5 Dividend Stocks to Put on Your Shopping List

As an income investor, are you skeptical about finding high-quality dividend stocks at a decent price now that theS&P 500 isheading to record highs? Fret not, for you've come to the right place. Our contributors just singled out five solid dividend stocks that are worth your money even in today's market:Genuine Parts Company(NYSE: GPC),Stanley Black & Decker(NYSE: SWK),NextEra Energy, Inc.(NYSE: NEE),General Electric(NYSE: GE), andCanadian National Railway(NYSE: CNI). Here's why these five stocks deserve to be on your dividend radar today.

Get more dividend income from the auto boom

Dan Caplinger(Genuine Parts): Boring can be beautiful when it comes to dividend stocks, and it's hard to find a company with a more basic business model than Genuine Parts. The company produces a wide array of parts for the automotive industry using the NAPA brand name, as well as operating other segments including industrial parts, office products, and electrical and electronic materials. With car owners having increasingly hung on to their vehicles for longer periods of time, demand for auto parts has been solid, and even in a competitive industry, Genuine Parts has been able to get its fair share of a growing market.

Image source: Getty Images.

Genuine Parts also stands out from its peers in one key way: It has been and remains committed to dividend growth. The parts maker currently has a 2.7% dividend yield, whereas many of its competitors don't pay a dividend at all. More important, Genuine Parts has increased its dividend each and every year for 60 straight years, through good and bad economic conditions, giving it one of the longest track records of dividend growth. The most recent dividend increase last year came to 7%. With the company routinely boosting its payout in early March, now's the time to take a closer look at Genuine Parts before it announces its next dividend hike.

A winner since 1843

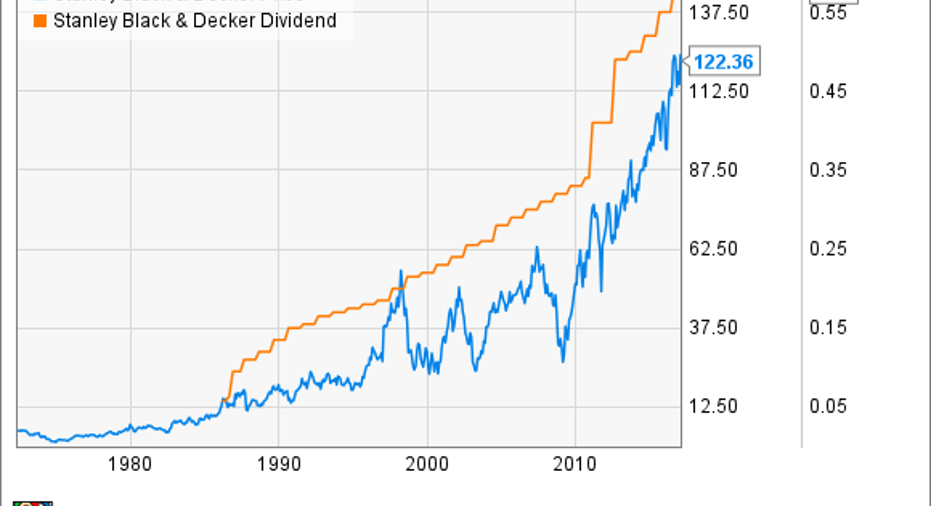

Daniel Miller(Stanley Black & Decker): Many consumers have heard of, and likely used products from, this world leader in tools and storage, but few have considered it as a stock for their shopping list -- and that's a mistake. Stanley Black & Decker has consistently increased its dividend for the past 48 years, and its record of paying dividends annually for 139 consecutive years is unmatched by any industrial company listed on the NYSE.

But it goes beyond just offering investors a consistent dividend with an impressive growth track record. The company's overall momentum was evident during its recent fourth quarter. Fourth-quarter revenue was up 3% to $2.9 billion with 4% organic growth, but the most intriguing aspect of the quarter was its significant acquisition activity. The company acquired Craftsman Brand from the struggling Sears Holdings company as well as Newell Brands' tools business.

Those acquisitions are expected to significantly enhance Stanley's already-strong global brand portfolio with three additional brands (Irwin Tools, Lenox, and Craftsman) as well as being accretive to earnings in the near term. During the third year, after the acquisitions are closed, the combined acquisitions are expected to add between $0.80 and $0.90 in earnings per share, and between $1.15 and $1.25 in earnings per share by year five. That's a big chunk considering that Stanley's full-year 2016 GAAP EPS checked in at $6.51 per share -- a 10% jump from 2015's result, to boot.

While investors might have used its tools or storage or security products, not enough investors consider Stanley Black & Decker for their portfolio -- but given its consistent dividend and recent acquisition spree, this stock should at least be on your shopping list.

This utility dividend could grow 6% to 8% through 2020

Neha Chamaria (NextEra Energy): You can find several utility stocks that pay good dividends, but NextEra Energy, Inc. deserves your attention right now for four reasons: the company's focus on renewable energy, its just-released earnings outlook, its dividend track record, and a reasonable valuation that offers an attractive entry point.

NextEra Energy is not only among North America's largest electric power companies, with a customer base exceeding 5 million, it is also the largest provider of wind and solar energy. What's more, it also runs eight nuclear power plants. Clearly, NextEra Energy is a lot more than your traditional utility, with an intent focus on a clean energy future.

