Better Buy: Coeur Mining, Inc. vs. Pan American Silver Corp.

Precious metals companies Coeur Mining, Inc. (NYSE: CDE) and Pan American Silver Corp. (NASDAQ: PAAS) inked a deal in early 2017. Pan American's mine acquisition should allow both silver and gold miners to further their internal goals, but which mining industry player is in the better position at this point?

Getting to the core

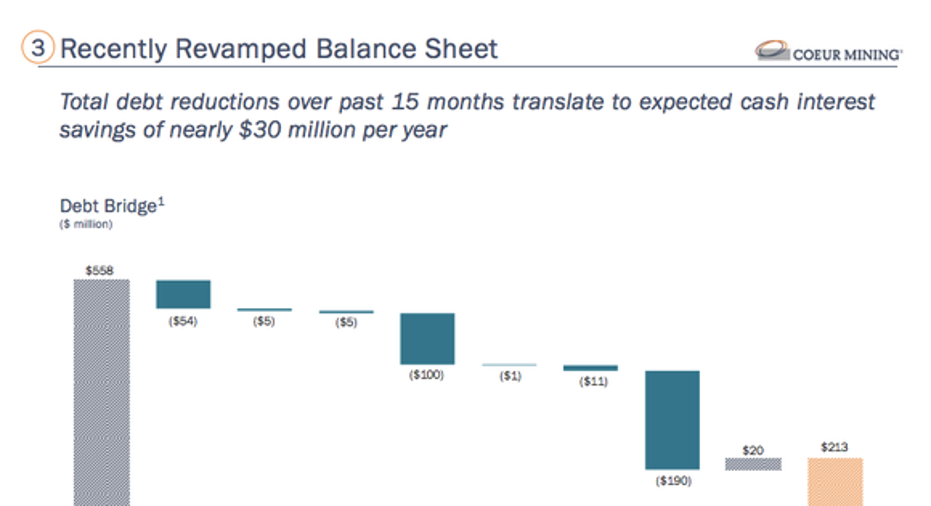

After a couple of key acquisitions in 2015, Coeur Mining is refocusing its business around core assets. A part of that process was selling non-core assets and, equally important, using that cash to trim debt. The numbers on the balance sheet front are pretty impressive, with debt down by roughly 60% between the third quarter of 2015 and the end of last year.

Image source: Pan American Silver Corp.

Meanwhile, Coeur has been upping its capital spending, with a 45% year-over-year increase in 2016 and plans for a further 30% increase this year. The focus is on near-mine exploration, which will account for roughly 70% of 2017 spending. This type of expansion is usually less risky than building new mines. Coeur expects both gold and silver production to increase this year, pushing its silver equivalent production up for the fourth consecutive year.

And while all of this expansion has been going on, costs have been heading generally lower. That said, the all-in sustaining costs projection for 2017 of $15.75 to $16.25 per silver equivalent ounce makes Coeur a marginal miner that needs relatively high commodity prices to turn a profit. That's the fly in the ointment that makes this choice more difficult.

Coeur has been working hard to improve the balance sheet. Image source: Coeur Mining, Inc.

Buying the cast-off

Pan American Silver's role in Coeur's portfolio reshuffling relates to its early 2017 agreement to acquire Coeur's Joaquin mine for $15 million in cash and $10 million worth of Pan American stock. The deal could be notable for Pan American because its silver production fell around 2.5% in 2016, with gold production essentially flat. This year isn't expected to be much better, with silver production projected to be flat in 2017 and gold production down around 10%.

Pan American Silver doesn't expect production to start picking up again until 2018 and 2019, as expansions at existing facilities bear fruit. That said, the miner has a cost advantage, with all-in sustaining costs per silver equivalent ounce projected to be between $11.50 and $12.90 in 2017, a couple of dollars lower than Coeur's. That makes it much easier for Pan American's mines to turn a profit.

Pan American has done a better job on the cost front. Image source: Pan American Silver Corp.

There's another subtle difference, here, too. Pan American Silver's long-term debt accounts for just 2.5% of its capital structure. That's a very low level, giving it plenty of leeway to afford its expansion plans. Coeur's debt makes up around 20% of its capital structure. That's not an outlandish number, and it's much better than it was just a year or so ago, but Pan American would likely be better able to handle another downturn in the precious metals space.

Getting while the "gettin" is good

In the end, Coeur is probably the better choice for investors today since the results of its refocusing efforts are showing up right now, as silver and gold prices are solidifying after a painful downturn. Pan American, while financially strong, isn't expecting notable production growth until a couple of years from now. Sure, Pan American would probably be better insulated from a precious metals downturn, but its growth plans basically miss the upturn that's taking place right now.

10 stocks we like better than Coeur MiningWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Coeur Mining wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of April 3, 2017.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.