Japan: No Quick Fix, Lots of Long-Term Reforms; China: Lots of Quick Fixes, No Long-Term Reform

By Michael Jones, CFA, RiverFront Investment Group Chairman/Chief Investment Officer

I have just returned from a 10 day due diligence trip to Japan, Hong Kong and Shanghai. The purpose of the trip was to update our assessment of the economic stimulus efforts and economic reforms underway in the two most important Asian economies: Japan and China. The trip included meetings with analysts, portfolio managers, business leaders and government policy makers.

My meetings in Asia left me with a strong impression that Japan is losing confidence in “quick fix” monetary policies, and I believe the Bank of Japan (BOJ) is likely to disappoint financial markets with only cautious, incremental policy moves. Despite the potential for short-term disappointment with Japan’s short-term stimulus efforts, I was impressed by the commitment to long-term reforms that I saw in Japan, and the progress made on these reforms since our 2015 due diligence trip.

My China meetings drew a sharp contrast with the situation in Japan. The regulatory and policy confusion that characterized China for much of the past year has given way to a clear focus on short-term stimulus policies. These stimulus efforts are clearly having a positive impact on the Chinese economy and on the earnings potential of Chinese and other emerging market companies. However, the focus on short-term stimulus appears to have come at the expense of badly needed long-term reforms.

From an investment perspective, another disappointment from the BOJ could prompt another pullback in Japanese equity prices and further appreciation in the yen. If that occurs, such a pullback could present an investment opportunity, as Japanese equity markets stand to benefit from continued reforms, conservative balance sheets with ample cash to fund stock buybacks, and extremely cheap valuation levels. In our view, these attributes will eventually become more important to global investors than short-term monetary manipulations.

China and the rest of emerging markets are enjoying the benefits of China’s single-minded focus on improved economic growth. We believe that the current economic and market momentum suggest we continue with our current overweight positions. However, the consequences for these short-term gains could be even deeper long-term problems for China. If either economic or price momentum fades, we must be quick to take risk management action and lower our exposure.

Japan – Short-Term Pain, Long-Term Gain

I encountered a surprising degree of complacency about Japan’s current economic trajectory. The prevailing attitude was that a 3% unemployment rate, 2% wage gains for temporary workers, and continued strength in real estate investment were sufficient to offset the impact of a stronger yen on the overall economy. I detected very little appetite for dramatic “quick fix” monetary policies, such as “helicopter money” (financing government spending with printed money instead of more debt). Most of the people I met with questioned both the need for bold, new monetary stimulus and the potential efficacy of such measures should they be enacted.

This overwhelming consensus view surprised me. Japan was the first major economy to escape the Great Depression, and many economists (including Ben Bernanke) attribute this relative economic success to the BOJ’s financing of government stimulus spending with printed money. However, the institutional memories at the Ministry of Finance (MOF) and BOJ appear to focus less on the economic success of helicopter money and more on how that monetary experiment ended. In 1936, Finance Minister Takehashi Korekiyo reacted to improved economic growth and accelerating inflation by ending the helicopter money policy, and rebellious military officers assassinated him (most of the helicopter money was funding defense expenditures). Based on my meetings, the overriding lesson the MOF takes from its 1930’s experiment with helicopter money is that politicians will never let the helicopter money end. If the BOJ and MOF open that door, they will never be able to close it again.

My contacts in Japan were equally dismissive of Ben Bernanke’s proposal that the BOJ swap its government bond holdings for perpetual zero coupon bonds. Such a transaction would effectively extinguish up to 40% of Japan’s current debt burden. Bernanke’s proposed transaction is referred to in Japan as a “debt for equity swap”, which is a very good description that illustrates the skepticism with which his proposal is viewed. Based on my meetings, the debt for equity swap suffers the same shortcoming as explicit helicopter money – if done once, the politicians will insist that the BOJ swap debt for equity every time Japan faces tough budgetary choices. BOJ Governor Kuroda comes from the MOF and is thought to share the MOF’s institutional mistrust of politicians. As a result, no one I spoke to in Japan seems to expect the current monetary policy review underway at the BOJ to result in any radical new monetary policy measures.

