The Hidden Risk in Wal-Mart's Acquisition of Jet.com

Image source: Getty Images.

This week, the United States' largest retailer,Wal-Mart Stores Inc. (NYSE: WMT), confirmed earlier rumors by buying upstart e-commerce company Jet.com. The Wall Street Journal (subscription required) reports Wal-Mart acquired the company for a total of $3.3 billion -- $3 billion in cash and $300 million in Wal-Mart stock. Overall, this is a small sum for the Arkansas-based retailer; as a point of comparison, the $3.3 billion figure is approximately half of what the company paid in dividends last fiscal year.

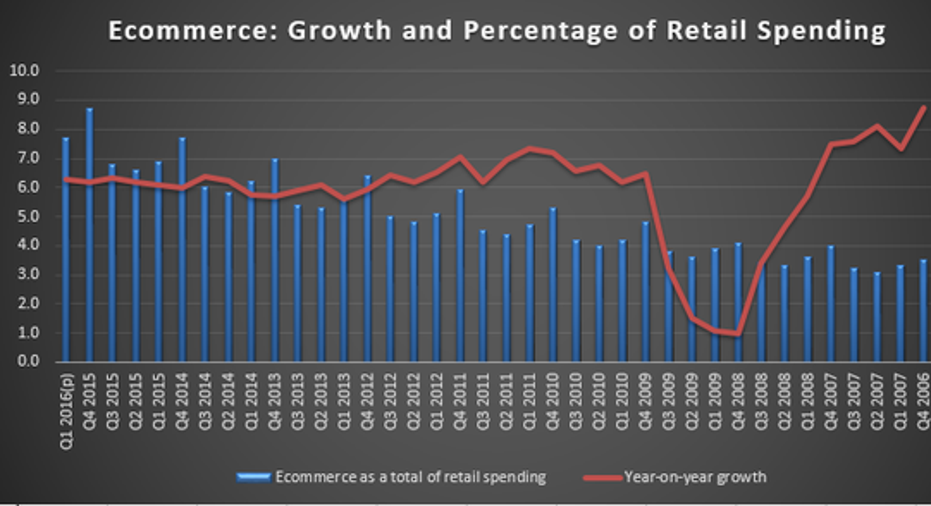

On the surface, it makes sense for Wal-Mart. Perhaps the biggest shift in the history of retailing, and certainly within the past decade or so, is the rapid growth of e-commerce. In that time, e-commerce sales have grown from a paltry 3.5% of total retail sales to 7.7% in preliminary estimates of Q1 2016. Overall, e-commerce has grown at a clip of 15% over the last two years, versus the overall real GDP growth of 2% to 3% during this period.

DATA SOURCE: U.S. CENSUS BUREAU. RIGHT Y-AXIS DENOTES YEAR-ON-YEAR GROWTH; LEFT Y-AXIS IS PERCENTAGE OF TOTAL RETAIL SPENDING.

Overall, Wal-Mart's purchase of Jet is a small bet on a growing market the company clumsily conceded to the likes of Amazon.com decades ago. The real risk to this deal is unlikely to show up in either company's balance sheet.

The culture could not be more different between Jet and Wal-Mart

A large-scale study from Big-Four accounting company KPMG found that 83% of all mergers failed to boost shareholder returns. There are many theories why shareholder value does not materialize: paying too much for the acquired company, synergies figures that fail to materialize, and poor due diligence. However, the biggest reason generally given is a mismatch in corporate culture.

By all accounts, the cultural differences between Wal-Mart and Jet could not be more different. Wal-Mart, an established retailer, is mostly worried about their bottom-line results, paying billions for share buybacks in an attempt to boost their earnings-per-share figures. Jet has continued to act like an aggressive start-up, more concerned with transactions and user growth at the expense of profits.

The Wall Street Journal article notes that the company has been adding 400,000 shoppers monthly and was on pace to sell $1 billion in merchandise annually. However, the company is unprofitable, and its goal of undercutting Amazon's prices would make it hard to grow margins. Last year, the company abandoned its goal of a $50 subscription fee, much like Amazon's Prime service, in an attempt to expand its shopper base. It appears Jet has sacrificed profit for growth.

Earlier this year, Wal-Mart did the exact opposite, choosing higher profit margins over revenue by closing 269 worldwide stores, many of which were the company's smaller Walmart Express concept and underperforming stores in Brazil.

For Wal-Mart, buying Jet was the easy part

There are potential benefits to the merger. Jet now has the buying power of the world's largest retailer and will most likely increase its already enviable 12-million SKU figure. What Jet brings is an Internet-focused and growth-first mentality.

The downsides are obvious: If Wal-Mart applies its ruthless cost-cutting culture, it's likely Jet's growth will slow as marketing is pared back in favor of profit. Although the two will remain separate brands, there's an additional risk Jet becomes defined by Wal-Mart, which is the exact opposite of what a high-flying technology-based company would want to happen.

In addition to the obvious financial loss in the event the acquisition fails, which is negligible in Wal-Mart's case, the company faces additional costs to combine distribution and potentially falling margins in the event Jet's razor-thin margin operations become a larger part of Wal-Mart's revenue haul.

Overall, this was an aggressive move for a company continuing to fall behind in e-commerce. However, paying for Jet was the easy part; successfully integrating both companies is where this battle will be won or lost.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Jamal Carnette has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Amazon.com. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.