Picking the Right Health Insurance Plan

Workers have multiple health insurance plans to choose from at more than one-third of U.S. small businesses and about two-thirds of large companies, according to the most recent Census data. Meanwhile, insurance options have expanded for millions of Americans, thanks to the Affordable Care Act, and, in many cases, have moved beyond the chocolate-or-vanilla varieties of years past.

Whether you're shopping for insurance through your employer, on the Obamacare exchanges or in the private market, it's important to carefully consider your choices.

But first, you have to cut through the sometimes confusing insurance-speak about deductibles, networks, coinsurance and the like. So just what should you think about when picking a health insurance plan?

Determine what's important to you

First, make a list of the things that are important for you to have in a health plan, says Deborah Chollet, a health insurance research leader at Mathematica Policy Research in Washington, D.C. This includes deciding how attached you are to your current doctor (if you have one) or any other health care providers.

If you want to continue the relationship you have with your doctor, you should ask which insurance plans he or she will be participating in during the upcoming plan year, says Craig Gussin, an insurance broker in San Diego and a spokesman for the National Association of Health Underwriters.

"What we may not know is that your doctor has already decided he or she is not taking a certain plan (in the next year) and hasn't notified the insurance company yet," Gussin says. "The networks are getting smaller; the network you had two years ago is not going to be the same now."

A low premium may be desirable, but ...

Ignoring the network of doctors and hospitals is just one of the big mistakes people tend to make when evaluating a health plan, says Dena Mendelsohn, a San Francisco-based health policy analyst for Consumers Union, the policy and advocacy arm of Consumer Reports.

"A lot of the time, people focus too much on the premium and they don't take into consideration additional costs that will happen throughout the year," she says.

Yes, a low premium can be very attractive, particularly for shoppers in the Obamacare exchanges, where tax credits based on your income and family size can sharply reduce or even eliminate the monthly cost.

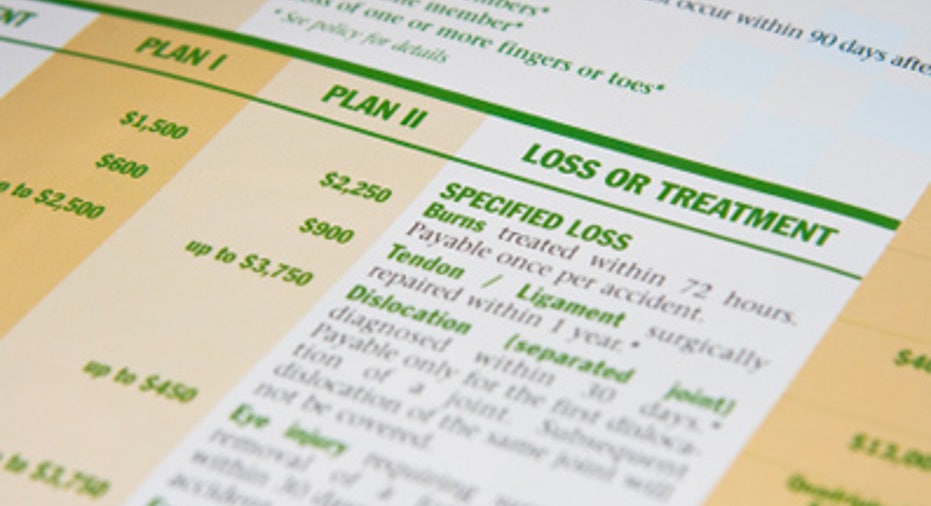

But understand that a plan with a cheap premium can come with a high deductible, potentially leaving you responsible for thousands of dollars of your own medical bills each year. You'll have to meet the deductible before coverage for many types of services kicks in.

Factor in all possible out-of-pocket costs

It's very important for consumers to consider the range of expenses that comes with any health insurance plan, says Chollet.

"You want to start looking at your tolerance for spending money at the point of service and whether your drugs are covered and how they're covered," she says. In other words, start thinking about how your finances would handle the maximum out-of-pocket costs possible throughout the term of your health plan.

While many types of preventive care are now supposed to be fully covered -- at no cost to you -- under health reform, you likely would have to pay copayments, coinsurance (a percentage of the overall costs) and a deductible for other services.

Things to consider when evaluating a health plan

- Would you like to keep your current doctor(s)?

- Does the plan cover your drug(s)?

- What is the quality of the hospitals available in your area?

- How high of a deductible can you afford? What about the copayment and coinsurance amounts?

- If you're shopping through the Obamacare exchanges, do you qualify for financial assistance that will lower the cost of your monthly premium?

If you're planning to enroll in Obamacare coverage, you can learn more about plans' out-of-pocket costs via the health exchange for your state. If you're shopping for insurance elsewhere, such as through your employer, review the materials given to you about your coverage options or check out the insurer's website.

Investigate doctors and hospitals

Other actions you should take before making a health insurance choice include examining a plan's network on the insurance company's website, then doing some research on the in-network specialists and hospitals.

A good place to start: The Joint Commission (formerly The Joint Commission on Accreditation of Healthcare Organizations), an independent nonprofit organization that accredits and certifies hospitals and health care programs. The commission's QualityCheck.org website allows you to find out if a hospital or medical practice has received the Joint Commission Gold Seal of Approval.

"(The) bottom line is you want a health plan, all else being equal, that has a very high-quality hospital near you, because that's probably where you will go if you need to be hospitalized," Chollet says.

Think about prescription drugs, too

Another place to look is the National Committee for Quality Assurance, a nonprofit that evaluates health care quality of medical practices, Chollet adds. Consumer Reports' website uses the committee's data on customer satisfaction, preventive services and treatment to rank health insurance plans at the state level.

You'll also want to verify if any plan you're considering will cover the prescription drugs you're taking.

"Every health plan has a drug formulary and if you are systematically on a course of drugs, you want to make sure that that formulary covers your drug," says Chollet.

The covered drugs will likely fall into either preferred or less preferred categories, or tiers. The preferred drugs tend to be generic, more established in the market and less expensive, while the less preferred drugs are usually newer and will have higher out-of-pocket costs for you, she says.

Don't just renew, do shop around

Although it may seem easy to just automatically renew whatever plan you currently have (if it's still available), you owe it to yourself to review any other, possibly newer options you may have, either through your employer or on the private market, advises Mendelsohn.

"Consumers should look at the whole picture and not just the basic price tag," she says. "Even though it may take more time, we strongly recommend shopping (around)."

Copyright 2014, Bankrate Inc.