Based upon my meetings in Japan, I predict that any policy adjustments at the BOJ’s September 21st meeting are likely be confined to modest adjustments to existing monetary policy tools (slightly more negative interest rates, marginal adjustment to quantitative easing (QE) targets, changes in the mix of securities being purchased). Investors may feel that, once again, the BOJ has let them down.

Long-Term Reforms Continue

Despite the potential for another disappointing outcome from the Bank of Japan, I was encouraged by the continued commitment to significant long-term reforms in Japan’s regulatory environment and business practices. Politically, Japan is the only developed economy with a stable government and a clear mandate for reform. Prime Minister Abe has cut the corporate tax rate from 37% in 2014 to just under 30% for 2016, and enacted a large fiscal stimulus package. The once sacrosanct rice production quotas are scheduled to end in 2018.

As a compliment to these government actions, Japanese companies are steadily moving away from long-standing “Asian Development Model” business practices that have depressed profitability and returns on equity (ROE). Achieving ROE targets and setting more aggressive goals for the next fiscal year are now a matter of “face” for many Japanese management teams.

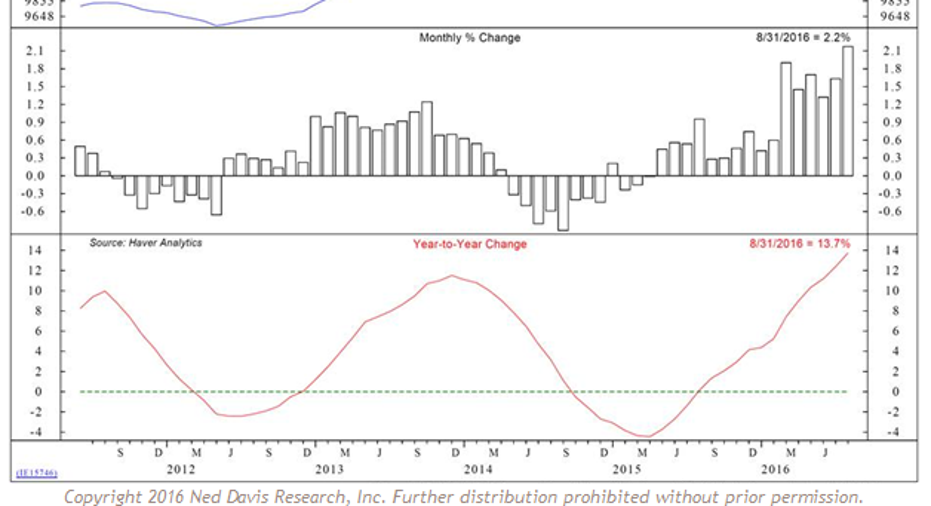

For the first few years of Abenomics, profitability and ROE improved simply due to the impact of a falling yen on overseas operations. The 15% appreciation in the yen over the past 9 months has ended the easy profitability gains and created a big headwind for 2016 earnings objectives. Japanese management teams have reacted to the stronger yen by devoting an increasing proportion of the cash hordes built up in recent years to dividend increases and aggressive shareholder buyback programs. Although stock buybacks have long been a common practice in the US, a disciplined focus on balance sheet management and improved ROE was not a part of the Japanese corporate culture prior to Abenomics. As shown in the graph below, Japanese companies have accumulated substantial cash reserves in recent years, and still have significant room to increase buybacks and dividends when compared to their more leveraged US counterparts.

China – The Future is Now

During our 2015 due diligence trip, Chinese officials were struggling to cope with a collapsing speculative bubble in China’s equity markets. The government’s response was a series of regulatory pronouncements and market interventions that appeared confused and lacking a coherent strategy. These government missteps injected a significant amount of volatility into the Chinese economy and global financial markets throughout 2015 and early 2016.

This confusing policy muddle has been replaced in 2016 by a single-minded focus on “quick fix” stimulus measures. Based on my meetings, it appears that this more coherent and focused policy response from the Chinese government has improved the short-term investment sentiment among our Chinese contacts. China is running record budget deficits to finance an aggressive fiscal stimulus program and has recently deployed inspectors out to the regional governments to ensure rapid implementation of these stimulus measures. The People’s Bank of China (PBOC) has reduced reserve requirements and cuts its overnight rate to 4.35%, and clearly has additional room to cut both even further if growth lags their targets.

