US stocks lower as investors eye developments in Turkey

U.S. stocks were lower Monday, with the Dow firmly in the red as the economic problems in Turkey dented investors’ appetite for risk.

The Dow Jones Industrial Average fell 125.44 points, or 0.5%, to 25,187.70. The S&P 500 was down 11.35 points, closing at 2,821.93. The Nasdaq Composite dropped 19.4 points, or 0.25%, to 7,819.71.

Turkey's lira plunged 10 percent overnight, before pulling back from that record low after the central bank pledged to provideminus s liquidity and cut lira and foreign currency reserve requirements for Turkish banks.

Turkey’s economy is in a rough spot, with soaring inflation and a plunging currency. There are some concerns of contagion in the eurozone and other emerging markets while economists say the U.S. is relatively sheltered.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 37986.4 | +211.02 | +0.56% |

| SP500 | S&P 500 | 4967.23 | -43.89 | -0.88% |

| I:COMP | NASDAQ COMPOSITE INDEX | 15282.009722 | -319.49 | -2.05% |

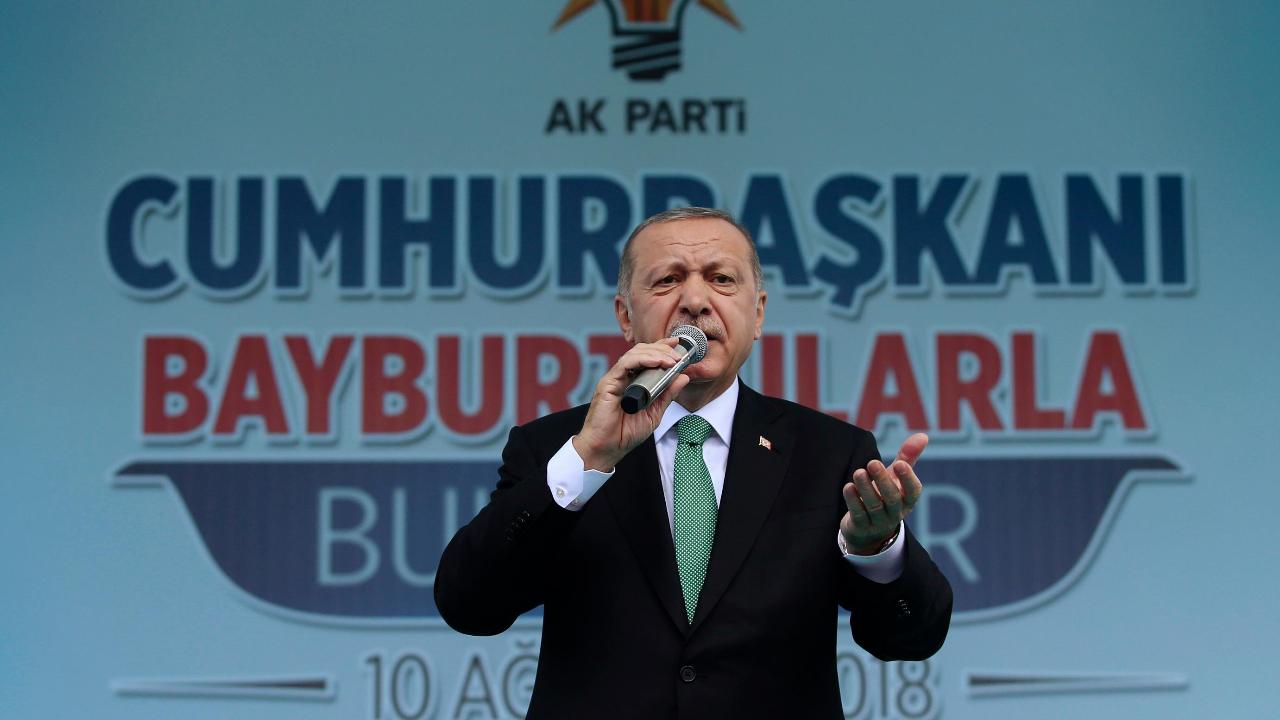

Meanwhile, the relationship between Turkey and the U.S. remains strained. There has been a standoff with the U.S. over a detained American pastor that Turkey, a NATO ally, has put on trial for espionage and terror-related charges linked to a failed coup attempt in the country two years ago.

Washington has demanded the pastor's release and imposed financial sanctions. As previously reported by FOX Business, Friday morning, President Trump tweeted about the situation with Turkey, announcing further tariffs and noting that relations between the U.S. and Turkey are "not good." Trump authorized doubling the tariffs on steel and aluminum, according to his tweet.

Stateside, earnings season is winding down with only a few companies reporting this week. The positive earnings have been a catalyst for U.S. stocks. According to Goldman Sachs, the second-quarter earnings season was stellar with the fastest earnings per share growth (25 percent) and the highest percentage of positive EPS surprises in seven years.

Commodities were mostly lower Monday, including gold. Normally, when investors’ appetite for risk decreases their demand for gold increases as gold is a safe-haven investment. However, right now an appreciating dollar is putting gold, and other commodities, under pressure. Many commodities such as gold are priced in U.S. dollars, therefore when the dollar’s value increases is dents demand from holders of international currencies.

FOX Business' Ken Martin contributed to this article.