Capital One Venture X Rewards Credit Card review: Luxury perks for less

The Capital One Venture X Credit Card is an excellent choice for frequent travelers who value luxury perks and can use the Capital One Travel portal. This card offers a generous sign-up bonus and travel credits that can easily offset the high annual fee.

Fox Money is a personal finance hub featuring content generated by Credible Operations, Inc. (Credible), which is majority-owned indirectly by Fox Corporation. The Fox Money content is created and reviewed independent of Fox News Media. Credible is solely responsible for this content and the services it provides.

Advertiser disclosure: Content provided by www.redventures.com. Fox and its content partners earn compensation from the affiliate companies below. This content doesn’t include all available offers, and compensation may impact how and where links appear in the content.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

If you want to travel in style, few cards offer as much value as the Capital One Venture X Rewards credit card.

At first glance, the card’s annual fee might seem steep. But the card's benefits — if used effectively — are worth more than the annual fee. And unlike some of their competitors, the benefits aren’t hard to use.

From its generous welcome bonus and lucrative rewards structure to its extensive lounge access and valuable travel protections, Venture X is one of the best travel credit cards out there.

Fox Money rating: 9.6

The Venture X is an excellent option for jet setters who value luxury perks and can use the Capital One Travel portal. While the card has a high annual fee, the sign-up bonus and travel credits can more than offset the cost for those who travel often.

Pros

- Generous sign-up bonus of 75,000 miles

- $300 annual travel credit

- Unlimited lounge access

- 10X miles on hotels and rental cars, 5X on flights booked through Capital One Travel

- 2X miles on all other purchases

- Up to $120 TSA PreCheck or Global Entry credit

Cons

- High annual fee of $395

- Redemption inflexibility with some travel partners

- Points value can fluctuate

Capital One Venture X benefits

The Capital One Venture X Rewards benefits are generous and easy to use. Its annual fee is also much lower than rival premium travel credit cards.

“I think the Venture X has generated excitement among consumers, even those typically averse to annual fees, because the Venture X feels like having a few travel cards rolled into one,” says Zac Hood, founder of Travel Freely. “Because of its straightforward earning, redeeming, and simplified but valuable perks and benefits, it’s one of the simplest ultra-premium cards to understand.”

Here’s a closer look at some of the Venture X’s benefits.

Sign-up bonus

One of the most attractive features of the Capital One Venture X Credit Card is its generous sign-up bonus.

New cardholders can earn 75,000 bonus miles after spending $4,000 in the first three months.

The bonus is worth up to $750 in travel when redeemed through Capital One Travel. This offers a significant boost to your travel rewards right from the start.

If that wasn’t enough, you’ll earn a 10,000-mile bonus every account anniversary — worth $100.

Whether you're planning a luxurious getaway or simply looking to offset the cost of your next trip, the welcome bonus can help you reach your travel goals faster.

Earning rewards

The Capital One Venture X Rewards offers a straightforward and rewarding earning structure:

- Earn 10X miles on hotels and rental cars booked through Capital One Travel

- Earn 5X miles on flights booked through Capital One Travel

- Earn 2X miles on all other purchases

This earning potential allows you to quickly accumulate miles on everyday spending. It can be particularly lucrative for those who frequently book travel through Capital One Travel.

Keep in mind that the best earning rates — 10X miles on hotels and rental cars and 5X miles on flights) — require you to book through Capital One Travel.

Travel perks and credits

The Capital One Venture X Rewards Credit Card also offers a suite of valuable travel perks. Cardholders receive a $300 annual travel credit for bookings made through Capital One Travel. This effectively lowers the card’s annual fee to $95.

Cardholders are also eligible for an up to $120 TSA PreCheck or Global Entry credit every four years.

Other notable travel perks include:

- Trip cancellation and interruption insurance

- Primary rental car insurance

- Travel accident insurance

- Premier Collection perks and credits for hotel bookings

- No foreign transaction fees

Lounge access

Cardholders enjoy unlimited access to Capital One Lounges and Priority Pass lounges worldwide. With over 1,300 Priority Pass lounges across the globe, this benefit can significantly enhance your travel experience.

Capital One Lounges offer a premium lounge experience, with amenities like comfortable seating, complimentary food and beverages, high-speed Wi-Fi, and more.

Redeeming Capital One Venture X miles

One of the most valuable ways to redeem rewards is to book travel through the Capital One Travel portal. This option allows for more flexibility, as you can book flights, hotels, rental cars, and more using your miles. There are also no blackout dates, and miles never expire.

Cardholders can transfer miles to 15+ travel partners at a 1:1 ratio, including popular airlines like Air France/KLM Flying Blue, British Airways, and Singapore Airlines, as well as hotel chains like Wyndham and Choice Privileges.

