Another Reason Snap, Inc. Ignores Emerging Markets

Snap (NYSE: SNAP) isn't interested in expanding into emerging markets. Whether or not CEO Evan Spiegel actually called countries like India and Spain "poor" or not isn't particularly relevant, since the company has made it clear that it is focusing its efforts on the U.S. and Europe. Here's how Spiegel justified that strategy on Snap's first earnings call last night:

This echoed what Snap had previously said in its prospectus: "We believe the concentration of our user base among top advertising markets gives us the opportunity to grow our [average revenue per user]." There's another reason why Snap doesn't want to get into emerging markets: It can't really afford to.

Image source: Snap.

It's all about the hosting costs

Snap had also alluded to this in its prospectus: "While growth in user engagement increases our overall monetization opportunity, it also bears an incremental cost to our business by increasing our hosting costs." These hosting costs are of tremendous importance to shareholders, since they dominate Snap's cost structure. The company also added that hosting costs are even more expensive in emerging markets: "We also benefit from the concentration of our users in developed markets because the hosting costs of serving these users is typically lower than in other markets. Our hosting costs may increase significantly in the future because we pay incremental hosting costs for new users and increased engagement."

Let's put some numbers to it in order to drive the point home. Here's Snap's average revenue per user (ARPU) by geographical segment last quarter:

|

ARPU |

Q1 2017 |

|---|---|

|

North America |

$1.81 |

|

Europe |

$0.24 |

|

Rest of World |

$0.19 |

|

Global |

$0.90 |

Data source: Snap earnings presentation.

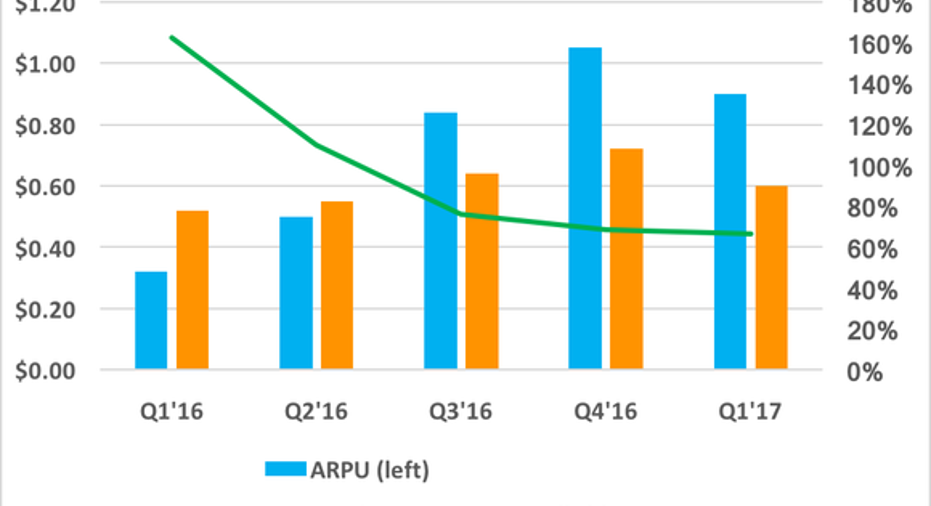

It's true that Snap was able to score more favorable contract pricing in the first quarter as it renegotiated its cloud spending deals with its infrastructure providers. That definitely helped reduce hosting costs per daily active user (DAU); total hosting costs declined sequentially even as DAUs increased sequentially. A year ago, hosting costs were over 160% of ARPU, but "only" 67% of ARPU last quarter.

Data source: Snap. Chart by author.

The chart above shows the global averages. Based on Snap's comments in the prospectus, we can say that the hosting costs per DAU in its rest of world segment should be higher than the global average of $0.60, while ARPU in that segment was a mere $0.19 last quarter. (Snap doesn't break out hosting costs in the same detail that it does ARPU.)

Simply put, Snap faces higher costs and significantly lower ARPU in emerging markets, and expanding there would only accelerate its losses as it gets squeezed. With gross margin already in negative territory, Snap can't afford that.

10 stocks we like better than Snap Inc.When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Snap Inc. wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of May 1, 2017

Evan Niu, CFA has the following options: long January 2019 $20 puts on Snap Inc. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.