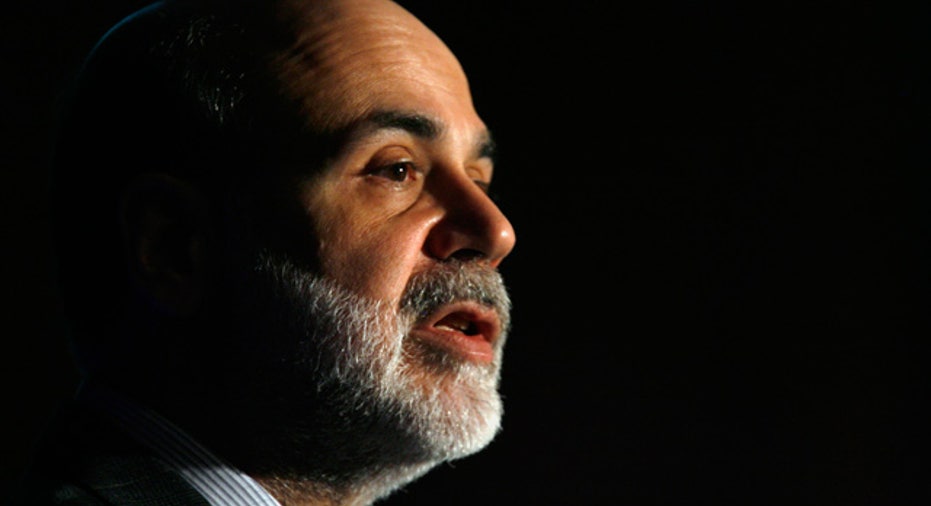

Bernanke Says New Rules Benefit Smaller Banks

New financial regulatory reforms should help reduce the edge that large banks have over smaller ones because of their implicit support from government, Federal Reserve Chairman Ben Bernanke said on Wednesday.

Bernanke argued the Dodd-Frank reform legislation will address the issue of firms perceived as too big to fail by restricting their activities, raising their capital requirements and enhancing regulators' ability to wind them down.

"A financial system dominated by too-big-to-fail firms cannot be a healthy financial system," Bernanke told a group of community bankers in a speech that did not touch on the broader economic outlook.

"One benefit of the reforms should be the creation of a more level playing field for financial institutions of all sizes," he said.

A number of other top Fed officials, including Richard Fisher, president of the Dallas Fed bank and Thomas Hoenig, president of the Kansas City Fed, have argued the legislation does not go far enough. They have called for very large banks to be broken up.

WATSON NO CREDIT OFFICER

Bernanke said part of the reason the new laws governing the financial sector would support community banks was that regulators are cognizant of their concerns and challenges.

With that in mind, the Fed is aware that many community banks need time to recover from the financial crisis.

"We recognize the importance of striking the right balance between promoting safety and soundness throughout the banking system and keeping the compliance costs for smaller banking firms as small as possible," he said.

He said the crisis suggested fancy computer models are no substitute for on-the-ground intelligence on lending, joking the IBM computer that had recently won the U.S. game show "Jeopardy!" was not well equipped to make credit decisions.

"This advantage for community banks is fundamental to their effectiveness and cannot be matched by models or algorithms," Bernanke said.

"Watson may play a mean game of Jeopardy, but I would not trust it to judge the creditworthiness of a fledgling local business or to build longstanding personal relationships with customers and borrowers."