Cardholders can redeem miles for cash back, gift cards, and other options. Remember that these redemption methods typically offer less value than travel redemptions.

How transferring miles work

Transferring miles to travel partners can be especially lucrative, helping you save hundreds (or even thousands) on travel.

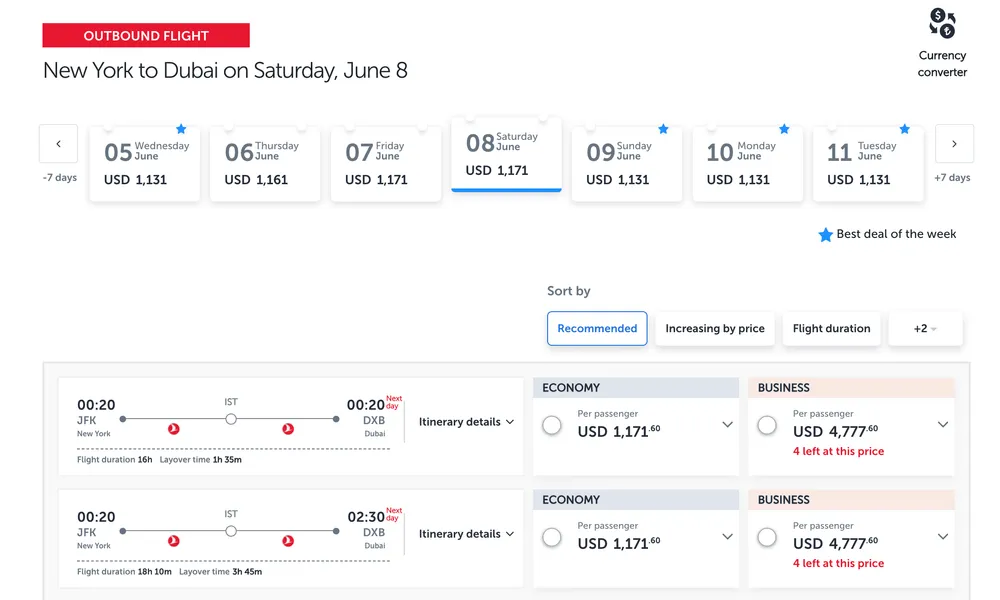

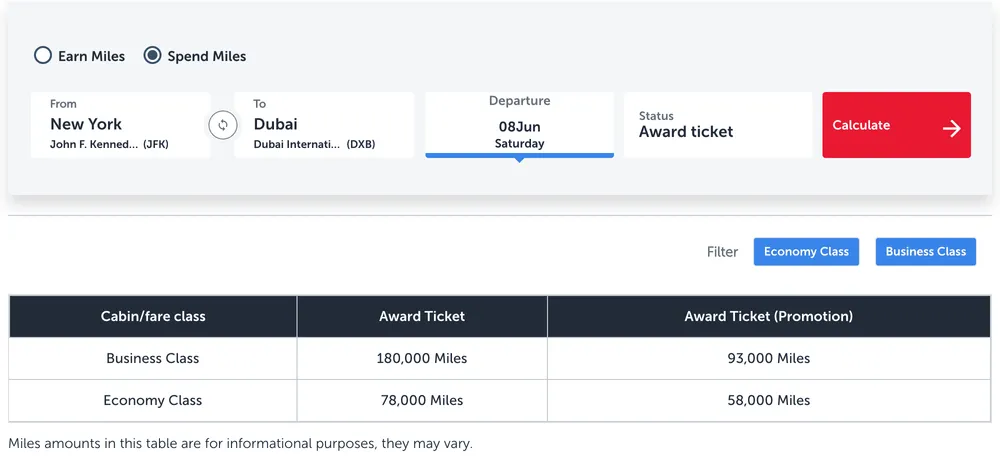

Let’s see how transferring miles looks in practice. Let’s say you want to take a one-way flight to Dubai from New York City on June 8 via Turkish Airlines.

Depending on when you book, prices are around $1,000 for economy class and well over $4,000 for a business class seat.

But, if you use transfer miles from your card directly to Turkish Airlines — a Capital One travel partner — you’d only need 78,000 miles for economy or 180,000 miles for business class ticket.

