Biden's economic plan could crush nation's recovery from coronavirus pandemic, conservative economists say

The Democratic presidential candidate's plan would ultimately result in about 4.9M fewer full-time employees

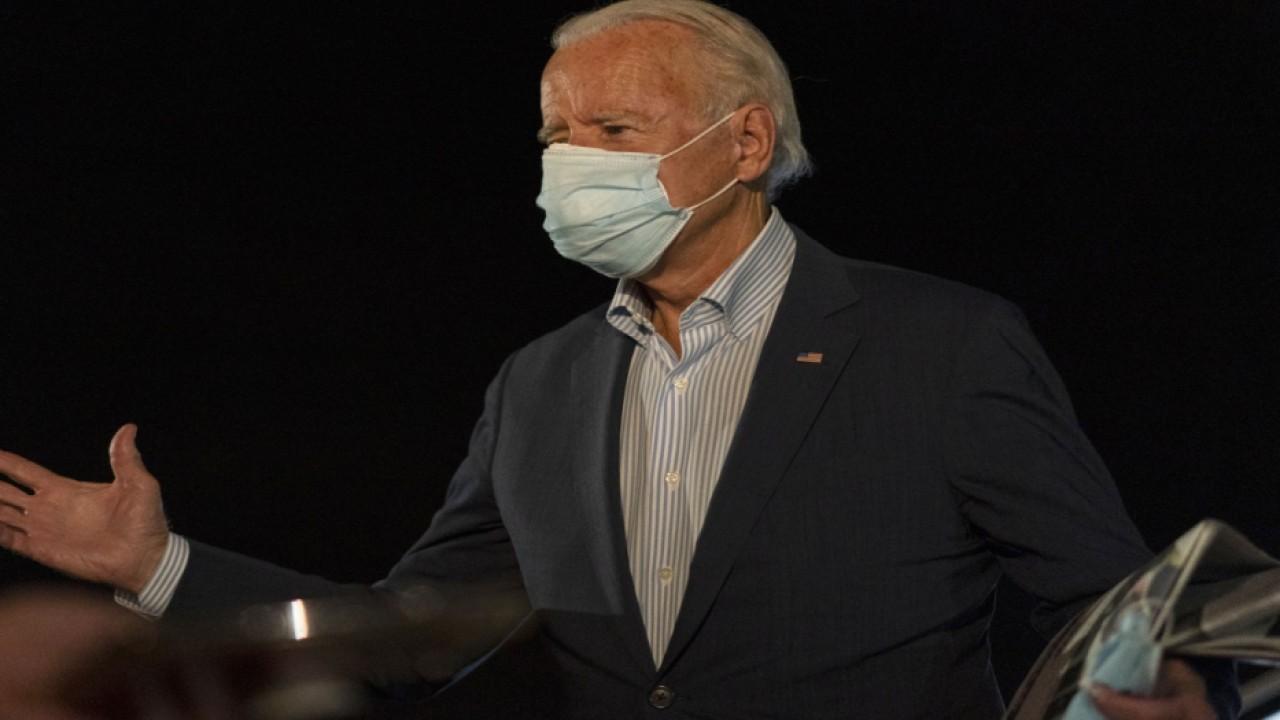

Joe Biden's economic agenda could destroy millions of American jobs and crush the nation's slow-but-steady recovery from the coronavirus pandemic, according to new projections from President Trump's former economists.

The Democratic presidential candidate's plan would ultimately result in about 4.9 million fewer full-time employees and reduce the nation's GDP, the broadest measures of goods and services produced in the country, by more than 8% over the next decade, according to the report, which was authored by Casey Mulligan, a University of Chicago professor who previously served as chief economist of the White House Council of Economic Advisers; Kevin Hassett, also a former White House economist now at Stanford University's Hoover Institution; Timothy Fitzgerald and Cody Kallen.

BIDEN'S TAX PLAN COULD DESTROY 3M JOBS, FORMER TRUMP ECONOMIST PROJECTS

A Biden presidency would translate into a loss of roughly $6,500 per household per year, the study shows.

The economists projected that Biden's plan to expand subsidies for health insurance under the Affordable Care Act; undo some of the 2017 Tax Cuts and Jobs Act and increase the taxation of corporates; and establish new environmental standards, reversing years of regulatory reform, would discourage Americans from working more and earning more.

The former vice president has unveiled a multitrillion-dollar agenda that would be funded in large part by higher taxes on wealthy U.S. households – which he describes as anyone earning more than $400,000 annually – and corporations. That includes higher income tax rates, an expansion of the payroll tax for Social Security, new tax credits and fewer deductions.

BIDEN PLATFORM WOULD RAISE TAXES BY NEARLY $3.4T, STUDY FINDS

Almost 80% of the tax increases backed by Biden would land on the top 1% of earners in the U.S., according to a recent projection from the Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania's Wharton School.

Biden has pledged to hike the corporate tax rate from 21% to 28% on "day one" if he wins the Nov. 3 election, regardless of the nation's unemployment rate.

"I'd make the changes on the corporate taxes on day one," he told CNN's Jake Tapper in mid-September. "And the reason I'd make the changes to corporate taxes, it can raise $1.3 trillion if they just started paying 28% instead of 21%. What are they doing? They're not hiring more people."

On top of that, Biden has promised to roll back other changes made by Trump in the 2017 Tax Cuts and Jobs Act, including restoring the top individual income tax bracket to 39.6% from 37% for those earning more than $400,000 annually.

BIDEN PLANS NEAR $10T PRICE TAG

That would result in an average tax increase of nearly $300,000 for households in the top 1% of the country, compared with a $260 per year increase for those in the middle, according to the Tax Policy Center.

Biden has also said he will subject wages above $400,000 to the 12.4% payroll tax, creating a so-called "donut hole" for earnings between $137,700 and $400,000, which would be exempt.

Other analyses of Biden's tax plans are more optimistic: Findings from the Penn Wharton Budget Model estimate it would cause the nation's GDP to shrink by 0.4% in 2030, and increase by 0.8% in 2050.

A separate report released by Moody's Analytics found that Biden would create roughly 7 million more jobs than Trump if he wins the November election.