2016 was, in fact, a record year for the company, as it added nearly 2.5 gigawatts of new solar and wind projects to its portfolio. 2016 was also a strong year in terms of operational performance, with the company earning roughly $2.9 billion versus $2.6 billion in 2015, representing 8.4% growth in adjusted earnings per share. Now, here's the real deal for income investors: NextEra Energy expects to grow its adjusted EPS by 6% to 8% through 2020. The following chart explains why the company's projections should excite dividend lovers:

Image source: NextEra Energy's presentation at the 51st EEI Financial Conference, November 2016.

You can see how NextEra Energy has grown its dividend by the same rate as adjusted earnings since 2005. Assuming it continues with the trend, shareholders can expect 6% to 8% growth in dividends in line with projected adjusted EPS growth through 2020. That's a pretty good deal for income investors. NextEra Energy stock isn't pricey, either, at under 20 times trailing earnings, 17 times forward earnings, and eight times its price-to-cash flow. Add in its 2.8% dividend yield, and this utility stock should make a great addition to your dividend shopping list.

An unconventional dividend play

Jamal Carnette, CFA (General Electric): At first glance, it may appear that General Electric is not a great dividend pick. Although GE has a 100-year history of paying quarterly dividends, the company is not a Dividend Aristocrat because it significantly cut dividend payouts in 2009. Even today, it pays less in annual dividends per share ($0.96) than it did before the 2009 market crash ($1.24).

However, it is important to note that the General Electric of today is not the same General Electric it was then. Pre-recession, the company was essentially a bank and was designated a Systemically Important Financial Institution, or SIFI, subject to increased regulation under Dodd-Frank legislation. CEO Jeffrey Immelt has since moved the company back to its manufacturing roots by selling financial assets and restructuring the business. In June, GE shed the SIFI label and can now pay dividends and/or buy back stock without approval from the federal government.

GE returning to its roots comes at a great time. Politically, it appears proposed policies will support GE's business model. The Wall Street Journal (subscription required) reports that the GOP House's tax plan is advantageous for export-heavy companies like General Electric by not taxing foreign earnings. Additionally, the plan incentivizes capital expenditures spending by allowing immediate deduction -- this should create demand for GE, particularly in the company's oil and gas, energy connections, power, and transportation business lines. Finally, a broad-based marginal-rate corporate tax cut should benefit GE by freeing up cash for its business clients.

There are risks: Most notably, GE would be one of the most negatively affected companies under trade wars and protectionism. Recently, the Iraqi government warned that deals with the company were at risk after President Donald Trump's travel ban. Last year, GE testified in favor of the Trans-Pacific Partnership, or TPP; Trump signed an executive order to withdraw from the agreement in his first week as leader. Additionally, the company's recently announced fourth-quarter earnings disappointed investors with a slight miss on the top line.

However, long-term income investors should ignore short-term noise and focus on GE's recent history of performance. Even under the SIFI designation, General Electric has done an enviable job of returning cash to shareholders. Since the 2009 cut, the company has grown its dividend 13.3% on an annualized basis. While the pace of growth is likely to slow, it's highly likely GE will continue to grow its dividend payout for years to come.

Big dividend growth from railroads

Tyler Crowe(Canadian National Railway):When you hear the term dividend growth, I'm pretty sure railroads isn't the first business segment that comes to mind. It should be, though, because Canadian National Railway's management has been rewarding shareholders with a growing dividend payment for more than 20 years.

CNI Dividend data by YCharts.

There are three pillars to Canadian National's business that have allowed the company to be a strong dividend payer for so long: its network, its diversified offerings, and its cost efficiency. Thanks to some opportune acquisitions over the past several years, Canadian National has the only rail network with access to the Atlantic, Pacific, and U.S. Gulf Coast, which provides customers with many more end-to-end options than most other rail carriers. Management estimates that two-thirds of all traffic originates and terminates on its network. Also, because of the configuration of its network, its largest customer traffic is intermodal and has a low exposure to coal. This is a pretty attractive position to be in as coal demand continues to decline in the U.S. and Canada.

What really pulls this all together, though, is the company's focus on cost efficiency. Reducing yard time, increasing average traffic speeds, and increasing fuel efficiency over time have helped the company produce the lowest operating ratio -- industry jargon for cost of goods sold -- among the North American railroad companies. All of these things have added up to a company that produces loads of free cash flow.

Canadian National Railway's dividend yield of 1.8% isn't going to wow any income investor, but managment is projecting a 10% increase in 2017, and its payout ratio suggests it can keep growing its dividend for some time. If you want some serious long-term dividend growth potential for your portfolio, take a look at this company.

10 stocks we like better than Stanley Black and DeckerWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Stanley Black and Decker wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017.

Dan Caplinger has no position in any stocks mentioned. Daniel Miller has no position in any stocks mentioned. Jamal Carnette owns shares of General Electric. Neha Chamaria has no position in any stocks mentioned. Tyler Crowe owns shares of General Electric. The Motley Fool owns shares of and recommends Canadian National Railway. The Motley Fool owns shares of General Electric. The Motley Fool has a disclosure policy.