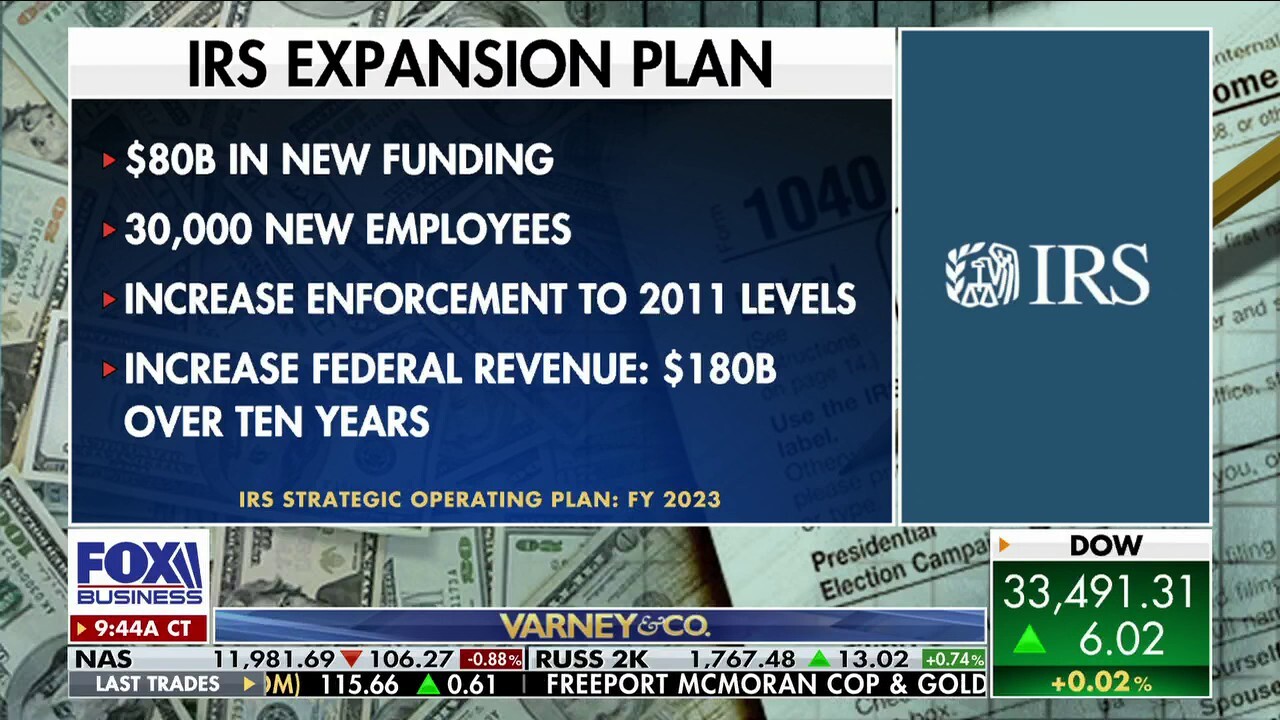

Economists predict big fights between Biden, Republicans over beefed-up IRS, $80B expansion

IRS reveals its spending roadmap on how tax agency will allocate money over the next decade

IRS plans to add 30K new employees by end of 2025, spending plan details

FOX Business' Lydia Hu breaks down the Internal Revenue Service's expansion plan, and reports that Treasury Secretary Janet Yellen claims audits will not increase.

After the Internal Revenue Service (IRS) released its roadmap showing exactly how it’s going to spend tens of billions of dollars over the next decade, economists are sounding off that the plan confirms their worst tax fears.

"I think you're going to see some major fights ahead on the budget where Republicans say: hell no, we're not going to give you tens of billions of dollars more money," FreedomWorks senior economic contributor and former Trump adviser Stephen Moore said on "Varney & Co." Monday.

"[Democrats and Biden] have made it very clear that their rhetoric was going to go after rich people and corporations. But in point of fact, they're aiming at everybody," Americans for Tax Reform president Grover Norquist said on "Kudlow" Friday.

Their comments come just days after the IRS unveiled its long-awaited spending plan for a controversial $80 billion cash infusion, pledging to hire thousands of new workers to audit wealthy Americans and big corporations.

I.R.S. EXTENDS TAX FILING DEADLINE FOR STORM-RAVAGED AREAS IN SEVERAL STATES

The IRS reportedly hopes to modernize technology, improve customer service, deliver real-time alerts, provide "world-class" customer service and crack down on the so-called tax gap by enhancing enforcement of the wealthy.

The IRS under President Biden is "aiming at everybody," Americans for Tax Reform president Grover Norquist said on "Kudlow" Friday. (Getty Images)

Nearly 30,000 new IRS employees are expected to be hired by the end of fiscal year 2025, including 8,782 hires in enforcement and 13,883 in taxpayer services. The new enforcement employees will be "exclusively" focused on high-earning households, larger partnerships and companies, according to IRS Commissioner Danny Werfel.

Conservative groups opposed to tax increases remain concerned that a beefed-up IRS means more audits for everyone, regardless of income.

"Congress had the opportunity to vote to forbid increasing audits on people who earned less than $400,000. The Republicans put that up and said, ‘Okay, if that's what you want to do, let's put it into law,’" Norquist explained. "And Biden opposed it and every single Democrat opposed it."

"There's going to be a big clash between President Biden and this new Republican House of Representatives on this $80 billion for the IRS," Moore added to the conversation. "Under Obama, remember, the IRS was weaponized and politicized to go after conservatives and Republicans. And we know that is very likely to happen under Joe Biden as well."

Biden budget readying for 'major fights ahead': Stephen Moore

FreedomWorks senior economic contributor Stephen Moore explains how the Internal Revenue Service's $80 billion restructuring will impact middle-class families.

Treasury Secretary Janet Yellen has assured Americans and lawmakers that audit rates will not increase, and the number of audits will not rise above historical levels.

"As I’ve said before, I have directed that these resources will not be used to increase the audit rate for small businesses and households making under $400,000 a year, relative to historical levels," Yellen said last month.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The IRS is going to increase audits on everyone: Grover Norquist

Americans for Tax Reform's Grover Norquist discusses concerns about IRS overreach and how it was granted $80 billion in funding on ‘Kudlow.’

But Moore cautioned: "They're not going to just go after the millionaires and billionaires."

"They're going to go after the middle class because, of course, that's where the money is," the economist continued. "If you want to get more money out of people, you have to go to the tens of millions of Americans who are in the middle class. And, boy, having just gone through a four-year audit from the IRS, it is worse than a root canal."

FOX Business’ Megan Henney contributed to this report.