The Latest: Tax bill revisions means less-generous cuts

WASHINGTON – The Latest on the GOP tax bill (all times local):

9 p.m.

A change made Wednesday to the Republican tax plan would mean less generous cuts for many Americans.

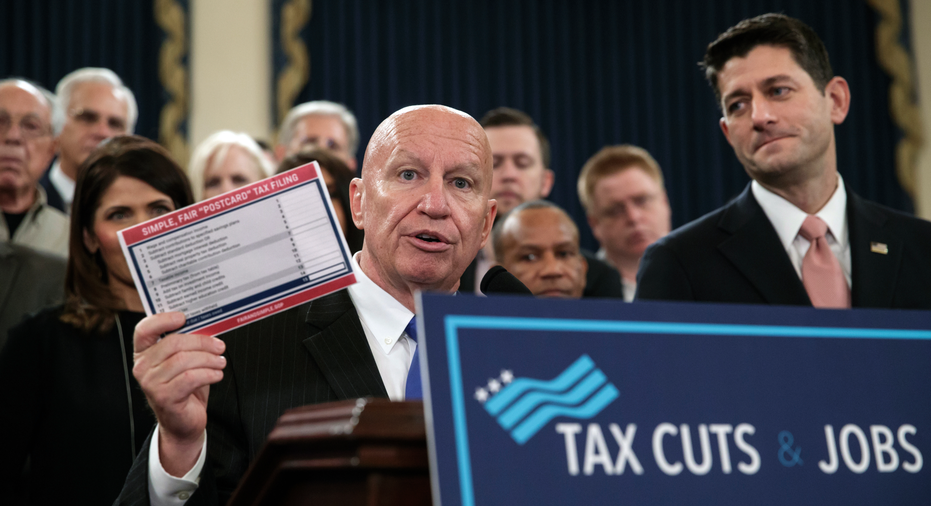

The House's top tax-writer, Rep. Kevin Brady, has released a revised version of the bill that would impose a new, lower-inflation "chained CPI" adjustment for tax brackets immediately instead of in 2023. That means more income would be taxed at higher rates over time.

The change reduces the value of the tax cuts for ordinary Americans by $89 billion over 10 years compared with the legislation released with fanfare Thursday.

As wages rise, middle-class taxpayers would have more of their income taxed at the 25 percent rate instead of at 12 percent, for instance.

___

3:05 p.m.

House Republicans have already made a change to their big tax overhaul: Now its tax cuts would be less generous.

Ways and Means Committee Chairman Kevin Brady would adjust tax brackets immediately instead of 2023, which means more income would get taxed at higher rates over time. And it would mean less generous tax cuts for individuals and families.

It's a new, lower inflation "chained CPI" adjustment for tax brackets.

The change would lower the value of the tax cuts by $89 billion over 10 years, compared to the version of the bill when it was unveiled Thursday.

As wages rise, middle-class filers would have more of their income taxed at the 25 percent rate instead of at 12 percent, for instance.

The move frees up money for the Texas Republican to use to address concerns by lawmakers when changing the bill further next week.

___

12:40 p.m.

The chairman of the House Ways and Means Committee says the president really wants to repeal the penalty for Americans who fail to get insurance under the Obama health care law.

Texas Republican Kevin Brady says there are obstacles to repealing the so-called individual mandate. Brady chairs the tax-writing committee

He points out the Senate has been unable to find enough votes to pass any health care legislation. Brady says: "Putting health care in that mix, there's pros and cons."

Brady says President Donald Trump "feels quite strongly about including this at some step." He says Trump spoke to him about it twice by phone and once in person.

Repealing the mandate would save about $400 billion.

Brady made the comments in an interview Friday with Politico

___

7:20 a.m.

House Republicans have unveiled a broad tax-overhaul plan that would touch virtually all Americans and every corner of the economy.

It would offer sharply lower rates for corporations and reduced personal taxes for many. But it would give fewer deductions to home-buyers and families with steep medical bills.

The measure would be the most extensive rewrite of the nation's tax code in three decades. It's the product of a party that faces increasing pressure to produce a big legislative victory before next year's elections.

GOP leaders praised the plan as a sparkplug for the economy and a boon to the middle class and christened it the Tax Cuts and Jobs Act.