Why SolarCity Needs Solar Securitization to Work

Image source: SolarCity.

One of the secrets of SolarCity Corp.'s business model is that it constantly needs financing to fund solar installations. Its business simply doesn't generate enough cash for SolarCity to finance projects itself, so it slices and dices the value created from each solar project and sells the pieces to investors.

One of the main pieces is called tax equity, where investors pay a certain amount for the tax benefits of a solar project (30% investment tax credit and accelerated depreciation) along with a percentage of the project's cash flow. The rest of the funding has to come from SolarCity itself or some form of debt. And the company would prefer to sell the future cash flows from solar projects to investors in the form of securitizations, which would give SolarCity immediate cash flow and put the risk of customers paying their bills on securitization investors.

Why securitization is such a desirable market Securitization isn't a new concept in finance, but it is new in solar. More commonly, securitization is used to fund credit card debt or mortgages. A bank bundles thousands of debts together and sells off pieces to debt investors, who take different interest rates depending on the risks they take. In a perfect world, a bank can fund 100% or more of its lending with these securitizations, creating a sustainable cash flow cycle.

SolarCity was trying to do something similar with solar projects. In the fourth quarter, it spent $2.71 per watt to build solar systems, which was less than the $2.73 per watt it got in financing during 2015. If the company could do this over and over again, it could fund operations with tax equity and securitizations while taking a piece of the value as profit long term.

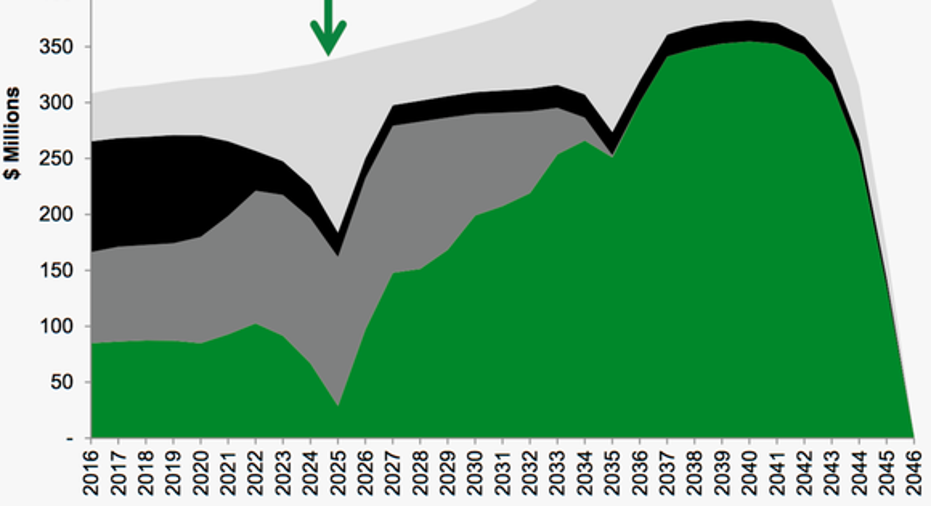

Below, SolarCity illustrated how its 1.7 GW PowerCo business is currently financed. Some of the dark grey portion is existing securitizations that have been sold. The green portion is cash flow SolarCity can keep or sell to investors through a new securitization. Keep in mind that only the first 20 years of this chart are contracted cash flows, so the lump of value on the right-hand side is value management projects exists, with no evidence to support that customers will renew leases after 20 years.

Image source: SolarCity Q4 2015 earnings presentation.

The problems of securitization in solar today The idea of selling off pieces of cash flows to investors is great, but they have to be willing to buy those cash flows for an interest rate that's attractive to the solar developer. If the rate is too high, the virtuous cycle of cash flows I outlined above either wouldn't take place or SolarCity would have to raise its prices.

And here's where SolarCity is running into problems. When securitizations first started in 2013, it looked like interest rates would be incredibly attractive. But in the last six months, rates investors have demanded have risen sharply.

|

Amount |

Weighted Interest Rate |

|

|---|---|---|

|

November 23, 2013 |

$54.4 million |

4.80% |

|

April 3, 2014 |

$70.2 million |

4.59% |

|

July 25, 2014 |

$201.5 million |

4.32% |

|

August 13, 2015 |

$123.5 million |

4.41% |

|

January 21, 2016 |

$185 million |

5.81% |

|

March 1, 2016 |

$49.6 million |

6.25% |

Data source: SolarCity.

There are a number of factors driving interest rates higher for SolarCity, including the Federal Reserve raising rates and the market's general turmoil in early 2016. But the bigger concern is that investors aren't as confident in residential solar cash flows as they once were.

SolarCity's slowing growth and the rising cost to acquire customers may be showing that selling solar on long-term contracts isn't as enticing as it once was. And if customers start to default on those contracts, it'll be those buying debt who pay the price, not SolarCity. And that risk requires a higher rate of compensation than it did as recently as a year ago.

Securitization isn't a sure thing The simple truth is that SolarCity can't finance all of its installations on its balance sheet, so it needs debt funding to survive. At the end of 2015, the company had just $382.5 million in cash, enough to fund about 141 MW of installations, or a little over a month of operations.

If SolarCity can't get the securitization market to work effectively (read: low rates) it'll have to find another alternative to fund project. And that's a growing concern for investors and a reason the stock is dropping. So, keep an eye on where rates head because right now they're not working in SolarCity's favor.

The article Why SolarCity Needs Solar Securitization to Work originally appeared on Fool.com.

Travis Hoium has no position in any stocks mentioned. The Motley Fool owns shares of and recommends SolarCity. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.