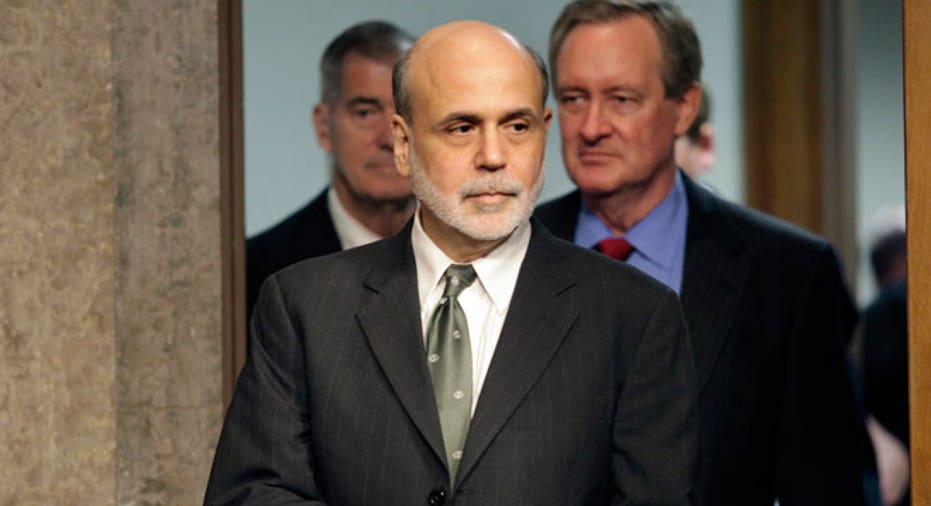

Bernanke: Fed Will Stick With Easy Policy Until Needed

Federal Reserve Chairman Ben Bernanke said on Tuesday the Fed will maintain ultra-easy U.S. monetary policy for as long as needed and will only begin to taper bond buying once it is assured that labor market improvements would continue.

In a speech to the National Economists Club that echoed dovish comments by his nominated successor, Janet Yellen, Bernanke also said that while the economy had made significant progress, it was still far from where officials wanted it to be.

"The FOMC remains committed to maintaining highly accommodative policies for as long as they are needed," he said in prepared remarks, referring to the policy-setting Federal Open Market Committee.

"I agree with the sentiment, expressed by my colleague Janet Yellen at her testimony last week, that the surest path to a more normal approach to monetary policy is to do all we can today to promote a more robust recovery," he said.

President Barack Obama nominated Yellen, the Fed's current vice chair, to replace Bernanke when his terms ends on January 31.

The Senate Banking Committee, which held a hearing for Yellen last week, will vote on her nomination on Thursday to pass it to the full Senate for consideration. She is expected to win confirmation with relative ease.

The Fed has held interest rates near zero since late 2008 and quadrupled its balance sheet to $3.9 trillion through three massive rounds of bond buying.

It decided in October to maintain asset purchases at an $85 billion monthly pace. Bernanke, in remarks likely to reinforce expectations the Fed will not taper until next year, said officials want evidence of durable job growth before scaling back buying.

"The FOMC still expects that labor market conditions will continue to improve and that inflation will move toward the 2 percent objective over the medium term. If these views are supported by incoming information, the FOMC will likely begin to moderate the pace of purchases," he said.

Fed officials meet next on December 17-18, although most economists don't think they will begin to scale back the bond buying until their meeting in either January or March.

(Reporting by Alister Bull; Editing by Krista Hughes)