Baby Boomers' Average Savings for Retirement

Baby boomers are turning 65 at a pace of roughly 10,000 per day, and if you're a baby boomer who is fast approaching retirement, you might be wondering if you're on target with your retirement savings goals.

While every baby boomer's situation is different, understanding how much your peers have set aside for their golden years can help shape your savings plans. Are you on track for financial security in retirement?

IMAGE SOURCE: SENIORLIVING.ORG VIA FLICKR.

The numbers

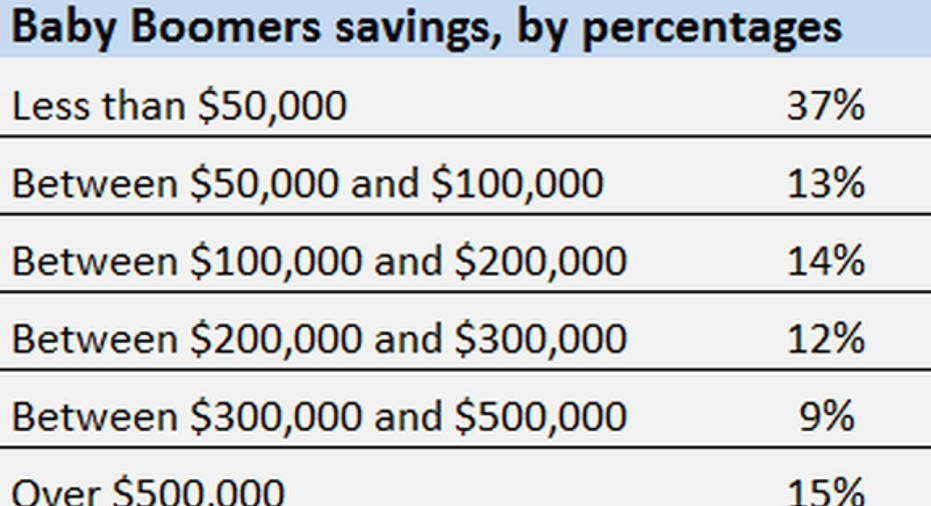

According to a recent PWC survey, baby boomer retirement savings vary widely, but roughly half of all baby boomers have set aside only $100,000 or less.

DATA SOURCE: PWCEMPLOYEE FINANCIAL WELLNESS SURVEY. TABLE BY AUTHOR.

More worrisome, over a third of baby boomers have saved less than $50,000 for retirement, and just 15% have accumulated nest eggs north of $500,000, an amount that could generate the kind of retirement income necessary to maintain a retiree's standard of living.

Those figures suggest that a significant proportion of baby boomers could end up struggling to pay their bills once they retire.Financial planners recommend withdrawing no more than 4% of retirement savings per year for expenses, and at that rate, the baby boomers with accounts smaller than $100,000 will produce less than $4,000 in retirement income annually.

If they withdraw more than 4%, they run a greater risk of outliving their money, yet, it seems very likely that's what many baby boomers will be forced to do. According to theBureau of Labor Statistics, the average age-65 or older household spent $44,664 last year.

Social Security in retirement

Social Security can bridge some of the gap between income and spending, but Social Security is designed to be a safety net, not the primary source of retiree income.

On average, Social Security replaces roughly 40% of a worker's pre-retirement income, and in 2017, the average retired worker will collect just $1,360 per month in Social Security benefits. The average couple will pocket $2,260 per month in Social Security in 2017.

Clearly, Social Security will help, but it could still fall short for many, especially since, according to the Social Security Administration,43% of singles and 21% of married couples count on Social Security for 90% or more of their day-to-day living expenses.

Change you can make now

If you're behind your peers in saving for retirement, even small changes now can have a big, positive impact on your future financial security.

The most retirement-friendly change you can make right now is to amp up your savings in tax-advantaged retirement accounts, including employer-sponsored plans, such as 401(k) and 403(b) plans. Many baby boomers participate in these plans, but they don't contribute tothem as much as they could, or should. Also, a significant percentage of people are offered these plans, but don't participate in them.

According to a Transamerica survey released this month, the average contribution rate to employer-sponsored retirement plans is 8%, and 23% of workers who are offered plans don't enroll in them.

In 2017, participants in these plans can contribute up to $18,000 plus an additional $6,000 if they're over 50. It's likely that most baby boomers aren't contributing at those levels and therefore many would-be retirees could benefit from increasing their contribution rate to 10% or higher. Even increasing your contribution rate by a little can pay off due to compound interest, so schedule time with your manager now to discuss an increase.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.