Why Shares of Bottomline Technologies Are Soaring Today

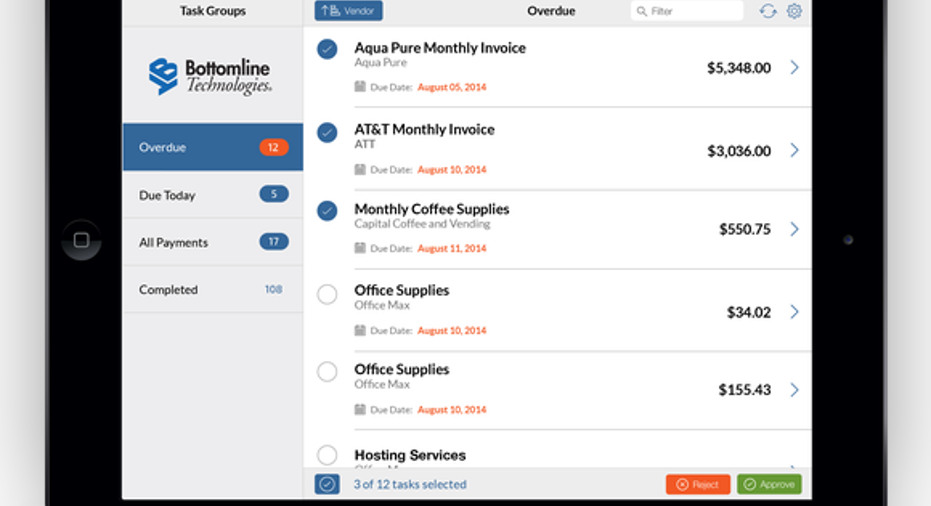

Image source: Bottomline Technologies.

What: Shares of cloud-based digital banking and business payment solutions provider Bottomline Technologies (NASDAQ: EPAY) surged on Friday following the company's fiscal fourth-quarter report. A double-digit rise in subscription revenue fueled a revenue and earnings beat, sending the stock up 12% by 11:30 a.m. EDT.

So what: Bottomline reported fourth-quarter revenue of $88.1 million, up 3% year over year, or up 5% on a constant currency basis. Analysts were expecting roughly $87 million of revenue. Subscription and transaction revenue, derived mostly from the company's cloud platforms, rose 14% year over year to $50.9 million. According to CEO Rob Eberle, bookings rose much faster than revenue:

Non-GAAP EPS came in at $0.37, up from $0.35 during the prior-year period and $0.07 higher than the average analyst estimate. On a GAAP basis, the company posted a loss of $0.16 per share, an improvement over a loss of $0.57 per share during the fourth quarter of 2015. A difference in tax rates was the only reason for the improvement, with GAAP operating income slumping by 45% year over year due to higher costs.

Now what: Double-digit growth of the company's cloud-based products was enough to drive revenue growth during the quarter, and as the mix shifts further toward the cloud, growth has the potential to accelerate. Bottomline announced a $60 million share repurchase program along with its report, citing its strong results, predictable business model, and an attractive stock price as good reasons to invest in its own stock. Investors agreed on Friday, driving the stock higher.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Timothy Green has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.