GEICO's 2015 Was One of The Worst on Record

Last year certainly wasn't the banner year that GEICO expected. The company is ordinarily one of Berkshire Hathaway's largest drivers of underwriting income, but 2015 proved to be one of its weakest on record.

GEICO recorded a pre-tax operating margin of just 2%, well below its 18-year average underwriting margin of 5.8%.

Said another way, for every $1 in premiums GEICO earned in 2015, it paid out $0.98 in losses and expenses. Only $0.02 fell to pre-tax underwriting profit. The company actually lost money on its underwriting in the fourth quarter of 2015.

Of course, this isn't to say that GEICO's best days are behind it. Universally, car insurance companies are reporting more accidents due to lower gas prices.

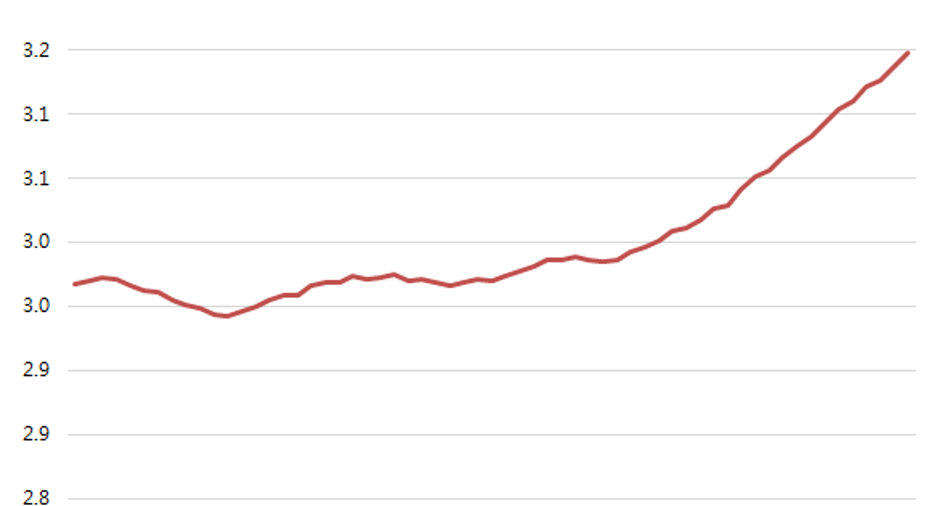

Total vehicle miles traveled surged as gas prices fell through 2014 and 2015, after flat lining in the years following the financial crisis. Americans are hitting the roads once again, and as miles traveled increases, the frequency of accidents increases, too.

In his annual letter to shareholders, Buffett wrote about GEICO's advantage over other auto insurers. It's an extraordinarily frugal company, which allows it to pass the cost savings on to its customers in the form of lower premiums. As GEICO grows, its scale gives it a greater economic advantage over its rivals and the business only gets stronger.

Though the advantage of being the low-cost operator gives GEICO an inherent advantage over its peers, it won't result in outsize profits in every single quarter and every single year. Provided driverless cars aren't just around the corner, GEICO's best days are still ahead of it.

The article GEICO's 2015 Was One of The Worst on Record originally appeared on Fool.com.

Jordan Wathen has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Berkshire Hathaway. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.