time it’s been sitting in your piggy bank – none of it matters. As the Federal Reserve notes on its website, “All U.S. currency, regardless of when it was issued, remains legal tender.â€

Because it’s 75% cotton and 25% linen, currency paper is more durable than everyday paper, which is made mostly of wood pulp. It can withstand a lot of wear and tear – the U.S. Bureau of Engraving and Printing estimates that it takes about 4,000 double folds (meaning one fold forward and one fold back) to rip a bill.

Still, bills do eventually wear out. Bills of smaller denominations tend to age the fastest, as they’re passed around more frequently than those of larger denominations. The Federal Reserve estimates that the average $1 bill lasts 4.8 years, while $5 and $10 bills last 3.8 years and 3.6 years, respectively. On the higher end of the spectrum, the average $20 bill lasts 6.7 years, while $50 bills and $100 bills last 9.6 years and 17.9 years, respectively.

In and out

To understand what makes a bill old, it’s important to look at the overall money cycle. The U.S. Bureau of Engraving and Printing (BEP) is where new money is printed; from there, it’s sent to the 12 regional Federal Reserve Banks, which then disseminate it to the public through commercial banks and other depository institutions. Consumers return money to banks in the form of deposits, and banks send cash back to the Federal Reserve Banks.

When cash comes to the Federal Reserve Banks, it passes through an automated scanning system that checks to make sure it’s in good enough shape to continue circulating. Bills that are ripped, torn or worn-out are removed from circulation and replaced with new ones so that the overall money supply remains the same. The Federal Reserve doesn’t handle coins; the U.S. Mint presides over that area.

A spokesperson for the New York Federal Reserve Bank says that, on average, one out of every five bills that comes through its scanning system is taken out of circulation.

Rest in ‘piece’

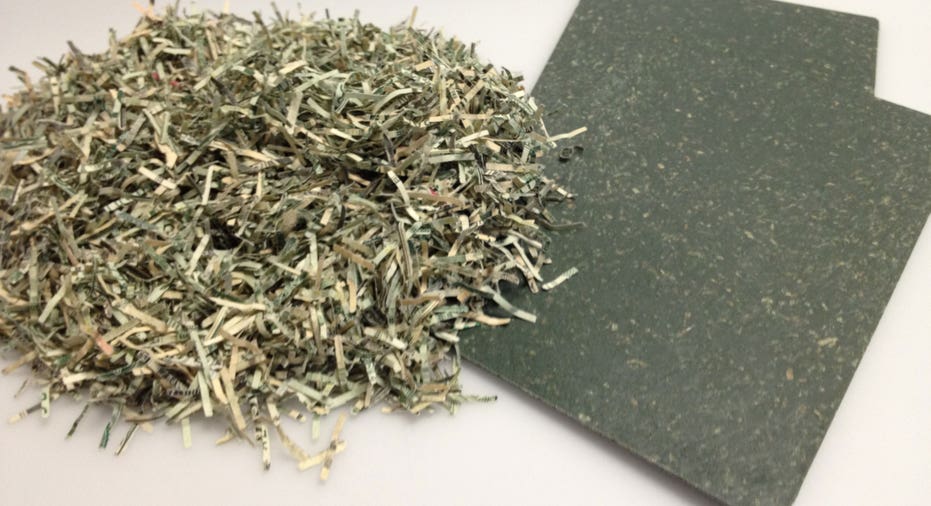

The majority of bills that are too worn for circulation are shredded by the Federal Reserve Banks and sent to landfills. The Fed generated a total of about 5,300 tons of shredded paper currency in 2011, according to a spokesperson.

None of the shreds are recycled into new bills, as doing so would compromise the new currency’s quality. Doug Crane, vice president at Crane & Co. – the company that manufactures all U.S. currency paper – says that since paper money is loaded with inks, recycling it would leave new bills with spots.

“That would cause a lot of rejects and inefficiencies in the printing plant,†he says.

Crane also says that as paper is recycled, it becomes weaker – and in the case of currency paper, which relies on the strength of its raw fibers, recycling it would be counterproductive.

Interestingly enough, Crane & Co. did recycle some currency shreds into stationery throughout the mid-nineties, but discontinued the process due to a lack of customer demand. (The stationery was called “Old Money,†of course.)

In any case, not all shredded currency goes directly to the landfill. A small portion of the shredded unfit bills is sold in various forms to tourists at the Federal Reserve Banks, while another portion is sent to manufacturers for use in countertops, insulation, fuel pellets and other products.

According to the BEP’s website, businesses that want to use large amounts of shredded currency have to obtain approval from the Federal Reserve Bank and written approval from the Office of Compliance. The BEP forbids shredded money from being used in products meant to hold food or drink due to the presence of chemicals in the ink.

Ford, which is simply experimenting with the shredded cash at the moment, has received several pounds of currency shreds and hundreds of pounds of a currency-based compound from materials supplier A. Schulman, says Ellen C. Lee, a plastics research technical expert at Ford.

Lee says the Federal Reserve has recently been in touch with Ford to discuss sourcing.

When you find a damaged bill

The Federal Reserve Banks aren’t the only ones on the lookout for damaged bills. Consumers can submit their badly ripped, torn and mutilated paper currency to the Bureau of Engraving and Printing along with a letter explaining how the bills got that way. If a claim is honored, the BEP will issue the consumer a Treasury check for the value of the damaged currency.

The BEP receives approximately 20,000 mutilated currency redemption claims a year and redeems more than $30,000,000 annually.

All of the currency it receives is destroyed, formed into bales and shipped to a waste-energy firm, a BEP spokesman says.