One of the few plans discussed during last year’s due diligence trip that has been executed is the PBOC’s “quiet QE” program. Under this plan, banks exchange bad real estate loans for local government bonds. The banks use these new bonds as collateral for additional loans from the PBOC. The PBOC is essentially using newly printed money to “extend and pretend” bad real estate debt. This program has injected significant additional liquidity into Chinese banks (although many Chinese banks remain technically insolvent) and helped fuel 14% loan growth over the past year. The rush of new lending is financing record car sales (up 24%) and home purchases.

All these stimulus efforts have resulted in improvement in the profitability and earnings power of Chinese companies over the past 9 months. Even industries with severe overcapacity problems (e.g. steel, chemicals, plate glass) have seen improved margins and profitability.

Housing starts have significantly lagged the recovery in housing sales, allowing excess inventory to be taken off the market and igniting renewed price appreciation in Tier 1 and Tier 2 cities. The housing recovery is slowly extending to Tier 3 cities, although Tier 4 cities remain largely ghost towns of unproductive real estate investment. Nonetheless, the rapid recovery in major housing markets could reduce the losses for the “big four” Chinese banks, and dividends from these banks are being used to shore up the capital of more vulnerable regional banks (since every bank is majority-owned by the state, they can rob Peter to keep Paul solvent).

The rapid year-to-date loan growth has been concentrated in mortgage loans to homebuyers, rather than construction loans to real estate developers. Mortgage loans are typically considered less risky than loans to developers, and that tendency is particularly pronounced in markets like China’s, with very low typical loan-to-value ratios (LTV). With an average LTV of 27% (according to Chinese regulators), losses from the current mortgage-driven real estate lending should not produce nearly as many defaults as the 2008-2011 developer driven lending boom, in our view.

A final short-term catalyst for Chinese financial markets is the potential for inclusion of China A-shares into the MSCI Emerging Market Equity Index. Due to the large number of passive investors in emerging markets, the inclusion of China A-shares may prompt significant buying from investors seeking to match the index composition. When rejecting China’s application last year, MSCI provided China with a list of 25 reforms and regulatory changes that have to be made for A-shares to be eligible for their indices. Regulatory authority over financial markets has been concentrated at the PBOC after the disastrous regulatory mistakes of the past year. The PBOC is the one entity in China that has continued to execute on long term reforms, in our view. They have already implemented 17 of the 25 reforms requested by MSCI, which bodes well for getting the remaining items resolved by the May 2017 deadline.

Reform? What Reform?

With the exception of PBOC’s technical financial market reforms, China’s single-minded commitment to enhancing short-term growth appears to have come at the expense of every major long-term reform initiative. During last year’s trip, Chinese officials were touting a newly announced plan to reform state-owned enterprises (SOEs). The plan involved partially privatizing non-strategic SOEs. The hope was that minority outside shareholders would improve corporate governance, enhance productivity and reduce corruption. An important side benefit was creating a new source of revenue for regional governments to replace their previous dependence on real estate sales. Based on my meetings with our

Chinese contacts, absolutely no progress has been made on this reform plan and most of our contacts consider sweeping SOE reform dead for the time being. Despite political rhetoric about the need to reduce excess capacity in “old China” industries like steel and shipbuilding, the only significant capacity reduction we detected was a requirement that coal companies reduce their operating schedule from 330 days to 230 days.

No progress has been made on reforming the hukou classification system that causes workers to lose healthcare and childcare benefits if they relocate. Meaningful economic reform could cause widespread displacement of steel, shipbuilding, and coal mining jobs, and these workers are likely to have to relocate in order to find work. Until the hukou system is substantially revised, it is hard to believe that the Chinese government can move forward with measures that would significantly reduce employment in the old smokestack industries. The social costs and potential for social unrest are likely to be too high.

