Facebook, Inc. Earnings Will Bring Revenue Growth Into Focus

In recent quarters, Facebook (NASDAQ: FB) has absolutely crushed it when it comes to growing its top line. But there's good reason this growth won't last. Indeed, the deceleration may have already started -- investors will find out whether or not the growth rate is contracting when the social network reports quarterly results on Wednesday, Nov. 2, after market close.

Facebook CEO Mark Zuckerberg. Image source: Facebook.

Facebook's monstrous growth isn't sustainable

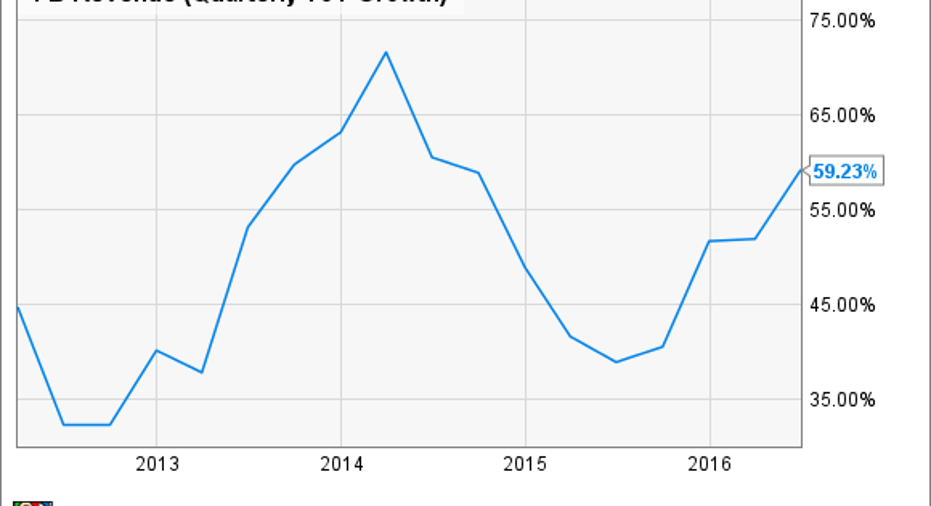

One reason Facebook's revenue growth is likely to decelerate soon is because recent astronomical growth rates are unsustainable. Facebook's $6.4 billion in second-quarter revenue, for instance, was up an incredible 59% compared to the year-ago quarter. This growth was driven by a 63% jump in Facebook's advertising revenue, which accounts for 97% of Facebook's total revenue.

For comparison, Aphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) Google revenue, which is driven primarily by digital advertising revenue, increased a more modest (but still solid) 20% in the company's most recent quarter. Sure, Google's $22.3 billion in quarterly revenue during the most recently reported quarter dwarfs Facebook's top line. But as Facebook's business continues to grow, the social network's growth rate for its advertising revenue will inevitably begin to decelerate toward levels closer to Google's.

Further, Facebook hasn't demonstrated a sustained period of growth at this level. Indeed, as recently as Facebook's second quarter of 2015, year-over-year revenue growth was meaningfully lower, at 39%. Therefore, with lower revenue growth than Facebook's 59% year-over-year third quarter occurring so recently, it's wise for investors to model for deceleration.

FB Revenue (Quarterly YoY Growth) data by YCharts

Management has warned of a coming deceleration

Perhaps the most obvious reason to expect Facebook's revenue growth to decelerate in the coming quarters is because management has essentially warned that this is exactly what is going to happen.

In Facebook's second-quarter earnings call, for instance, Facebook CFO David Wehner said tough year-over-year comparisons, beginning in the third quarter of 2016, will drive "lower advertising revenue growth rates in each successive quarter in 2016." While Wehner admitted the "main drivers" for advertising growth will still be catalysts in 2016, tough year-ago comparisons will simply make sustaining the 59% year-over-year revenue growth achieved in Q2 difficult.

And beyond Facebooks' third quarter, investors should expect revenue to continue to decelerate, according to Facebook management. Wehner explicitly warned a key driver for Facebook's advertising revenue -- ad load -- won't be as big of a catalyst in the future.

For Facebook's third quarter, analysts seem to be taking management's warning into account. On average, analysts are expecting revenue to increase by about 54%, down from Facebook's 59% growth in Q3. But this is still a notably optimistic outlook considering just two quarters ago Facebook's year-over-year revenue growth was lower, at 52%.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Daniel Sparks owns shares of Facebook. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Facebook. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.