Microsoft Corporation Continues to Crush It With Office 365

Well done, Satya. Well done. Microsoft CEO Satya Nadella. Image source: Microsoft.

Investors can safely say that Microsoft (NASDAQ: MSFT) has successfully navigated the transition of one of its most important products: Office. This is not a new storyline. The software giant launched the subscription-based version of its flagship productivity suite half a decade ago, but there had been some initial skepticism as to whether or not Microsoft could actually pull off the switch. At the time, customers could just pay a one-time licensing fee to purchase the product for keeps (before the next major version inevitably came out a few years later).

Last week, Microsoft reported strong fiscal first-quarter results, which were primarily buoyed by strong performance in the Azure cloud infrastructure unit and continued gains with Office 365. Shares now trade at all-time highs -- even higher than the peak of the 2000 tech boom.

The subscriber count rises

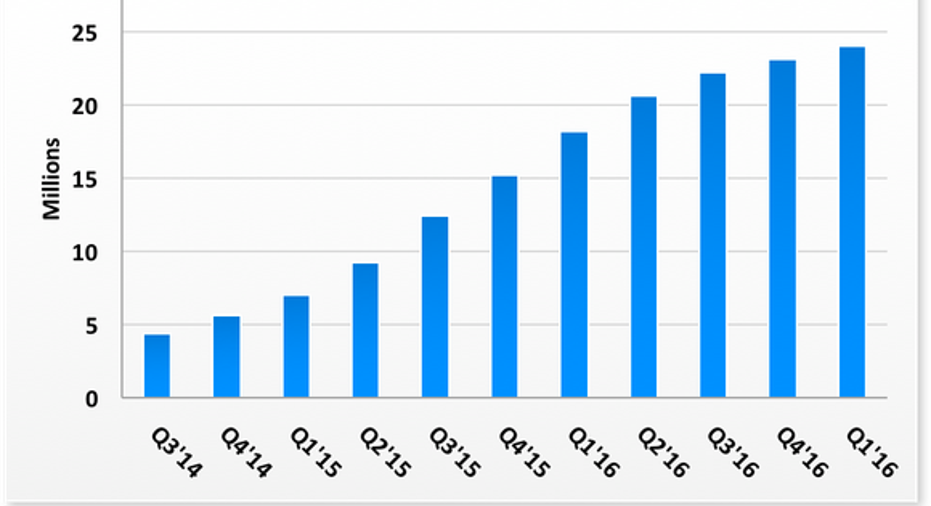

Nearly a third of revenue during the quarter came from the productivity and business processes segment, which saw revenue rise by 6% to $6.7 billion. On the consumer side, sales jumped 8% and Office 365 consumer subscribers continued the upward march to 24 million. This is what progress looks like:

Just the way investors like most charts: up and to the right. Data source: SEC filings. Fiscal quarters shown. Chart by author.

More importantly, the commercial side is faring even better, with Office 365 commercial revenue jumping 51%. Seeing as how the enterprise is what pays Microsoft's bills, that should be music to investors' ears. The software giant now has over 85 million monthly active commercial users for Office 365, up 40% year over year. Combined with the consumer side, that puts total consumer subscribers and enterprise users at 109 million -- each paying monthly subscription fees.

Don't just take my word for it; here's CFO Amy Hood on the conference call:

Microsoft maintains a healthy backlog of unearned revenue, which now totals $33.6 billion if you include both the current portion and the long-term portion. As you can see from Hood's comments above, commercial comprises about two-thirds of that total.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Evan Niu, CFA has no position in any stocks mentioned. The Motley Fool owns shares of Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.