This Economic Report Is Good News for Shares of Bank of America, Citigroup, and JPMorgan Chase

Image source: iStock/Thinkstock.

The inflation data released today for the month of October could spur the Federal Reserve to raise interest rates at its meeting next month. If it does so, that'd be good news for shares of JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), and Citigroup (NYSE: C), as well as virtually every other bank in the country.

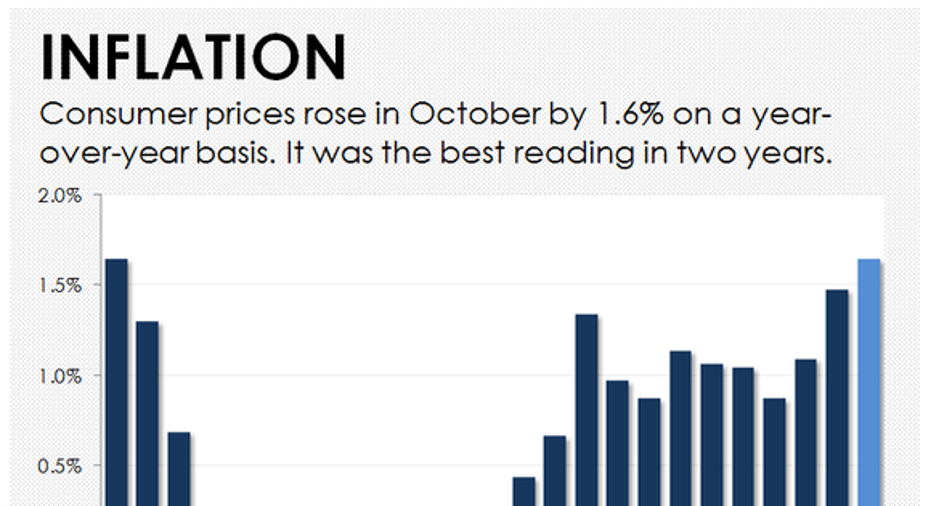

Consumer prices rose last month by 1.6% compared to October 2015. That's still meaningfully below the Fed's 2% target rate, but the figure is headed in the right direction.

Data source: Federal Reserve Bank of St. Louis. Chart by author.

For much of 2015, the U.S. economy saw little to no price inflation, and in many cases, consumer prices declined, spawning fears of deflation. Things turned around earlier this year and have been on the ascent ever since, with last month marking the most rapid increase in consumer prices in two years.

It's tempting to think about inflation as a bad thing, given that it erodes the purchasing power of the U.S. dollar. However, a reasonable amount of inflation is good for an economy, spurring growth by effectively reducing the cost to borrow.

It's also a positive sign for banks such as JPMorgan Chase, Bank of America, and Citigroup. These banks generate tens of billions of dollars' worth of revenue by lending out money to borrowers. The higher the interest rates at which they can do so, the more money they'll make.

The problem is that the Federal Reserve is unlikely to raise interest rates from the near-zero level they've been at since the financial crisis until there are signs that inflation is normalizing -- that is, approaching the central bank's 2% target.

You can get a sense for how much this would help banks by looking at the interest rate sensitivity analyses they include in their quarterly filings with the Securities and Exchange Commission. To this end, here's how much JPMorgan Chase, Bank of America, and Citigroup predict they'd earn in additional net interest income if short- and long-term rates increase by 100 basis points, or 1 percentage point:

|

Bank |

Additional Net Interest Income Assuming 100-Basis-Point Interest Rate Increase |

|---|---|

|

Bank of America |

$5.3 billion |

|

JPMorgan Chase |

$2.8 billion |

|

Citigroup |

$2.0 billion |

Data source: Regulatory filings.

With this in mind, it should come as little surprise that shares of all three of these banks are trading higher today. Roughly halfway through the trading session on Thursday, Bank of America's stock is up 2.1%, Citigroup's by 1.7%, and JPMorgan Chase's by 0.8%.

It remains to be seen, of course, whether the Fed will pull the trigger and follow through on its intimations that it'll raise rates next month. But the signs are certainly pointing in the positive direction.

Forget the 2016 Election: 10 stocks we like better than Bank of America Donald Trump was just elected president, and volatility is up. But here's why you should ignore the election:

Investing geniuses Tom and David Gardner have spent a long time beating the market no matter who's in the White House. In fact, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now...and Bank of America wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 7, 2016.

John Maxfield owns shares of Bank of America. The Motley Fool recommends Bank of America. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.