Here's How Boston Beer Co. Can Start Growing Again

Source: Getty Images.

Recently, I had the pleasure of editing and publishing Rich Duprey's "Is It Time for Boston Beer Co. to Be Taken Private?" to Fool.com. In it, he lays out the case for Jim Koch, the founder and CEO of Boston Beer Co. (NYSE: SAM) -- the maker of Samuel Adams and numerous other craft-beer labels -- to take the brewer off the public market.

The argument he lays out warrants consideration, and Rich isn't the first person to call for big changes.In a Wall Street Journal piece, titled "Upstart Brewers Rise Against Craft-Beer Founding Father Samuel Adams," author Tripp Mickle quotes Susquehanna Financial Group analyst Pablo Zuanic as saying, "It is time for Boston Beer to consider selling itself." The article then goes on to point out that "Sam Adams has gotten too big and familiar to be considered an authentic craft by elitist beer connoisseurs, yet it isn't hefty enough to have the cost advantages of big brewers."

Boston Beer is at a crossroads. But it's also in a unique position to further the cause of craft brewing and reward its shareholders in the process. Here's how.

Stuck in limbo

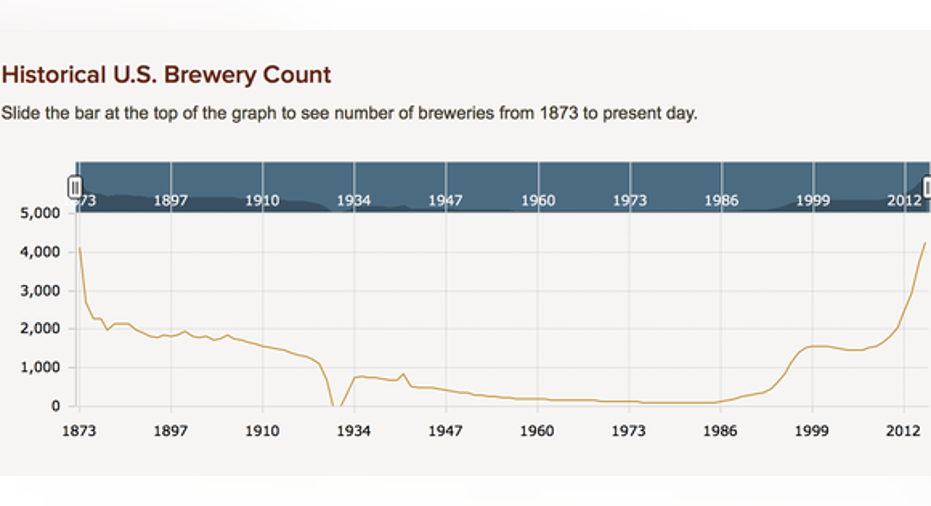

Craft brewing, as a category, has exploded over the past two decades, as Americans craved an ever-wider variety of beer options. There are more independent breweries in the United States today than at any other point since 1873:

Image source: National Brewers Association.

What defines a craft brewer is in itself interesting. The frequent source for such matters, the Craft Brewers Association, defines it as an entity that (1) produces 6 million barrels of beer or fewer per year, (2) is less than 25% owned by an alcohol industry member that is not itself a craft brewer, and (3) has a culture of innovation, among other qualitative measures. The irony is that the 6 million-barrel annual production number was upped in 2010 from 2 million barrels, to include none other than Boston Beer.

Two things seem obvious. First, the exact definition of a craft brewer is, as with most things in life, in the eye of the beholder. Second, most in the industry still respect Sam Adams' status as a craft brewer. At the very least, partnering with Boston Beer is preferable to making a deal with the megabrewers, as we recently saw when Virginia-based craft breweryDevil's Backbone was excluded from a Virginia craft-brewers' festival that it had pioneered, for the simple reason that it had recently sold out to the biggest brewer of them all, AB InBev (NYSE: BUD). This perception is precisely where Boston Beer's advantage lies.

Making beer vs. making money

Imagine you're a craft brewer. You have a small operation, brewing beer out of just one facility, and you do it more for the love of a good beer you want to share than for the money. And that's a good thing, because -- let's face it -- you probably aren't making a mint as a craft brewer. Odds are that your operations cost over $1 million to get started, and any conversation you have with distributors involves constant haggling over pricing and volumes.

Then comes the hard part: You have to hope that consumers buy your beer at local stores, on a consistent basis, for years to come. Sounds like a gamble, right? It is.

Data on the profitability of craft brewers is spotty at best, but it's well known that for every successful story, there are dozens that fail. There just isn't enough space in grocery-store beer aisles to accommodate everyone. Even smaller peer Craft Brew Alliance (NASDAQ: BREW), a company trying to strike a delicate balance between profitability and engendering the quality associated with craft beers, leaves much to be desired in terms of profitability:

| Metric | FY 2011 | FY 2012 | FY 2013 | FY 2014 | FY 2015 |

|---|---|---|---|---|---|

| Revenue | $149.2 million | $169.2 million | $179.2 million | $200 million | $204.2 million |

| Net income | $9.7 million | $2.5 million | $2.0 million | $3.1 million | $2.2 million |

| Return on Equity | 9.7% | 2.4% | 1.8% | 2.7% | 1.9% |

Data source: S&P Global Market Intelligence.

This leads us to the real advantage that the likes of AB InBev and Miller Coors (NYSE: TAP) hold. Over 100 years ago, they created the distribution infrastructure and massive facilities required to gain a dominant market share. This is why, in spite of its staggering growth, craft beer has merely dented their position in the United States. Even today, theycontrol 79% of beer sales in the United States.

