Excited About Caterpillar Inc.'s Latest Big Buy Rating? Think Again

Are Caterpillar's dark days over? Image source: Getty Images.

Analysts are turning increasingly bullish onCaterpillar Inc. (NYSE: CAT), with the biggest rating upgrade coming from Deutsche Bank: It rated Caterpillar stock a buy with a 12-month price target of $98, or almost 20% upside from current prices. That's huge given that Caterpillar is already up about 20% year to date. Interestingly enough, Caterpillar stock has hugely outperformed peers like General Electric (NYSE: GE) this year despite operating in extremely difficult business conditions and facing equally severe, if not bigger, headwinds than General Electric. So what really are the chances of Caterpillar rallying another 20% in one year?

What is Deutsche Bank betting on?

Analysts at Deutsche Bank consider 2016 to be the "cyclical trough" for Caterpillar, and believe that 64% of the company's revenue is "at trough levels" with the "bulk of the natural resource downturn in the rearview mirror." In other words, Deutsche Bank thinks the worst is behind Caterpillar's resource industries (mining) business. Deutsche Bank analyst Nicole DeBlase furtherbelieves that the market hasn't given Caterpillar its due for its aggressive restructuring efforts that have saved the company almost $2.25 billion since 2013.

There's no denying that Caterpillar has made some bold moves, including plant shutdowns, to tackle the challenges, but is that enough to propel the stock 20% higher? I don't think so.

Where's the recovery?

Among Caterpillar's three business segments -- resource industries, construction industries, and energy and transportation (E&T) -- the first has proven to be the toughest in recent years as commodities markets crashed, forcing miners to slash capital expenditures and postpone or scrap major projects. As demand for Caterpillar's mining equipment fell, so did profits from its resource industries segment.

Data source: Company financials. Chart by author.

I won't call a bottom unless that red line reverses and moves up for some quarters. Even then, improving year-over-year profit comparisons must be backed by rising sales volumes and orders to be meaningful. Caterpillar's backlog is currently declining rapidly and orders are hard to come by. Resource industries turned in a loss of $163 million in Q2 compared to a profit of $27 million in the year-ago period, and worldwide retail sales plunged 39% for the three months ending in August.

The recent rally in commodities like iron ore and copper might have fueled optimism, but it's important to understand that Caterpillar can gain from it only when commodity prices stabilize at levels profitable enough for miners to revive projects and purchase new equipment. When that'll happen is anyone's guess given the uncertainty in global economies like China and Europe. Mining giant BHP Billitonis targeting 30% lower capital and exploration expenditures for fiscal 2017 after having already slashed its capex by 40% during the fiscal year that ended June 30, 2016.

Miners have a reason to be cautious: According to PricewaterhouseCooper's latest mining report, the top 40 miners in the world have collectively written off a staggering 32% of the capex spent since 2010. No one knows where that figure's headed, and it's almost certainly too early to make a call regarding Caterpillar's unique situation. There are, however, some clues.. Why, just last month, Caterpillar announced plans to divest a part of its mining business that includes a layoff of around 200 workers, indicating that the pain could last much longer.

E&T looks worse!

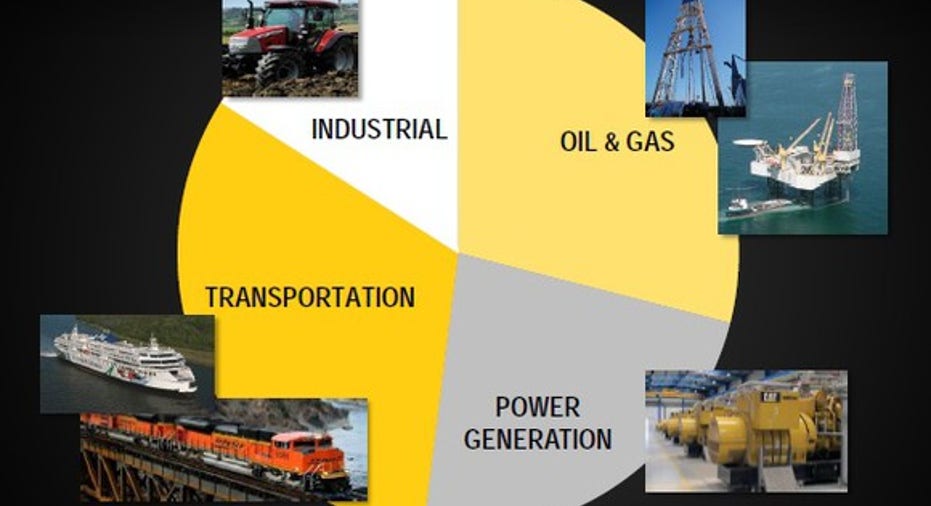

Caterpillar's E&T segment, which accounted for almost 40% of its total machinery sales last year, is in an equally dismal state right now. E&T's growth has hit the brick wall after oil prices plummeted and forced oil and gas companies to tighten their purse strings. Meanwhile, railroads and truckers are getting increasingly cautious as freight volumes stagnate. None of it bodes well for E&T, as oil and gas and transportation are its largest markets.

Image source: Caterpillar Inc.'s presentation at Wells Fargo Industrials Conference, May 2016.

Just so you know, Caterpillar isn't the only one suffering. Last quarter, General ElectricCFO Jeffrey S. Bornstein confirmed the transportation business is in a "very difficult cycle" even as the oil and gas environment remains "very, very tough." To give you another example, Cummins-- which makes engines for both on-highway and off-highway markets -- downgraded its full-year revenue guidance to down 8% to 10% in Q2 as demand from trucking, power, and off-highway markets slid. I can't find any reason to be hopeful about Caterpillar's E&T business for now.

That leaves us with Caterpillar's construction-equipment segment, which is also experiencing pockets of weakness in key markets like North America and Latin America. Caterpillar's worldwide retail construction-equipment sales were down about 9% for the three months ending in August, with Latin America reporting a 29% drop in sales.

Long story short, Deutsche Bank might have gotten excited a little too early given how tough Caterpillar's end-market conditions are. Caterpillar might be at the bottom of the cycle, but any recovery, whether in mining or oil and gas, could be painfully slow -- and that should be reflected in the stock's price, too.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Neha Chamaria has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Cummins. The Motley Fool owns shares of General Electric. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.