3 Top Tech Dividend Stocks For The Next 10 Years

Image source: Getty Images

With interest rates near historic lows, dividend stocks are having something of a moment right now. It's hard to argue against the evidence. For long-term investors, dividend growth becomes the dominant determinant of returns for investors.

Considering this income opportunity scarcity, it should come as no surprise that maturing tech franchises like Apple (NASDAQ: AAPL), Verizon Communications (NYSE: VZ), Qualcomm (NASDAQ: QCOM), and others are increasingly becoming destinations for dividend investors. Here's why each of these tech dividend stocks are great picks for the next 10 years and beyond.

Qualcomm's dividend growth outlook

Qualcomm remains one of my favorite tech dividend stocks, largely on the strength of its oft-overlooked history of outstanding dividend growth. Keep this in mind, Qualcomm has grown its dividend at an average annual rate of 20.2% in each of the past five years, and that just scratches the surface of Qualcomm's status as a tech dividend powerhouse.

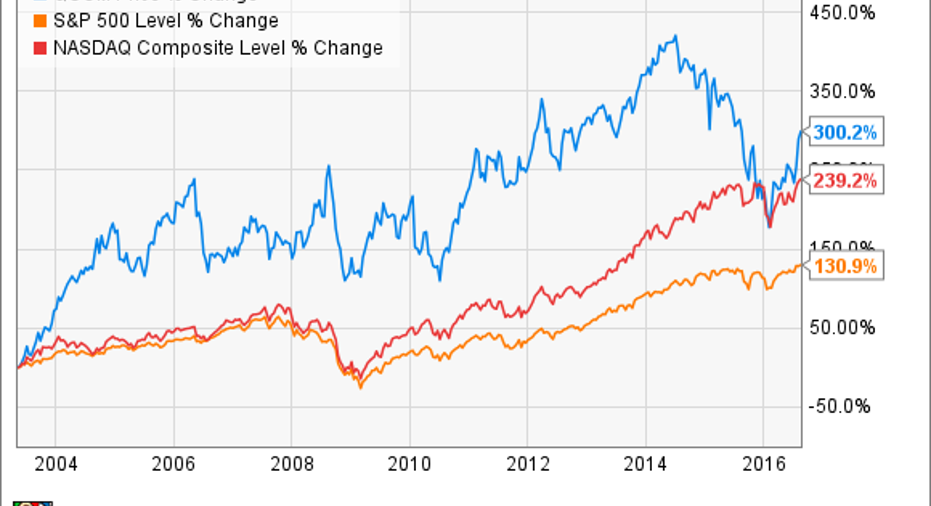

Since Qualcomm initiated its payouts in 2003, the semiconductor giant has increased its dividend 1,583% in total, good for an annual average growth rate of 22.3%. This dedication to increasing its payouts helps explain why Qualcomm's share price appreciation handily outpaces the Nasdaq and S&P 500 over that period.

Better still, Qualcomm appears to have made significant progress in resolving the issues facing its business, particularly in its very important Qualcomm Technology Licensing (QTL) division that produces the bulk of the company's operating income. With its current 3.4% dividend yield sitting toward the upward limit of its historic range, track record of incredible dividend growth, and the outlook for its business improving, Qualcomm looks like one of the most compelling dividend plays for long-term tech investors today.

Verizon's dividend growth outlook

As the highest yielding candidate of the three stocks discussed in this article, Verizon Communications seems especially well suited for investors seeking income in the near-term. Investors closer to or in retirement will certainly love its 4.3% current yield, but that isn't the end of the story for Verizon as an income investment. Here's how Verizon's recent history of dividend payments breaks down.

| Metric |

2006 |

2015 |

# Of Annual Increases |

|---|---|---|---|

|

Verizon Annual Dividends |

$1.62 |

$2.23 |

10 |

Source: Verizon investor relations

As you can see, Verizon's dividend growth has been far more tepid than the likes of Qualcomm. However, the company's mix of current yield and moderate growth still make it a compelling income-producing option, and the telecommunications giant shows little sign of letting up.

The company's core telecom business continues to simply ooze cash. This gives Verizon the necessary financial flexibility to aggressively invest in future networks standards like 5G, while also moving into additional pockets of potential opportunity. Case in point, Verizon's recent push into digital content and advertising complements its core telecom business nicely and should expose the company to a growing, tangential business. No matter how you slice it, Verizon figures to remain one of the most prolific dividend payers in tech for years to come.

Apple's dividend growth outlook

Apple isn't necessarily synonymous with dividends, at least at present. After all, the world's largest publicly traded company only began paying a dividend in 2012. What's more, Apple's current 2.1% dividend yield roughly matches that of the broader market. Thankfully though, this backward-looking analysis grossly understates Apple's ability to increase its payments in the years to come.

Apple's legendarily profitable consumer electronics business has provided the tech giant with a cash hoard that would be the envy of plenty of sovereign nations. As of its most recent earnings report, Apple carried an astounding $162 billion in net cash and investments on its balance sheet. This single statistic provides Apple unparalleled financial flexibility to drive increased shareholder value through a whole host of activities, including dividend increases.

Further solidifying Apple's case as a dividend stock worth betting on, Apple's management has demonstrated a consistent commitment to increasing the company's cash disbursements and share buybacks. The iDevice maker substantially expanded its capital return program in 2013, 2014, and 2015. It has also increased its dividends each year since re-initiating its dividend policy. All said, Apple plans to return over $200 billion to its shareholders through 2017, unless it again opts to increase its capital return program, which certainly seems plausible considering Apple's recent history.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Andrew Tonner owns shares of Apple. The Motley Fool owns shares of and recommends Apple, Qualcomm, and Verizon Communications. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.