So where does Boston Beer fall in all of this? At last count, it had around just a 1% market share. That's right, just 1%. It's still relatively small, but it has been one of the few craft brewers that has been able to generate fantastic returns for its owners:

| Metric | FY 2011 | FY 2012 | FY 2013 | FY 2014 | FY 2015 |

|---|---|---|---|---|---|

| Revenue | $513 million | $580.2 million | $739.1 million | $903 million | $959.9 million |

| Net income | $66.1 million | $59.5 million | $70.4 million | $90.7 million | $98.4 million |

| Return on equity | 37.7% | 27.7% | 25.5% | 24.4% | 21.8% |

Source: S&P Global Market Intelligence.

The natural conclusion one arrives at after surveying the U.S. beer industry is that the consumer is the main beneficiary of the advent of craft beer -- it almost certainly hasn't been the brewers themselves. There are outliers, to be sure -- namely Boston Beer -- but earning above-average returns on capital as a craft brewer is, at best, a crap shoot. To tip the odds in one's favor, you need the distribution network to reach consumers. It has nothing to do with hops or ratings. To compete with Budweiser and Miller, one needs a partner. A partner like Boston Beer.

A craft-brewing conglomerate

Once one realizes that the true advantage of the megabrewers isn't their beer but their distribution network, one instantly gains all the more respect for Sam Adams. It started out as a small craft brewer in the 1980s with a lager recipe. Today, it sells Sam Adams, Angry Orchard, and numerous other alcoholic beverage brands to over 350 wholesale distributors that operate not just in the United States but also in multiple foreign markets.

Boston Beer accomplished the impossible, but it now finds itself at a crossroads. It can remain a decently sized craft brewer, possibly going private, or it can go for the gold, doing what AB InBev wishes it could do. It can become a craft-brewing conglomerate with dozens of beloved brands under its umbrella.

Boston Beer doesn't even have to fork over cash to make this happen. As with John D. Rockefeller's Standard Oil in its early days, competitors can be offered stock to join forces with the dominant player, and everyone benefits. Any small brewer brought into the fold would be instantly more valuable, given access to Boston Beer's distribution network. Not only that, but the move would also be far more preferable to selling out to megabrewers for basically any craft brewer looking to cash in its chips. Better to join forces with a spiritual brother than sell out to what many perceive as the evil empire that is AB InBev.

The outcome for Boston Beer shareholders will be a reignition of the company's growth engine. Any particular craft brand that seems to be striking a chord with consumers could quickly have its volumes ramped up and given space on shelves within SAM's distribution network. True, there will be ownership dilution. And yes, there will probably be growing pains. But given the high valuation assigned to Boston Beer's own shares, the exchange seems more than fair:

| Trailing P/E | 26.02 |

| Forward P/E | 25.98 |

| 5-Year EPS Annualized Growth Estimate | 6.2% |

| 5-Year Trailing EPS Growth | 9.39% |

| 5-Year Average Return on Equity | 27.52% |

Data source: S&P Global Market Intelligence.

Current shareholders should make peace with the sobering fact that Boston Beer is currently boasting approximately the same forward P/E ratio as near-monopolistic tech giantAlphabet and the elephant in the room,AB InBev. No matter what you think of Boston Beer's future, it's safe to say that its shares arenot cheap.

This doesn't have to be a bad thing, though. Its growth profile is waning, yet it still commands a lofty valuation. This is, according to none other than Warren Buffett, the ideal time to issue shares when making acquisitions. "Our share issuances follow a simple basic rule: We will notissue shares unless we receive as much intrinsic business valueas we give," Buffett wrote, in his 1983 Berkshire Hathaway letter to shareholders.

Even Buffett has been known to issue shares in Berkshire Hathway when making acquisitions over the years, particularly at times when he and Vice Chairman Charlie Munger deemed Berkshire shares as decidedlynot cheap.

Given Boston Beer's own lofty valuation, why not offer promising craft brewers a chance to come into the fold in exchange for shares in Boston Beer? Koch wouldn't even have to give up voting control thanks to Boston Beer's dual-class share structure. This move also seems preferable to going private, as that would require (in all likelihood) billions of debt being piled on top of SAM's decidedly rich valuation multiples.

There's also a slight precedent for this idea. The founder of Magic Hat Brewing Company, Alan Newman, has been a friend and colleague of Koch for over two decades, and when Magic Hat was sold in 2010, it was Koch who persuaded Newman, along withStacey Steinmetz, to return to the craft-brewing industry under the Boston Beer Co. umbrella. And thus, Alchemy & Science was born. Its only directive from Koch was to "make craft brewing in America an even better place."

Final thoughts

Both Boston Beer and the craft-brewing industry at large have an opportunity to go on the offensive. Consumers clearly want a variety of craft beers, but the surge in brewers is starting to make the economics less attractive. Boston Beer, as the market leader of the craft-brewing industry, can and should take ownership of its position and simultaneously reignite its own growth profile by offering shares to craft brewers that it seeks to acquire. The targets themselves become more valuable, instantly, because of Boston Beer's distribution network, and the brewers themselves know that they've found a good home with a parent company that respects what craft brewing truly stands for.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fools board of directors. Sean O'Reilly has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Berkshire Hathaway (B shares), and Boston Beer. The Motley Fool recommends Anheuser-Busch InBev NV. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.