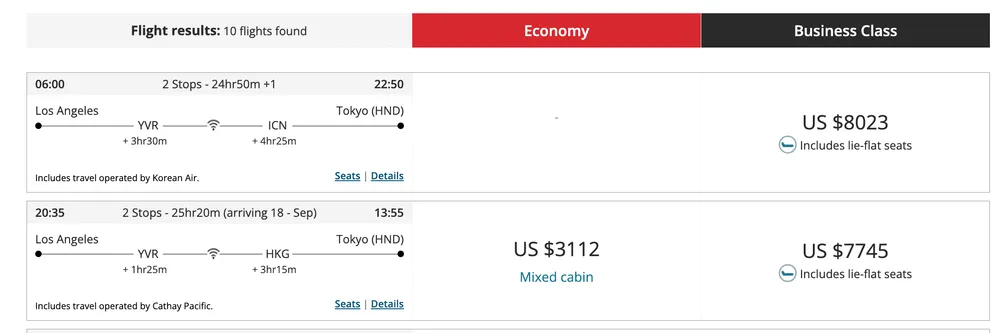

Or, let’s say you want to fly from Los Angeles to Tokyo, Japan, in September. A normal one-way economy ticket would cost around $2,000-$3,000. A business-class ticket would cost upwards of $8,000.

But Air Canada — another Capital One travel partner — offers flights between North America and Pacific time zones for 45,000-80,000 miles for economy class and 75,000-175,000 miles for business class.

Finding deals with miles takes a little work, but the savings can be substantial. Also, ensure availability before transferring miles to a partner airline.

If you don’t want to take the time to transfer miles to travel partners, you can also redeem miles as a statement credit or use rewards to book travel directly with Capital One.

Capital One Venture X drawbacks

Annual fee

One of the main drawbacks of the Capital One Venture X Rewards Credit Card is its $395 annual fee. While this fee is lower than other premium travel credit cards, it can still be a significant expense for some cardholders — especially those who don’t travel often.

But it’s to analyze the value of the card's benefits in relation to the annual fee. For example, the $300 annual travel credit effectively reduces the annual fee to $95 for those who can fully utilize the credit. The value of the lounge access, travel insurance, and other perks can easily exceed the remaining $95 for frequent travelers.

The Venture X’s annual fee is also much lower than other premium travel cards. For example, the Platinum Card® from American Express has an annual fee of $695. See rates and fees. The Chase Sapphire Reserve® has an annual fee of $550.

Redemption inflexibility

While Venture X offers a 1:1 transfer ratio to multiple travel partners, the value of these transferred miles can fluctuate based on the specific program and redemption. There’s often limited availability for award tickets, especially business class, which may not coincide with your travel plans.

Some travel partners may also have limited availability or blackout dates, restricting the usefulness of transferred miles.

Redeeming miles through the Capital One Travel portal may not always provide the best value, as prices on the portal may be higher than booking directly with airlines or hotels. That’s why you should carefully compare redemption options to ensure you get the most value from their miles.

Is the Capital One Venture X right for you?

While the Capital One Venture X Rewards offers impressive benefits, it's essential to consider your travel habits and spending to determine if the card is a good fit. The Venture X is an excellent choice for frequent travelers who:

- Spend significantly on travel: If you frequently book flights, hotels, and rental cars, the Venture X's bonus categories and travel credits can provide significant value.

- Value airport lounge access: If you appreciate the comfort and convenience of airport lounges, the Venture X's complimentary access to Capital One Lounges and Priority Pass lounges can enhance your travel experience.

- Can use the card's annual travel credit: If you can easily use the $300 annual travel credit through Capital One Travel bookings, this effectively reduces the card's annual fee to just $95.

If you rarely travel or prefer to book directly with airlines and hotels, the Capital One Venture X card may not provide enough value to justify the annual fee. On the other hand, if you frequently book travel through the Capital One Travel portal and can take advantage of lounge access and other perks, the card can be a valuable addition to your wallet.

“For those who can utilize the Capital One Venture X card's numerous benefits, it provides excellent value despite the $395 annual fee,” says Hood. “The card effectively pays for itself with the $300 travel credit and 10,000 bonus miles [on each account anniversary].”

How we rated this card

Every credit card review we publish has undergone a rigorous editorial process to ensure accuracy and objectivity.

We rate all credit cards on a 10-point system, with 10 being the highest possible score and 1 being the lowest possible score. We assess each card across several key factors, weighted based on what our research shows matters most to readers like you. Learn more about our methodology here.

The bottom line

The Capital One Venture X Rewards is a premium travel credit card with great rewards, benefits, and travel protections. The card's tiered rewards structure, which favors travel purchases made through the Capital One Travel portal, can also be lucrative for those who can utilize this booking method.

However, the high annual fee and potential redemption inflexibility may be drawbacks for some cardholders. It's essential to carefully consider your travel habits and preferences to determine if the Capital One Venture X Rewards Credit Card fits you.

Editorial disclosure: Opinions expressed are author's alone, not those of any bank, credit card issuer, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included in the post.