Tesla's Musk closes SolarCity deal, more challenges lie ahead

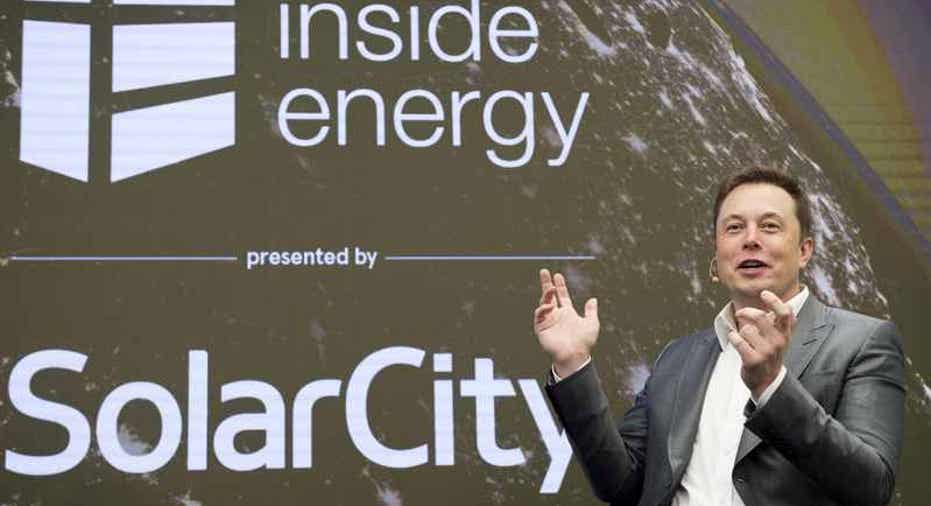

LOS ANGELES – Tesla Motors Inc Chief Executive Elon Musk won approval on Thursday from the electric luxury automaker's shareholders for an acquisition of SolarCity Corp, the solar energy system installer in which he is the largest shareholder.

The stock swap deal, worth about $2 billion, caps a tumultuous year for Musk and Tesla. The proposed acquisition of SolarCity, a money-losing installer of residential solar power systems, prompted a 13 percent fall in Tesla's share price after Musk outlined the deal in June.

Tesla said the deal was "overwhelmingly" approved by 85 percent of unaffiliated shareholders. Shares rose 1.3 percent in after-hours trade after gaining 4.7 percent in the regular session to close at $188.66.

"Your faith will be rewarded," Musk told shareholders assembled at the company's Fremont, California, facility.

Tesla investors have also been rattled by a federal investigation of the death of a Tesla owner operating his car on Autopilot, a driver assistance system, and by concerns Musk may be overextended between ambitious future goals for Tesla, the work of integrating SolarCity, and his CEO duties at SpaceX.

The automaker's shares are down nearly 20 percent for the year, and took a hit after Donald Trump's victory in the presidential election. A key Trump advisor on environmental issues, Myron Ebell, has said federal tax subsidies for electric vehicles should be cut off.

Tesla faces more challenges in the months ahead, as the company tries to make a five-fold leap in its annual vehicle production and launch next year its new Model 3 sedan, aimed at mass-market customers able to buy a vehicle with a starting price of $35,000.

Tesla last month reported a narrow profit for the third quarter, and Musk said he did not expect the company would have to sell more shares to finance the Model 3 launch. However, most analysts expect the company will have to raise capital next year, possibly with a sale of equity.

Musk and other company insiders recused themselves from the shareholder vote on the SolarCity acquisition. But Musk campaigned hard for the deal, arguing SolarCity's operations would add $1 billion to Tesla's revenue by 2017, and generate an additional $500 million in cash over three years.

Musk received a boost for the SolarCity deal earlier this month when Institutional Shareholder Services (ISS) recommended that investors in both companies approve the deal. Under the proposed transaction, SolarCity shareholders will get 0.110 of a Tesla share for each share in the solar company.

As of Sept. 30, SolarCity had $259.3 million in cash and cash equivalents and $6.68 billion in total liabilities, including debt.

SolarCity has expanded dramatically in the last five years, but it relies heavily on borrowing money to finance its no-money-down residential solar installations. After expanding installations more than 70 percent between 2014 and 2015, SolarCity ratcheted down its forecast three times this year and now expects just a modest increase compared with 2015.

(Editing by Joseph White and Matthew Lewis)