Perhaps most disturbingly, President Xi’s current policies appear to be further entrenching the worst aspects of the Asia Development Model (ADM). Under ADM, consumer spending is depressed to create a savings surplus to fund exports and fixed asset investments. When the economy gets too big for exports to keep driving growth (Japan in the early 1990’s, China in the early 2010’s), the economy must transition to a consumer-led economy to avoid eventual stagnation (see the 10/7/2015 Strategic View for more details on ADM).

Instead of the bold SOE reforms proposed last year, the government is now simply pushing to merge existing SOEs into larger entities with more pricing power. Simultaneously, foreign companies face increasing restrictions on their ability to compete through Xi’s “China First” policy. Uber’s sale of its China operations to Didi, its Chinese rival, is a good case in point. Thanks to my daughter’s language skills, we were able to conduct a random, unscientific survey of our Uber drivers. My daughter’s vocabulary had to expand to include the Mandarin word for “monopoly” and other, less polite descriptions of the post-merger company. Driver pay and benefits were cut while the price of a ride has increased. Although short-term profits are up for Didi and other companies benefiting from Xi’s initiatives, slower pay gains and higher prices for key consumption items will not help China transition to a consumer economy.

Investment Implications

Financial markets may once again be disappointed by the BOJ’s actions at its September 21st meeting. Unlike our meetings in 2015, when we detected the BOJ’s interest in potentially taking interest rates negative, we detected little or no appetite for bold new monetary stimulus efforts. However, Japan is committed to significant fiscal stimulus over the coming year, in addition to the significant corporate tax relief that has already been implemented. With corporate Japan sitting on significant cash reserves and apparently willing to engage in unprecedented (for Japan) stock buybacks, any pullbacks in Japanese equity markets could present a buying opportunity given the relative undervaluation of Japanese equities.

China’s leadership is pulling every fiscal and monetary lever in order to stimulate the Chinese economy. These efforts are having obvious impact on the earnings and growth prospects for Chinese companies, although Xi’s “China First” initiative is muting the impact on foreign companies operating in China. The upward momentum these stimulus efforts are providing to the Chinese market may be enhanced by the potential for China A-shares to be added to MSCI indices at the next review in 2017, and by China’s ability to provide even more stimulus through additional cuts in still high reserve requirements and interest rates.

Although our outlook for the next 12-18 months is positive, we believe that the tradeoff for all this short-term stimulus has been a suspension of most long-term reform initiatives. The short-term focus of China’s leadership risks making its long- term problems even more formidable and might inhibit its ability to shift to a more sustainable consumer-led economic model. This lack of progress on long-term economic reforms is all the more concerning in light of the populist backlash against global trade, especially China’s role in global trade, which has characterized the US presidential election. No one I spoke to in Asia believed that the populist rhetoric might actually lead to any serious restrictions on Chinese exports to the US. No one had any thoughts as to how the Chinese economy would adapt if the US placed additional restrictions on market access in sectors such as steel, aluminum and commodity chemicals, the sectors where China has been accused of selling below cost in order to keep their factories running.

These long-term risks mandate the need for a clear risk management plan for our Chinese exposure. In our view, short-term earnings and price momentum are currently too strong not to participate, but we acknowledge that we must be willing to leave this party early rather than risk staying too late.

Michael Jones is the Chairman and Chief Investment Officer at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information:

Past performance is no guarantee of future results.

RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with the portfolios’ composite benchmarks.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Using a currency hedge or a currency hedged product does not insulate the portfolio against losses.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Strategies seeking higher returns generally have a greater allocation to equities. These strategies also carry higher risks and are subject to a greater degree of market volatility.

In a rising interest rate environment, the value of fixed-income securities generally declines.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations. Any discussion of the individual securities that comprise the portfolios is provided for informational purposes only and should not be deemed as a recommendation to buy or sell any individual security mentioned.

Index Definition:

MSCI Emerging Markets Index consists of indices in 23 emerging economies, and covers approximately 85% of the free float-adjusted market capitalization of each of the 23 countries. It is not possible to invest directly in an index. Copyright ©2016 RiverFront Investment Group. All Rights Reserved.

This article was provided by our partners at ETFTrends.